- United States

- /

- Entertainment

- /

- NYSE:SPOT

Will Spotify (SPOT) Leadership Shift Reshape Its Strategy or Reinforce the Status Quo?

Reviewed by Sasha Jovanovic

- In late September 2025, Spotify Technology announced that founder and CEO Daniel Ek will move to Executive Chairman, while co-presidents Gustav Söderström and Alex Norström will become co-CEOs effective January 1, 2026, pending board approval.

- This formalizes an operating model that has been in place since 2023, signaling continuity in leadership but raising questions about future strategy and capital allocation.

- We'll now explore how the CEO transition and Ek’s new strategic leadership role may influence Spotify's investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Spotify Technology Investment Narrative Recap

To own Spotify Technology stock, you need to believe that the company can translate its global user growth, expanding content offerings, and investments in AI-driven personalization into sustained revenue and profit gains, despite high content costs and intensifying competition. The recent CEO transition formalizes an existing leadership structure, so it does not materially impact the near-term focus on the Q3 2025 earnings release, which remains the most important short-term catalyst, while ongoing dependence on major record labels is still the biggest risk to margins.

Spotify's recent Q2 2025 results, featuring both year-over-year sales growth and a return to a net loss, put even greater emphasis on upcoming earnings announcements as key markers for the company's ability to expand profitability. While the CEO transition reflects leadership continuity, the earnings trajectory and evidence of gross margin improvement remain front of mind as investors assess whether Spotify's business fundamentals are headed in the right direction.

However, the major risk investors should keep in mind is that, unlike subscriber growth, Spotify’s long-term profitability still depends on...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's outlook forecasts €23.8 billion in revenue and €3.4 billion in earnings by 2028. This projection expects annual revenue growth of 12.8% and an earnings increase of €2.6 billion from the current €806 million.

Uncover how Spotify Technology's forecasts yield a $747.78 fair value, a 10% upside to its current price.

Exploring Other Perspectives

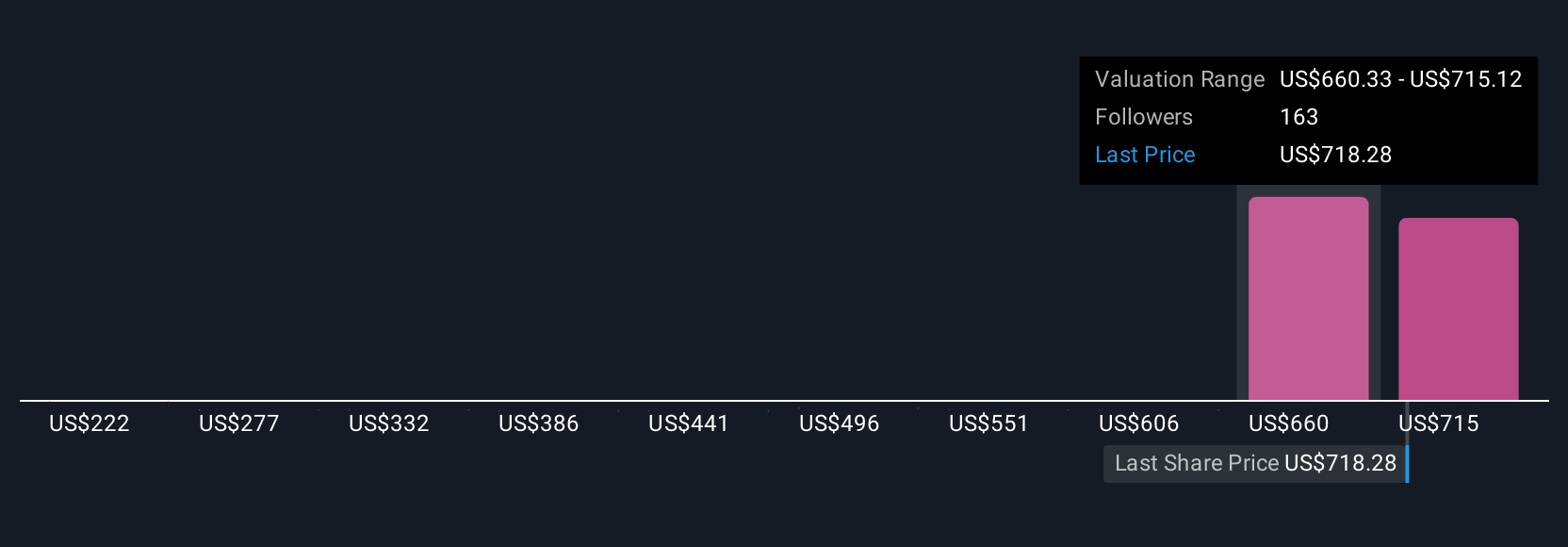

Twenty-five members of the Simply Wall St Community estimate Spotify's fair value between US$222 and US$769.91 per share. As the company continues to rely significantly on music licensing costs, opinions on valuation and future margin expansion differ widely, be sure to explore several alternative viewpoints.

Explore 25 other fair value estimates on Spotify Technology - why the stock might be worth as much as 13% more than the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026