- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Shareholder Class Action Filed Against Snap (SNAP) Over Advertising Revenue Growth Misstatements

Reviewed by Simply Wall St

Snap (SNAP) faced a challenging week as it was hit with a shareholder class action lawsuit alleging misleading statements concerning its advertising revenue growth. This development came at a time when broader markets reacted favorably to Federal Reserve Chair Jerome Powell's indication of potential interest rate cuts. Despite these mixed influences, Snap's share price remained relatively flat over the week, consistent with the broader market movements. While the lawsuit might have added some negative sentiment, it was largely balanced by positive macroeconomic signals, such as the anticipation of lower interest rates which bolstered other tech stocks.

Be aware that Snap is showing 2 warning signs in our investment analysis.

The recent shareholder class action lawsuit against Snap over alleged misleading statements about advertising revenue growth could have significant implications on the company's future prospects. While such legal challenges might create short-term uncertainties and potential costs, Snap’s overarching narrative remains centered on augmented reality and digital ad trends shaping its future revenue streams. However, the lawsuit might hinder investor confidence, potentially impacting revenue and earnings forecasts in the near term.

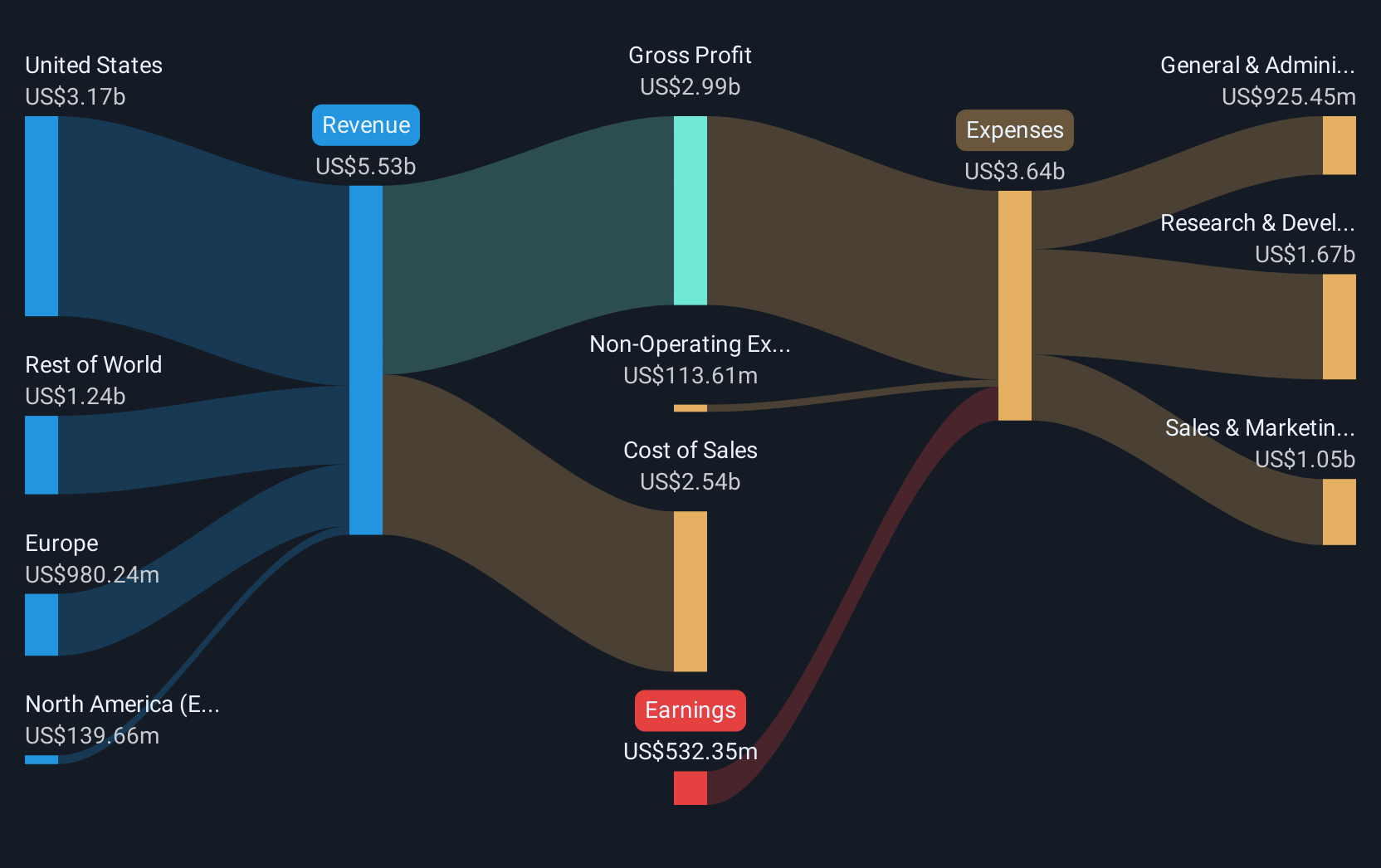

Over the past year, Snap's total shareholder return was a decline of 23.78%, indicating a challenging period for the company. In comparison to the broader markets, Snap underperformed, as the US Interactive Media and Services industry saw a return of 27.9%. This disparity highlights the difficulties Snap faces within a competitive industry while struggling to effectively monetize its platform.

The current share price of $7.05 offers a substantial gap compared to the analyst consensus price target of $9.28, suggesting potential room for upside. However, realizing this target relies on Snap successfully navigating its growth obstacles, improving its ad revenue streams, and achieving solid earnings growth that aligns with analyst assumptions. The balance between legal challenges and technological advancement remains crucial for Snap's financial outlook.

Click here to discover the nuances of Snap with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives