- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT): Is Recent Profitability and Growth Priced In? A Fresh Look at Valuation

Reviewed by Kshitija Bhandaru

Reddit (RDDT) has been capturing the market’s attention lately after signaling major improvements such as rapid advertising revenue growth, high user engagement, and its first profitable quarter. Investors are now looking toward the upcoming quarterly results.

See our latest analysis for Reddit.

Reddit’s strong momentum is difficult to miss lately. The stock posted a 4.65% 1-day share price gain and climbed 45.4% over the past three months, despite a modest setback in the last 30 days. Recent catalysts, such as surging ad revenue and anticipation for next quarter’s results, have kept sentiment bullish. In the bigger picture, Reddit’s 1-year total shareholder return of over 200% places it among this year’s standout performers.

If this kind of breakout run has you looking for more, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the spotlight on Reddit’s recent outperformance and soaring future expectations, investors are now asking a critical question: Is there truly value left on the table, or has the market already priced in all that explosive growth?

Most Popular Narrative: 3.4% Undervalued

Reddit’s current share price of $211.70 sits slightly below the most widely followed narrative’s fair value estimate of $219.15. As momentum builds, the gap between market and narrative value remains narrow yet meaningful, raising the stakes for bulls and skeptics alike.

Continual product and platform improvements, including a feed redesign, integration of Answers in search, and international expansion, are viewed as multi-year catalysts supporting further user engagement and top-line outperformance.

Curious what ambitious figures drive that seemingly modest valuation gap? The narrative banks on blockbuster growth rates, margin leaps, and a bold future profit multiple. Discover which controversial projections set this story apart. The numbers will surprise you.

Result: Fair Value of $219.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on digital advertising and challenges in achieving real traction abroad could quickly undermine Reddit’s bullish narrative if trends were to shift.

Find out about the key risks to this Reddit narrative.

Another View: Stretched by Market Multiples?

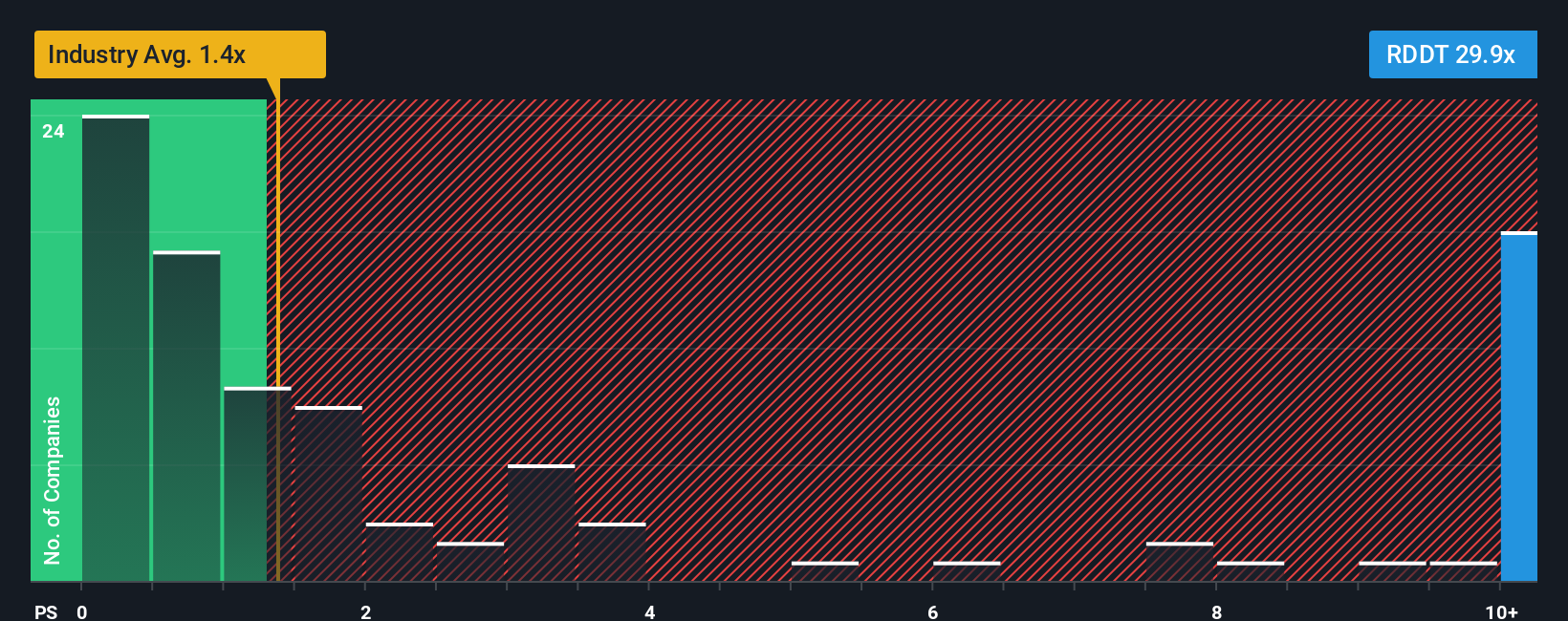

While narrative value points to upside, Reddit’s price compared to its sales tells a different story. The company trades at 23.8 times sales, which is far higher than peers averaging just 3.4 and well above the fair ratio of 11.5. This signals increased valuation risk if expectations cool. Should investors trust momentum or proceed with caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you have a different take or want to dig deeper into Reddit's outlook, creating your own data-driven narrative takes just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

Opportunity never waits. If you’re serious about maximizing your returns, put your money to work in new directions with these powerful investment screens from Simply Wall Street:

- Tap into breakthrough medical technologies and uncover explosive potential with these 32 healthcare AI stocks.

- Spot undervalued gems primed for their next leg up. Start sifting for bargains with these 891 undervalued stocks based on cash flows.

- Secure income with confidence by targeting high-yield opportunities through these 18 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives