- United States

- /

- Software

- /

- NasdaqGS:CYBR

US High Growth Tech Stocks To Watch Now

Reviewed by Simply Wall St

As the U.S. stock market begins the week on an upward trajectory, with key indices like the Nasdaq and S&P 500 showing gains, investors are closely watching economic indicators and corporate earnings reports that could influence future Federal Reserve interest rate decisions. In this environment of heightened market activity and anticipation, identifying high-growth tech stocks involves assessing their potential for innovation, adaptability to changing economic conditions, and resilience in a competitive landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.61% | 23.30% | ★★★★★☆ |

| Exelixis | 10.59% | 20.82% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| Circle Internet Group | 27.59% | 82.06% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Trade Desk (TTD)

Simply Wall St Growth Rating: ★★★★★☆

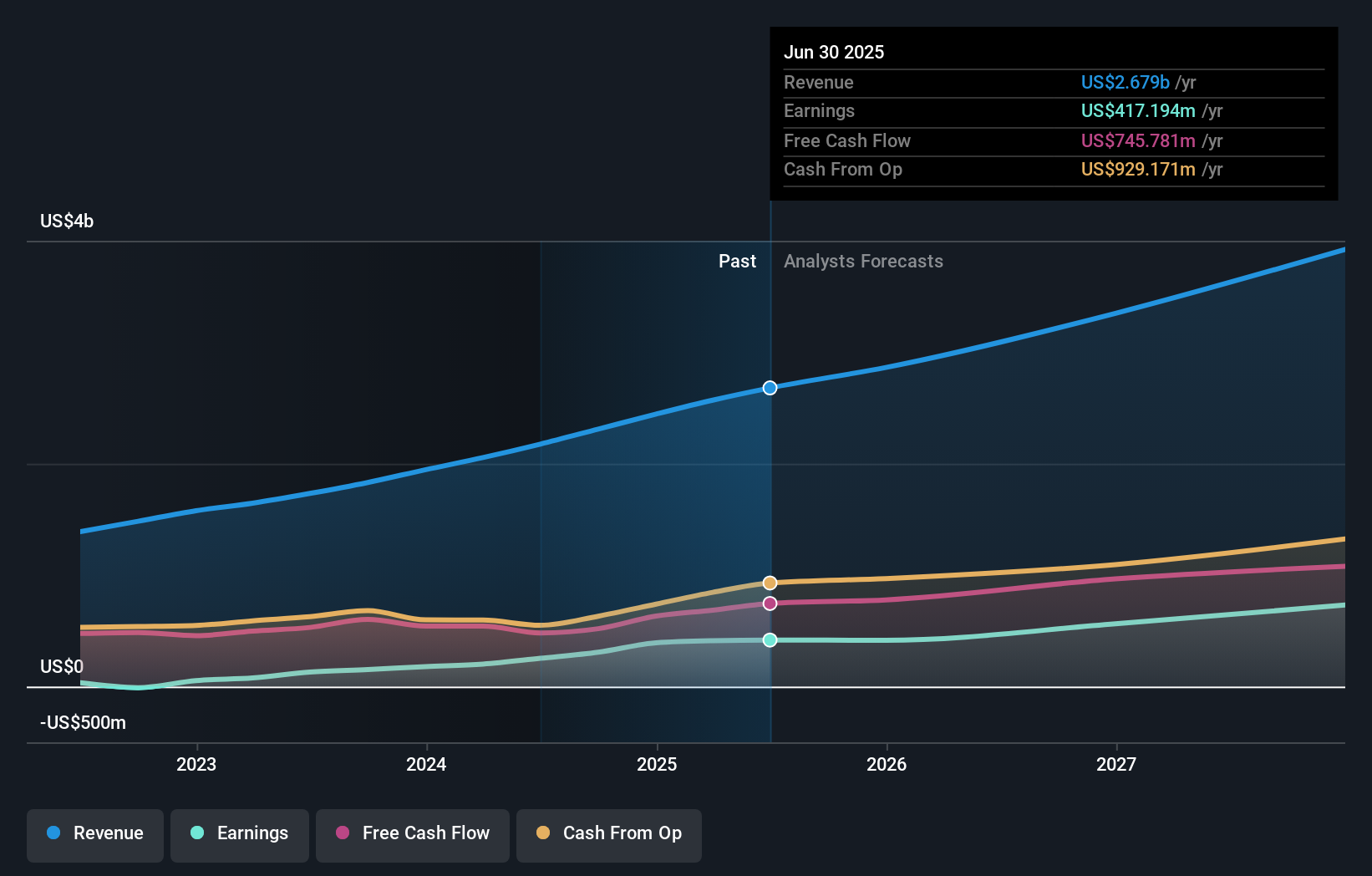

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform, with a market capitalization of approximately $24.44 billion.

Operations: The company generates revenue primarily through its advertising technology platform, which brought in $2.68 billion. The focus is on providing a comprehensive solution for advertisers to manage digital ad campaigns across various formats and devices globally.

Trade Desk's recent strategic alliances and product launches underscore its adaptability and foresight in the high-growth tech landscape. The collaboration with DIRECTV to integrate streaming interfaces into Ventura TV OS, announced on October 1, 2025, enhances Trade Desk's smart TV offerings, potentially boosting its market presence by simplifying access to ad-supported content. Furthermore, the launch of Audience Unlimited on September 29 revolutionizes digital advertising by using AI to optimize third-party data usage, reducing costs and complexity for advertisers. These initiatives not only reflect Trade Desk’s innovative approach but also align with industry trends towards more integrated and efficient advertising solutions.

- Delve into the full analysis health report here for a deeper understanding of Trade Desk.

Gain insights into Trade Desk's historical performance by reviewing our past performance report.

CyberArk Software (CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

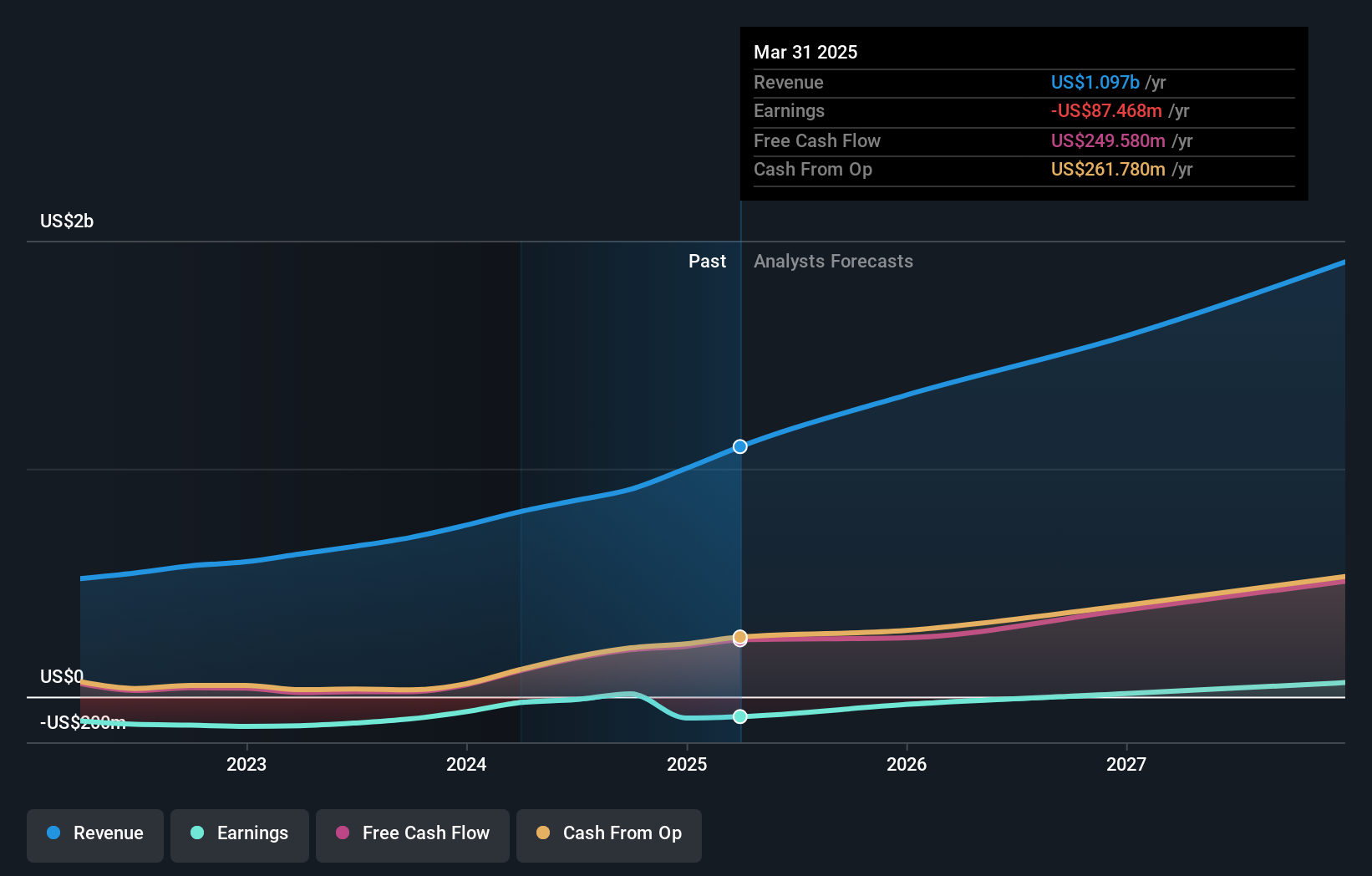

Overview: CyberArk Software Ltd. is a company that specializes in developing, marketing, and selling software-based identity security solutions and services globally, with a market cap of approximately $24.78 billion.

Operations: CyberArk generates revenue primarily from its security software and services segment, amounting to $1.20 billion. The company operates across various regions, including the United States, Israel, and Europe.

CyberArk Software's recent technological enhancements and executive shifts underscore its strategic positioning within the cybersecurity landscape. On October 7, 2025, CyberArk expanded its Machine Identity Security portfolio, introducing features that automate the discovery and security of machine identities—a crucial advancement given the rising incidents related to machine identity breaches. This innovation not only addresses a growing market need but also positions CyberArk at the forefront of identity security solutions in an era dominated by AI and cloud technologies. Moreover, executive appointments announced on September 15 aim to bolster leadership in trust and information management, essential for sustaining growth in a competitive sector. These strategic moves are expected to enhance CyberArk's market adaptability and customer engagement significantly.

- Dive into the specifics of CyberArk Software here with our thorough health report.

Assess CyberArk Software's past performance with our detailed historical performance reports.

Reddit (RDDT)

Simply Wall St Growth Rating: ★★★★★☆

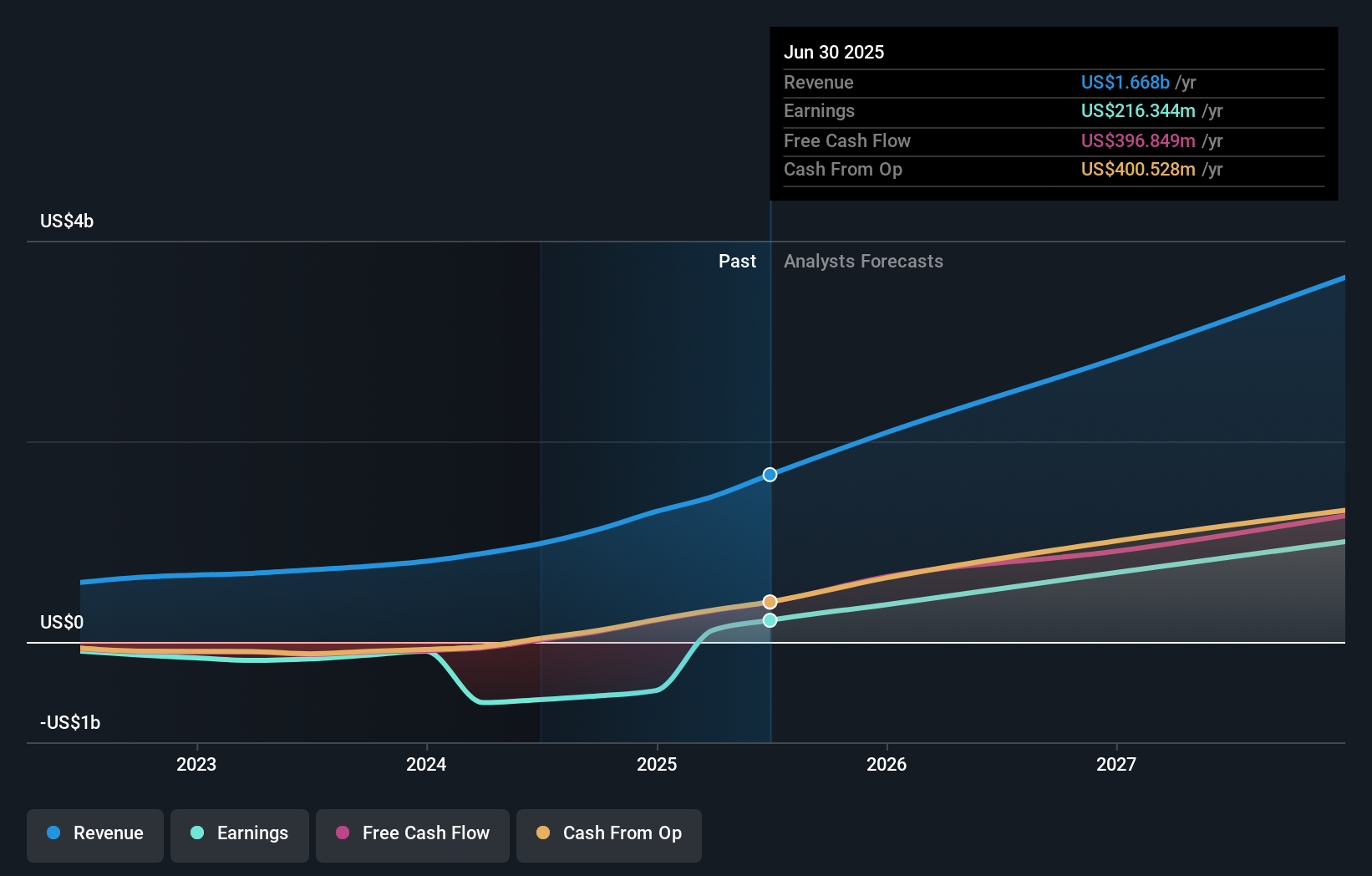

Overview: Reddit, Inc. operates a digital community both in the United States and internationally with a market capitalization of $36.49 billion.

Operations: Reddit generates revenue primarily through its Internet Information Providers segment, amounting to $1.67 billion.

Reddit's trajectory in the high-growth tech sector is marked by notable volatility and strategic challenges, particularly influenced by external technological shifts. The company's revenue growth forecast at 24.3% annually outpaces the US market average of 10.1%, underscoring its potential despite recent hurdles. However, legal challenges and significant algorithm changes from Google have impacted user traffic and advertising revenue, leading to a sharp 9.3% drop in stock price after revealing a slowdown in daily active user growth. On the innovation front, Reddit continues to adapt, with R&D expenses aligning closely with industry demands to refine user engagement strategies amidst evolving AI capabilities in search technologies.

- Get an in-depth perspective on Reddit's performance by reading our health report here.

Review our historical performance report to gain insights into Reddit's's past performance.

Summing It All Up

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 69 more companies for you to explore.Click here to unveil our expertly curated list of 72 US High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives