- United States

- /

- Software

- /

- NYSE:YOU

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a notable 21% increase over the past year, with earnings projected to grow by 14% annually. In such an environment, identifying high growth tech stocks often involves looking for companies that demonstrate strong innovation and adaptability in rapidly evolving sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 28.91% | 28.19% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 30.95% | 61.73% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Wix.com (NasdaqGS:WIX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wix.com Ltd. operates as a cloud-based web development platform for registered users and creators globally, with a market capitalization of approximately $12.73 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $1.70 billion. It offers a cloud-based platform that enables users to create and manage websites and other web content worldwide.

Wix.com's recent innovations and strategic partnerships underscore its adaptation to the evolving tech landscape. On January 30, 2025, Wix launched the Business Launcher, an AI tool that simplifies launching new businesses online, signaling a shift towards integrating AI deeply into user interactions. This move complements their strategy of enhancing digital marketing tools for privacy compliance, as seen with their expanded partnership with TWIPLA announced on January 28. These initiatives are part of why Wix reported a robust annual revenue growth of 11.8% and an impressive earnings growth forecast at 31.8% per year. Additionally, Wix has actively returned value to shareholders by repurchasing $200 million worth of shares in the past year, affirming its financial confidence amidst expansion efforts.

- Take a closer look at Wix.com's potential here in our health report.

Understand Wix.com's track record by examining our Past report.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and globally with a market cap of $74.50 billion.

Operations: Sea Limited generates revenue through its digital entertainment, e-commerce, and digital financial services segments. The company's operations span Southeast Asia, Latin America, and other international markets.

Despite recent challenges, Sea's trajectory in the tech sector remains marked by robust growth prospects. With a revenue increase projected at 14.4% annually, it outpaces the US market average of 8.8%, highlighting its competitive edge in a dynamic industry landscape. Furthermore, anticipated earnings growth stands at an impressive 38.1% per year, significantly above the US market forecast of 14.5%. This financial vigor is somewhat tempered by a substantial one-off loss of $196.9 million last fiscal year, which impacted earnings negatively by 85.8%. However, with strategic adjustments and a focus on innovative sectors like digital entertainment and e-commerce, Sea is poised to harness its strong market position and R&D investments to navigate future challenges effectively and sustain its growth momentum.

- Unlock comprehensive insights into our analysis of Sea stock in this health report.

Evaluate Sea's historical performance by accessing our past performance report.

Clear Secure (NYSE:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clear Secure, Inc. operates a secure identity platform under the CLEAR brand name primarily in the United States, with a market capitalization of approximately $3.22 billion.

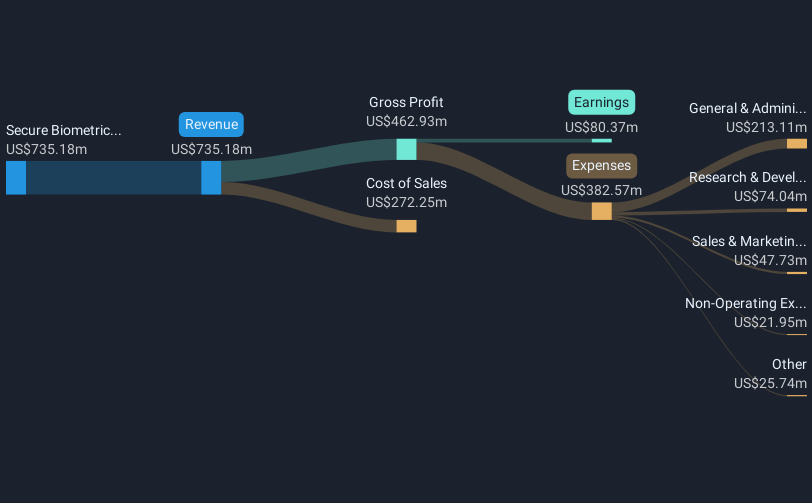

Operations: The company generates revenue from its secure biometric identity verification services, amounting to $735.18 million.

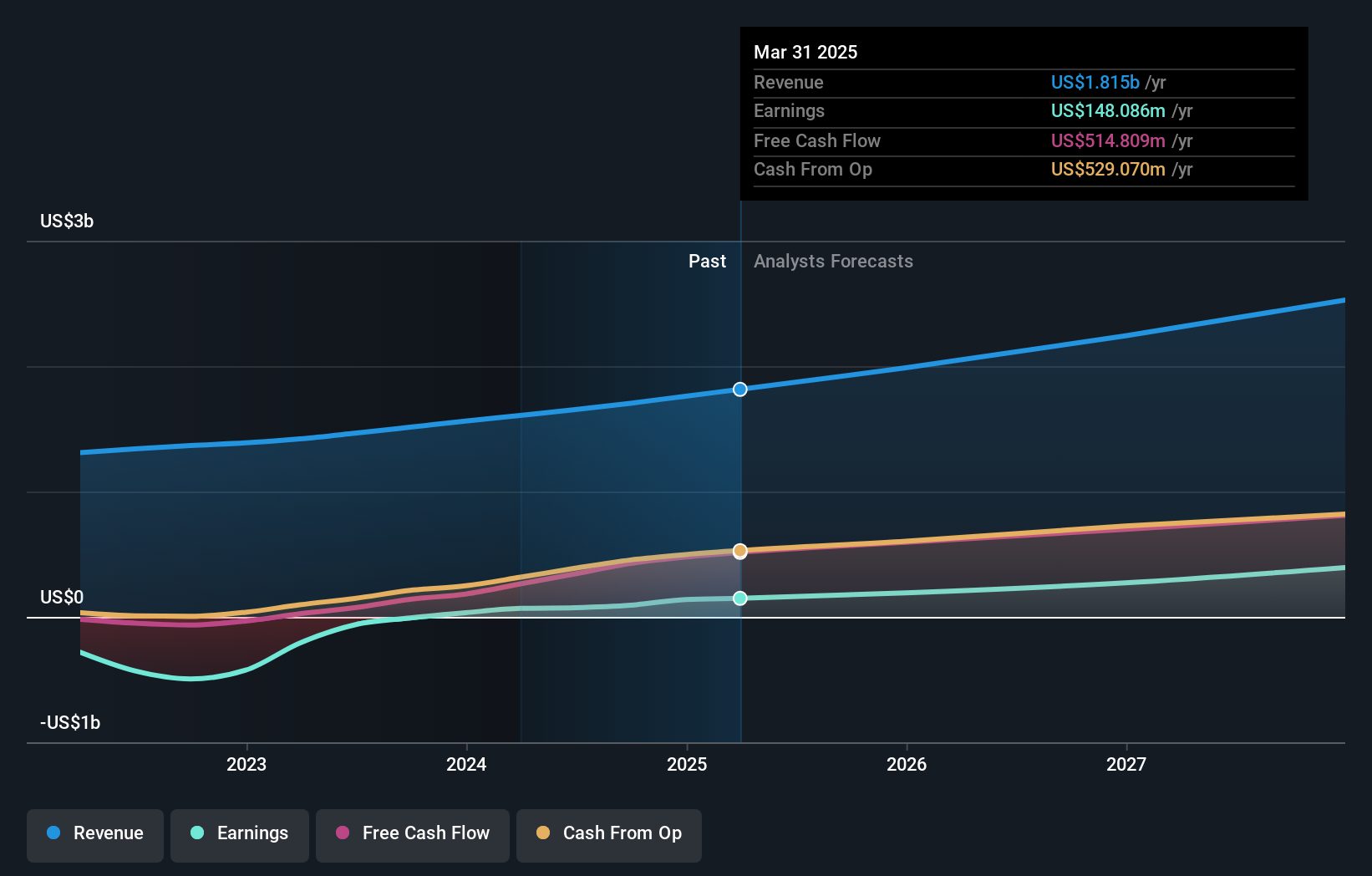

CLEAR Secure, a leader in identity verification solutions, is expanding its technological footprint and market influence. Recently, the company announced integrations with Epic's MyChart for seamless patient identity processes and launched its services at Portland International Airport, enhancing traveler experiences. These strategic moves not only broaden CLEAR's service offerings but also reinforce its commitment to security and efficiency in high-traffic environments. With a notable R&D spend of $120 million last year, representing 15% of their total revenue, CLEAR is investing heavily in innovation to stay ahead in the competitive tech landscape. This focus on R&D is crucial as it supports ongoing product enhancements and expansions into new markets like healthcare and consumer services, ensuring sustained growth amidst evolving industry demands.

- Get an in-depth perspective on Clear Secure's performance by reading our health report here.

Assess Clear Secure's past performance with our detailed historical performance reports.

Taking Advantage

- Gain an insight into the universe of 233 US High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives