- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Waiting for SNAP Inc.'s (NYSE:SNAP) Insider Buying as a Possible Bottoming Indicator

Key Takeaways:

- SNAP remains under pressure and without Q3 guidance

- Even after an 85% decline, we are still waiting for any notion of insider buying

The stock market correction of 2022 will eventually ber, regardless of whether it ends up as a full-blown rcession, or a minor bump on the longest bull market in history – SNAP Inc. (NYSE: SNAP) will likely make the special list.

Since its peak value, once popular tech stock declined over 85%, signaling an erosion in value seen only in the dot-com bubble.

See our latest analysis for Snap

Q2 Earnings Results

- EPS: -US$0.02 (miss by US$0.01)

- Revenue: US$1.11b (miss by US$30m)

- Global daily active users: 347m (vs. 344.2m expected)

Other highlights:

- Growth in impressions: +9%

- Adjusted operating expenses: US$665m, +56% Y/Y

- Staff costs: +44% Y/Y

Meanwhile, operating cash flow decreased to a negative US$124m, from +US$101m in Q2. Another concerning fact is that the management refused to issue guidance for Q3, quoting challenging forward-looking visibility. They expect "approximately flat" revenue, while analysts expected 18% growth.

Unsurprisingly,the stock collapsed 26% after market hours.

It seems that the company struggles under a combination of factors. First, there is increased competition in the online and well as policy shifts like Apple's iOS update that influenced ad targeting. Then, there are macro-pressures as businesses shift their marketing budgets amidst fears of recession, but more importantly- the rising cost of capital.

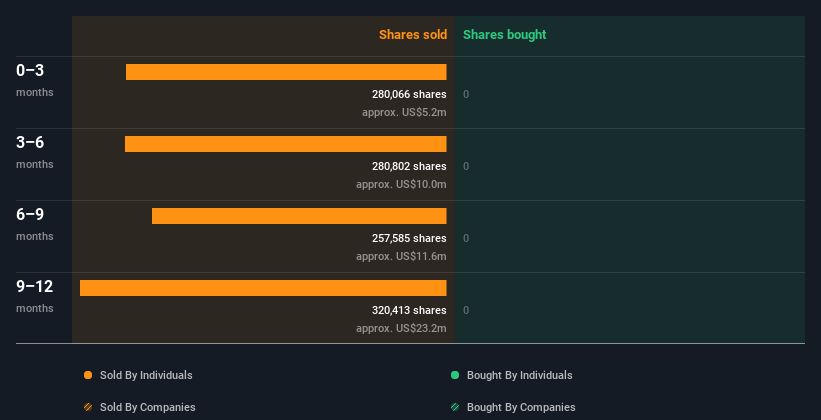

Snap Insider Transactions Over The Last Year

In the last year, Snap insiders didn't buy any company stock. Despite a significant price decline, we are still waiting for the first insider buying, which is somewhat concerning, given that corporate insiders are starting to buy across the market.

The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders ar buying, then you'd love this free list of companies. (Hint: insiders have been buying them).

Still Waiting for Improvements

Insiders haven't bought Snap stock recently despite a massive correction over the last months. This points out that there will be more pain down the road and management's reluctance to give any form of guidance seems to confirm that thesis.

Observing the parallels with 2008, when the advertisement market collapsed, the major problem might not be in the company but in its external environment. Management can slow hiring, and pursue other cost-cutting techniques but it cannot create demand for its advertising services out of thin air.

While insider transactions can help us build a thesis about the stock, it's also worthwhile knowing the risks facing this company. To help with this, we've discovered 3 warning signs (1 makes us a bit uncomfortable!) that you ought to be aware of before buying any shares in Snap.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have a HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives