- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (NYSE:RDDT) Sees 11% Price Rise Following Q1 Earnings Turnaround

Reviewed by Simply Wall St

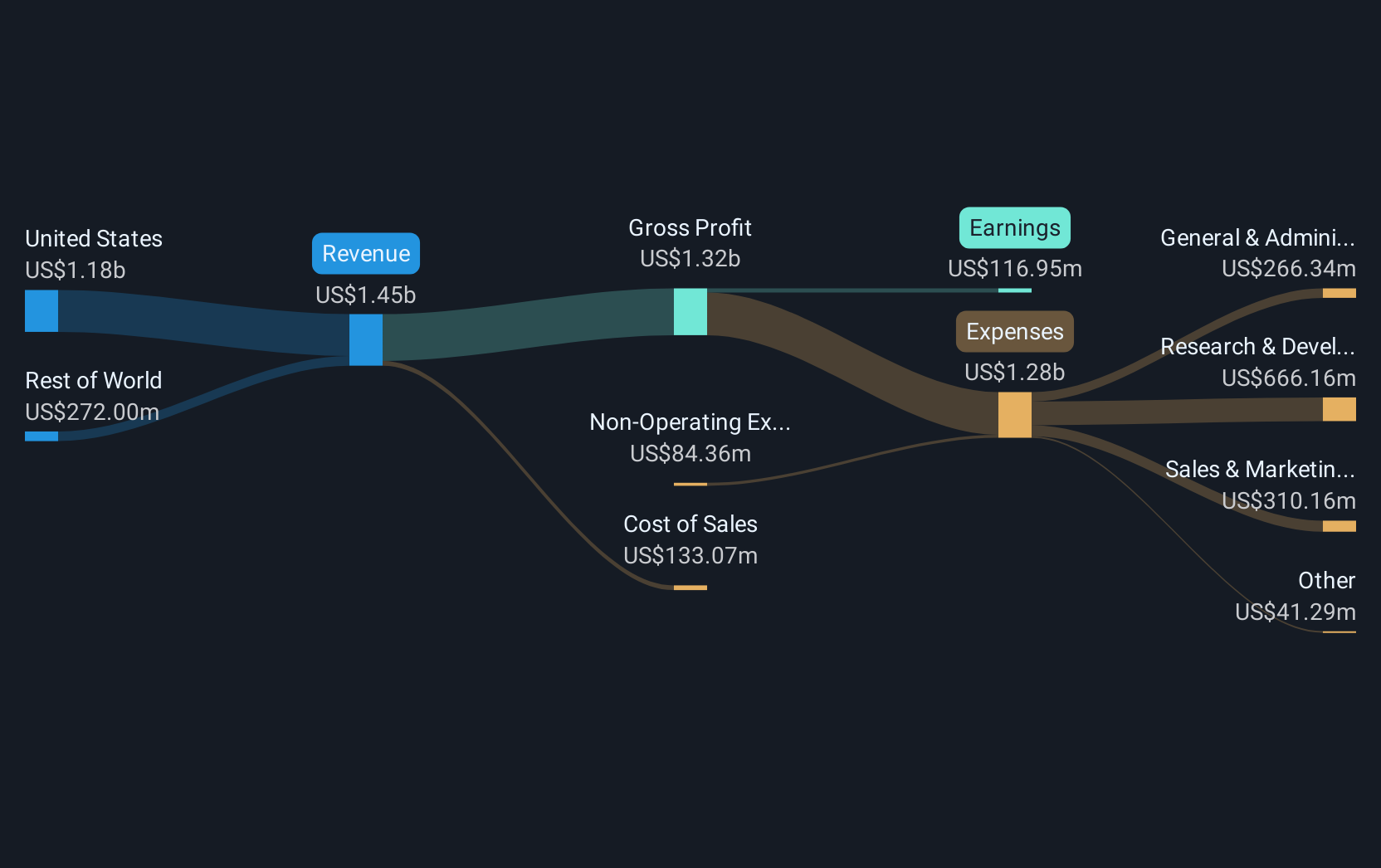

Reddit (NYSE:RDDT) recently integrated with Smartly, enhancing its advertising capabilities and influence over consumer purchasing decisions, potentially influencing its impressive 11% price rise last week. This integration, paired with robust Q1 2025 earnings showing significant revenue growth and a transition from loss to positive net income, signals strong operational progress. These developments are aligned synergistically against an overall market increase of 2% over the same period. Such corporate advancements add weight to Reddit's price movement, reflecting positive sentiment and reinforcing market confidence in its growth trajectory and advertising potential.

Every company has risks, and we've spotted 1 warning sign for Reddit you should know about.

Reddit's integration with Smartly has not only led to an immediate share price increase but also aligns with the company's larger growth narrative. The move supports expansion in advanced ad solutions and enhances Reddit's appeal across key international markets, potentially bolstering revenue streams and profitability. Over the past year, Reddit's shares saw a remarkable total return of 107.14%, showcasing its robust performance against the US Interactive Media and Services industry, which achieved a lower return of 12%. This outperformance is indicative of Reddit's growing influence and successful monetization efforts.

The integration and recent earnings advancements project further positive impacts on revenue and earnings forecasts. Analysts anticipate Reddit's revenue will grow consistently, with an expectation that earnings may exceed US$770 million by 2028. Despite the current share price of US$104.62, the analyst price target of US$150.25 reflects a potential 30.4% increase, highlighting market confidence in Reddit's strategic initiatives. As Reddit continues to leverage Smartly's capabilities, the company's trajectory suggests possible sustained profitability, with implications for competitive positioning in the global market.

Upon reviewing our latest valuation report, Reddit's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives