- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify Technology (NYSE:SPOT) Jumps 21% After Impressive Earnings Report

Reviewed by Simply Wall St

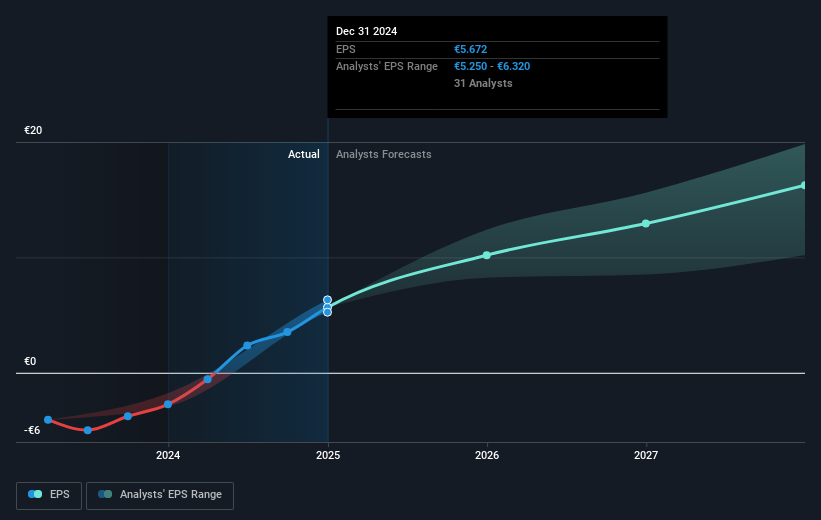

Spotify Technology (NYSE:SPOT) experienced a notable 21% increase in its share price over the last quarter, influenced by several key developments. First, the company reported impressive earnings, with fourth-quarter sales and net income significantly improving from the previous year, marking a turnaround from a net loss to substantial profitability. Additionally, Spotify's strategic alliance with Warner Music Group introduced ambitions to strengthen commitments to artists and fans, potentially boosting investor confidence. In the context of a volatile broader market that has faced a mix of gains and losses, these positive corporate achievements likely provided the momentum for Spotify's share price advancement. Despite an absence of share repurchases during the recent quarter, investor sentiment appears buoyed by Spotify's operational growth and strategic partnerships, distinguishing its performance from other tech stocks affected by market uncertainties.

Jump into the full analysis health report here for a deeper understanding of Spotify Technology.

Over the past five years, Spotify Technology has seen a very substantial total return of 386.37%. Several key developments contributed to this growth. Spotify's acquisition of strong profits has bolstered its earnings growth at an annual rate of 28.9%, reflecting its successful efforts in becoming profitable, particularly noted over the past year. Furthermore, Spotify's net income surged to EUR 1.14 billion for the full year ending 2024, compared to a substantial net loss in the previous year, further fortifying its financial standing.

Spotify's strategic maneuvers have also played a significant role. The company forged a multi-year partnership with Warner Music Group to enhance artist and fan engagement. Additionally, the integration of Spotify's services within Opera's Music Player expanded its reach and user base. These moves helped Spotify outperform the US Market and the broader US Entertainment industry over the past year, where average returns stood at 9% and 23.9%, respectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives