- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (NYSE:SNAP) Partners With Later Revolutionizing Creator Collaboration And Scheduling On Snapchat

Reviewed by Simply Wall St

Snap (NYSE:SNAP) recently announced a partnership with Later to enhance influencer marketing through Snapchat's APIs, a notable development that may not have fully offset its stock performance. Over the past week, the company experienced a 5.75% decline in share price. This movement occurred amid a broader market drop of 3.6%, partly driven by investor reactions to mixed signals from major tech stocks and economic concerns exacerbated by new tariff announcements from President Trump. Despite ongoing innovations like Snap's collaboration with Later, tech stocks including Snap have faced pressures from economic uncertainty and market volatility. While Snap's initiatives may position it well for future growth, the immediate market environment and broader economic signals have kept pressure on its stock price, reflecting a complex interplay of company-specific and macroeconomic factors.

Get an in-depth perspective on Snap's performance by reading our analysis here.

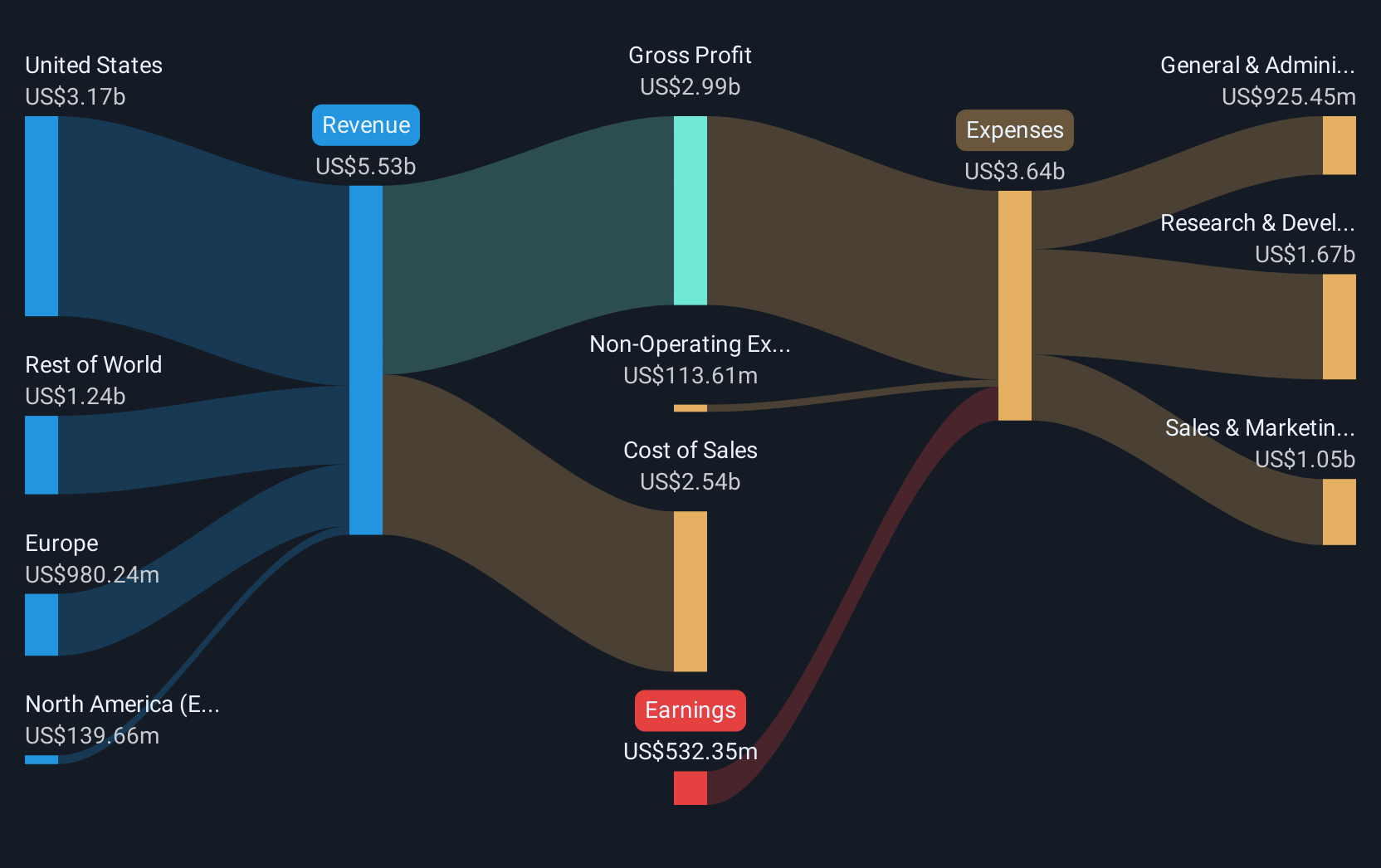

Over the last year, Snap Inc. experienced a total shareholder return of 7.64% decline, underperforming the broader US market which provided a return of 16.9%. The company's financial results showed improvement with fourth-quarter 2024 reporting US$1.56 billion in sales, as well as achieving a net income of US$9.1 million compared to the previous year's loss. However, significant insider selling over the past three months and no repurchases during the company's authorized buyback period might have contributed to investor concerns.

Additional pressure came from public nuisance lawsuits filed in January 2025, targeting social media platforms, including Snap, for their alleged impact on youth mental health. Meanwhile, the announcement of a US$1.5 billion debt offering in February 2025 albeit earmarked for refinancing and corporate purposes possibly reflected strategic positioning aimed at stabilizing financial operations moving forward.

- Discover whether Snap is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Snap's growth trajectory—explore our risk evaluation report.

- Invested in Snap? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Snap, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives