- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

3 US Stocks Estimated To Be Up To 48.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn with major indices like the S&P 500, Nasdaq, and Dow Jones posting losses for October, investors are keenly assessing opportunities amid fluctuating earnings reports and economic indicators. In this environment, identifying undervalued stocks becomes crucial as they may offer potential for growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.19 | $72.49 | 48.7% |

| Cadence Bank (NYSE:CADE) | $33.43 | $64.68 | 48.3% |

| WEX (NYSE:WEX) | $172.60 | $343.98 | 49.8% |

| Constellium (NYSE:CSTM) | $11.10 | $21.63 | 48.7% |

| Okta (NasdaqGS:OKTA) | $71.89 | $138.69 | 48.2% |

| Reddit (NYSE:RDDT) | $119.30 | $230.13 | 48.2% |

| AeroVironment (NasdaqGS:AVAV) | $214.96 | $419.99 | 48.8% |

| Bowhead Specialty Holdings (NYSE:BOW) | $29.11 | $56.49 | 48.5% |

| Verra Mobility (NasdaqCM:VRRM) | $25.97 | $50.05 | 48.1% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $475.98 | $917.19 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

Expand Energy (NasdaqGS:EXE)

Overview: Expand Energy Corporation is an independent exploration and production company operating in the United States, with a market cap of approximately $19.57 billion.

Operations: The company generates revenue of $3.29 billion from its exploration and production activities in the United States.

Estimated Discount To Fair Value: 39.9%

Expand Energy appears undervalued based on discounted cash flow analysis, trading at US$84.72 against an estimated fair value of US$140.92. Despite a recent net loss and reduced profit margins, the company's earnings and revenue are forecast to grow significantly faster than the market, with earnings expected to increase by 65.1% annually. However, shareholder dilution and a dividend not well-covered by earnings present risks. A substantial share buyback program may support stock value recovery efforts amidst these challenges.

- Our expertly prepared growth report on Expand Energy implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Expand Energy stock in this financial health report.

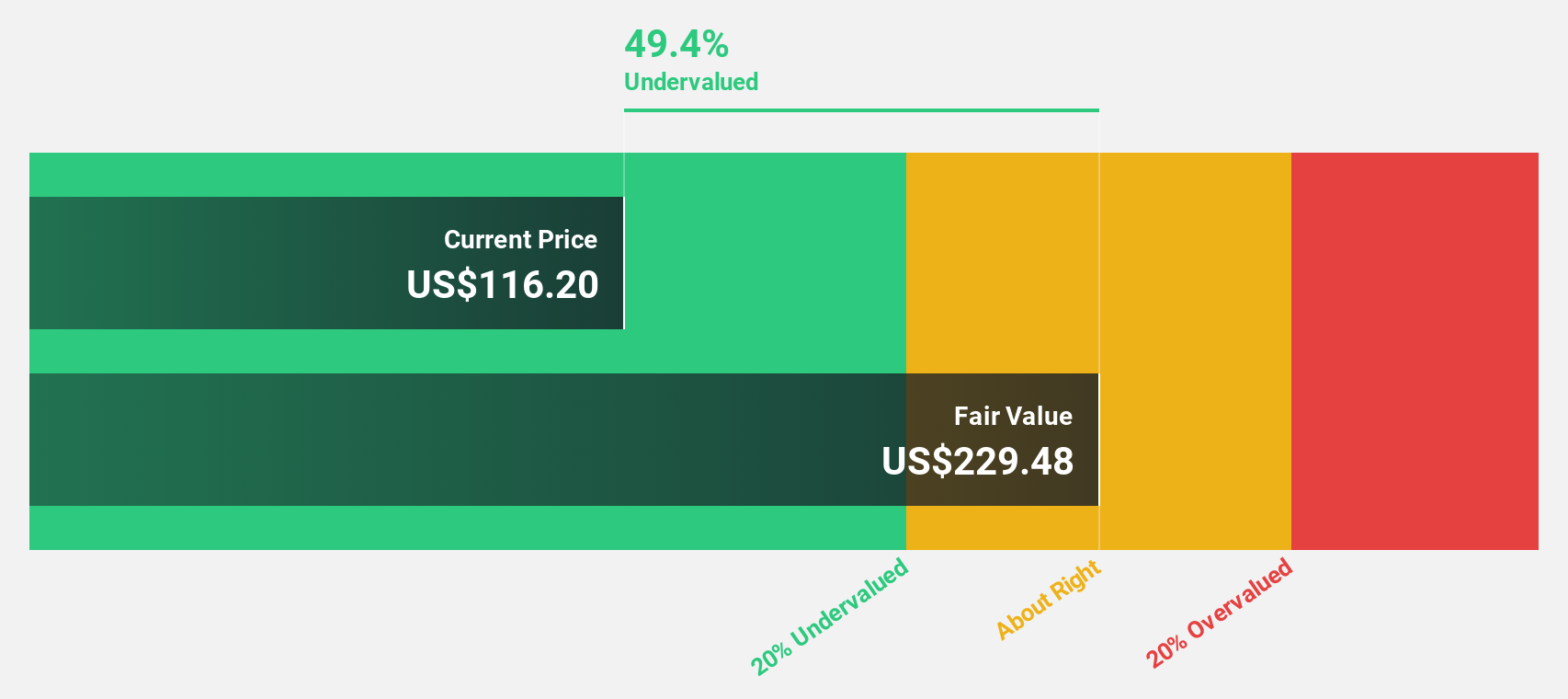

Reddit (NYSE:RDDT)

Overview: Reddit, Inc. operates a website that organizes digital communities and has a market cap of $20.95 billion.

Operations: The company generates revenue of $1.12 billion from its Internet Information Providers segment.

Estimated Discount To Fair Value: 48.2%

Reddit, Inc. is trading at US$119.3, significantly below its estimated fair value of US$230.13, suggesting undervaluation based on discounted cash flow analysis. Despite recent earnings improvements with a net income of US$29.85 million for Q3 2024, the company has experienced high volatility and insider selling recently. Revenue is projected to grow over 21% annually, outpacing the U.S. market growth rate and supporting potential future profitability within three years despite current losses.

- Our earnings growth report unveils the potential for significant increases in Reddit's future results.

- Take a closer look at Reddit's balance sheet health here in our report.

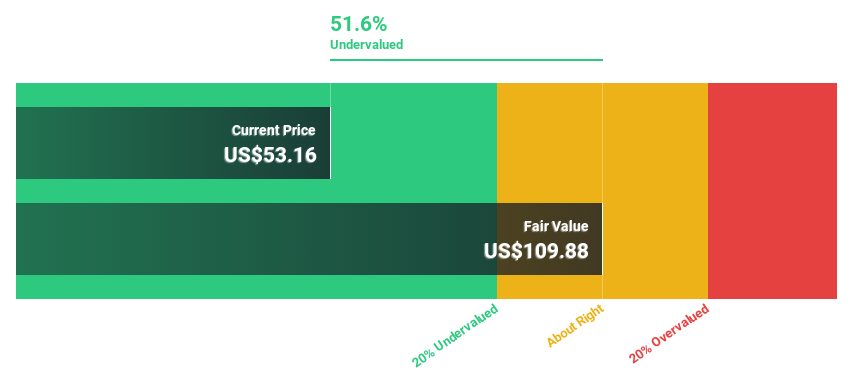

Smurfit Westrock (NYSE:SW)

Overview: Smurfit Westrock Plc, along with its subsidiaries, is engaged in the manufacturing, distribution, and sale of containerboard, corrugated containers, and other paper-based packaging products both in Ireland and internationally; it has a market cap of approximately $26.68 billion.

Operations: The company's revenue is derived from its operations in manufacturing, distributing, and selling containerboard, corrugated containers, and various paper-based packaging products across Ireland and international markets.

Estimated Discount To Fair Value: 46.9%

Smurfit Westrock is trading at US$51.5, well below its estimated fair value of US$96.91, indicating potential undervaluation based on discounted cash flow analysis. Despite forecasted earnings growth of 31.6% annually, recent financial results show a net loss of US$150 million for Q3 2024 and significant shareholder dilution over the past year. Revenue growth is expected to outpace the U.S. market, but profit margins have declined significantly from last year’s levels.

- The analysis detailed in our Smurfit Westrock growth report hints at robust future financial performance.

- Click here to discover the nuances of Smurfit Westrock with our detailed financial health report.

Seize The Opportunity

- Explore the 185 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives