- United States

- /

- Auto Components

- /

- NYSE:MOD

3 US Stocks That May Be Trading Below Estimated Value In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed performances with major indices showing slight fluctuations, investors are keenly observing economic indicators like the upcoming jobs report to gauge potential impacts on interest rates. Amidst this cautious atmosphere, identifying stocks that may be trading below their estimated value can present opportunities for those looking to invest strategically. Understanding what constitutes an undervalued stock—often characterized by strong fundamentals and potential for growth despite current market pressures—is crucial in navigating today's complex financial landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.16 | $53.27 | 49% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.31 | $61.52 | 49.1% |

| Afya (NasdaqGS:AFYA) | $15.08 | $29.41 | 48.7% |

| Ally Financial (NYSE:ALLY) | $35.61 | $69.71 | 48.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | $93.54 | $186.41 | 49.8% |

| Constellium (NYSE:CSTM) | $10.77 | $20.78 | 48.2% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $39.04 | $75.33 | 48.2% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $32.78 | 48.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.78 | $30.71 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.44 | $12.59 | 48.8% |

Let's uncover some gems from our specialized screener.

Coeur Mining (NYSE:CDE)

Overview: Coeur Mining, Inc. is engaged in the exploration of precious metals across the United States, Canada, and Mexico with a market cap of approximately $2.45 billion.

Operations: The company's revenue is derived from its operations at Wharf ($233.95 million), Palmarejo ($370.89 million), Rochester ($197.95 million), and Kensington ($207.87 million).

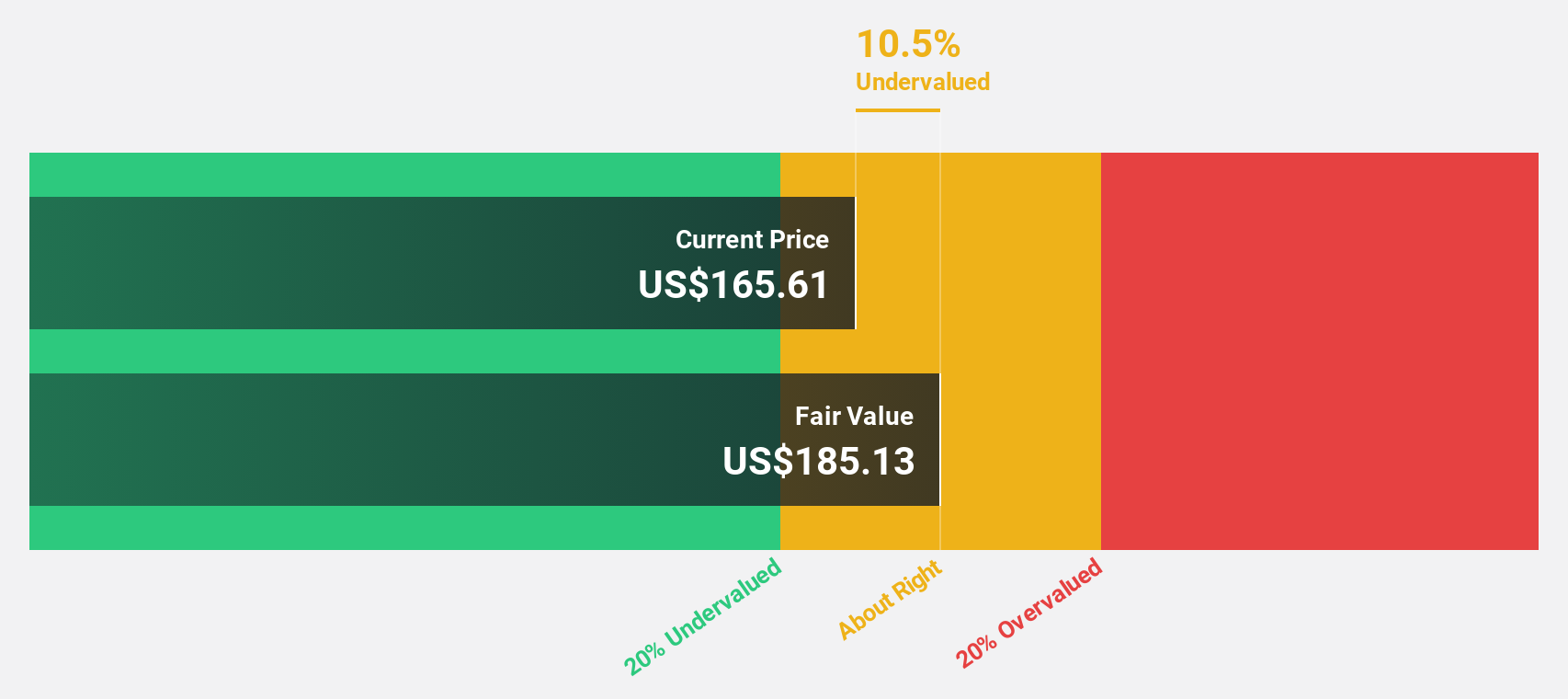

Estimated Discount To Fair Value: 48.8%

Coeur Mining is trading significantly below its estimated fair value, suggesting potential undervaluation. Analysts forecast robust earnings growth of 83.05% annually and expect the company to become profitable within three years, outperforming market averages. Recent exploration results from the Silvertip project indicate substantial resource potential, enhancing future revenue prospects. However, shareholders have experienced dilution over the past year. The company's recent return to profitability and strong quarterly sales growth further highlight its improving financial position.

- In light of our recent growth report, it seems possible that Coeur Mining's financial performance will exceed current levels.

- Dive into the specifics of Coeur Mining here with our thorough financial health report.

Modine Manufacturing (NYSE:MOD)

Overview: Modine Manufacturing Company offers thermal management products and solutions across various countries including the United States, Italy, Hungary, China, and the United Kingdom, with a market cap of approximately $6.39 billion.

Operations: The company's revenue segments include Climate Solutions at $1.20 billion and Performance Technologies at $1.30 billion.

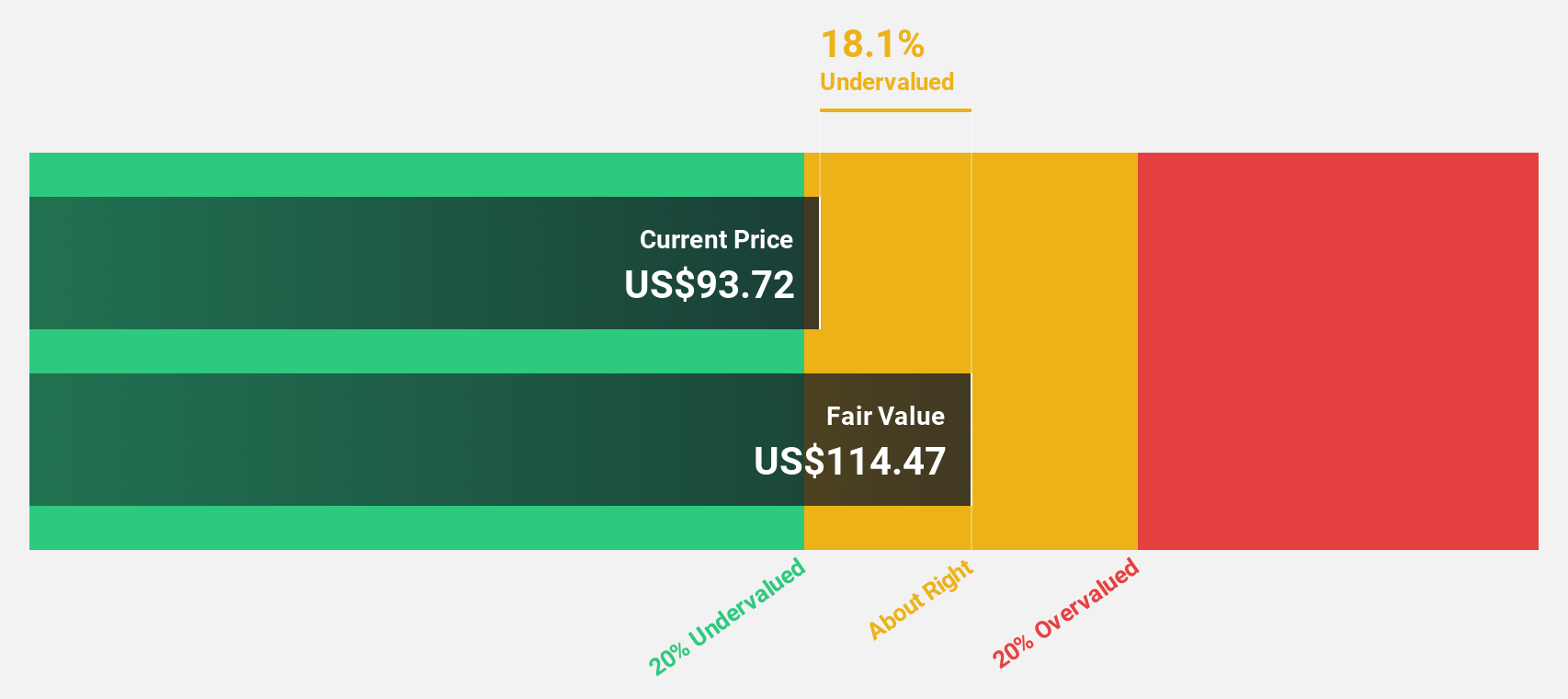

Estimated Discount To Fair Value: 16.8%

Modine Manufacturing is trading at US$121.1, below its fair value estimate of US$145.6, indicating some undervaluation based on cash flows. Analysts project earnings growth of 26.4% annually, outpacing the broader U.S. market's expected growth rate. Despite significant insider selling recently, Modine's strategic expansions in India and Canada to meet rising data center cooling demand could bolster future revenue streams and enhance its global footprint in precision cooling solutions.

- Our earnings growth report unveils the potential for significant increases in Modine Manufacturing's future results.

- Click here to discover the nuances of Modine Manufacturing with our detailed financial health report.

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other regions globally, with a market cap of approximately $61.12 billion.

Operations: The company's revenue segments include digital entertainment, e-commerce, and digital financial services across various regions worldwide.

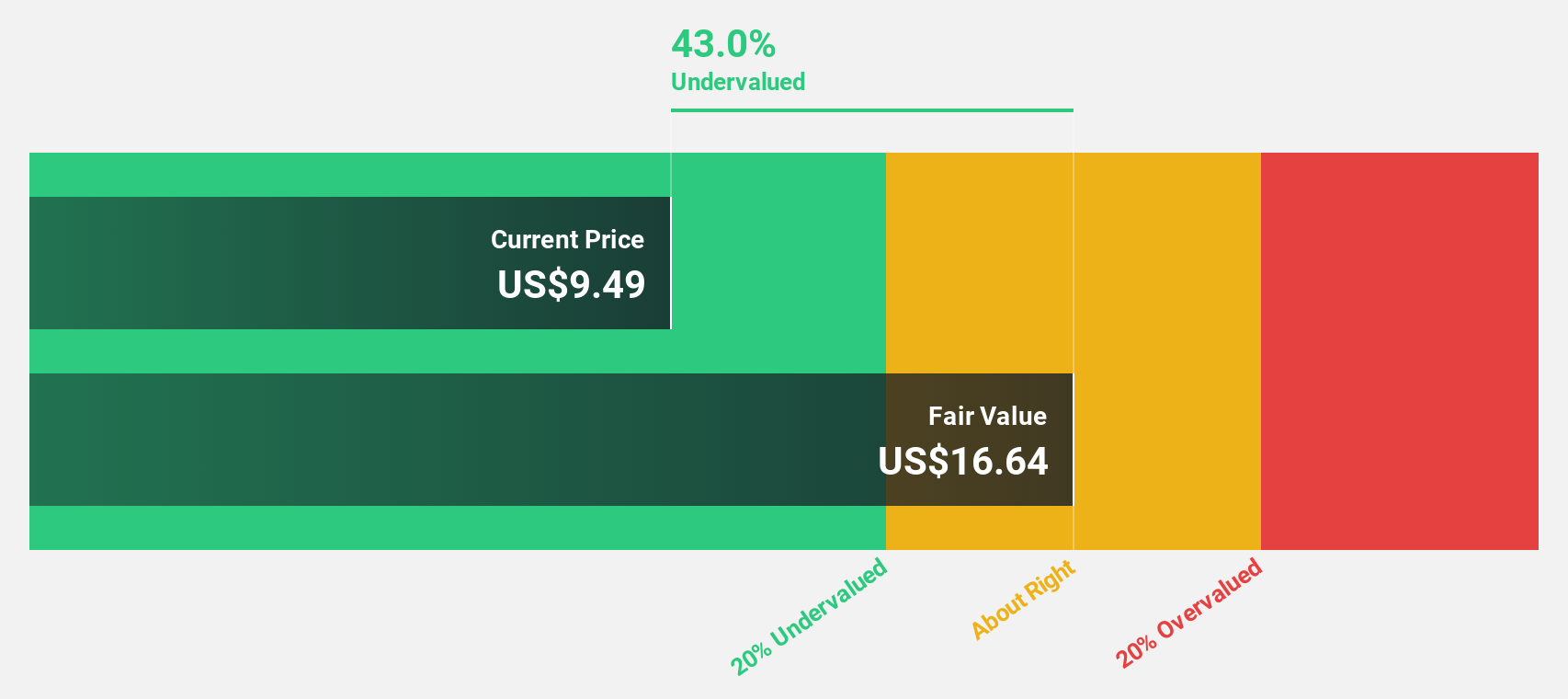

Estimated Discount To Fair Value: 43.3%

Sea Limited is trading at US$109.35, significantly below its estimated fair value of US$192.78, highlighting its undervaluation based on cash flows. Recent earnings show a turnaround with a net income of US$153.32 million for Q3 2024, compared to a loss the previous year, despite profit margins declining from 5.3% to 0.6%. Analysts forecast robust earnings growth of 37.7% annually over the next three years, surpassing market averages and indicating potential future value appreciation.

- Our expertly prepared growth report on Sea implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Sea.

Summing It All Up

- Gain an insight into the universe of 169 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Provides thermal management products and solutions in the United States, Italy, Hungary, China, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives