- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX): Assessing Valuation After Launching New Developer Tools and Growth Initiatives

Reviewed by Simply Wall St

If you are keeping an eye on Roblox (RBLX), this week’s annual Developers Conference probably caught your attention. The company unveiled a set of new tools and features, including Roblox Moments, aimed directly at helping its vast creator community enhance their content and reach broader audiences. With a stated ambition to claim 10% of the global gaming content market in the long run, Roblox’s latest product rollouts signal a clear push to deepen platform engagement, support creators’ businesses, and open fresh pathways for monetization.

Momentum for Roblox has been building steadily. Shares have surged 105% over the past six months, reflecting how the market is responding to the company’s combination of record developer earnings, in-demand IP partnerships, and new monetization streams such as advertising and licensing. Even with recent regional content restrictions and ongoing concerns around child safety, investor sentiment has stayed resilient, likely due to the company’s swift safety pivot and strong Q2 results. In short, both the company and its stock have been on an upswing as management continues to deliver on engagement and growth metrics.

After this impressive run and the latest round of strategic moves, the key question is whether Roblox’s current price already reflects all these future opportunities, or if there is still a window to buy into the next wave of growth.

Most Popular Narrative: 10.8% Undervalued

The prevailing narrative views Roblox as undervalued by about 11%, driven by rapid international expansion, new monetization strategies, and shifting audience demographics.

International expansion and localization initiatives, especially enhancements in auto-translation and server infrastructure, are driving rapid user growth in APAC and other regions. This broadens the addressable market and increases global revenue potential. Advancements in platform infrastructure, scalability, and AI-driven content tools are reducing barriers for creators. These improvements are fueling an acceleration of user-generated content and viral hits, strengthening engagement, increasing DAUs, and supporting long-term growth in transaction-based revenue and average bookings per user.

Ever wondered what bold assumptions fuel Roblox’s latest valuation? Imagine global growth levers, a shift in the user base, and future earnings projections unlike anything seen before. If you want to understand the quantitative forces electrifying this price target, explore the full narrative for the detailed blueprint that’s shaping expectations.

Result: Fair Value of $143.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, escalating costs and dependence on viral content could threaten Roblox’s growth story if user and monetization gains do not keep pace.

Find out about the key risks to this Roblox narrative.Another View: Are the Numbers as Generous?

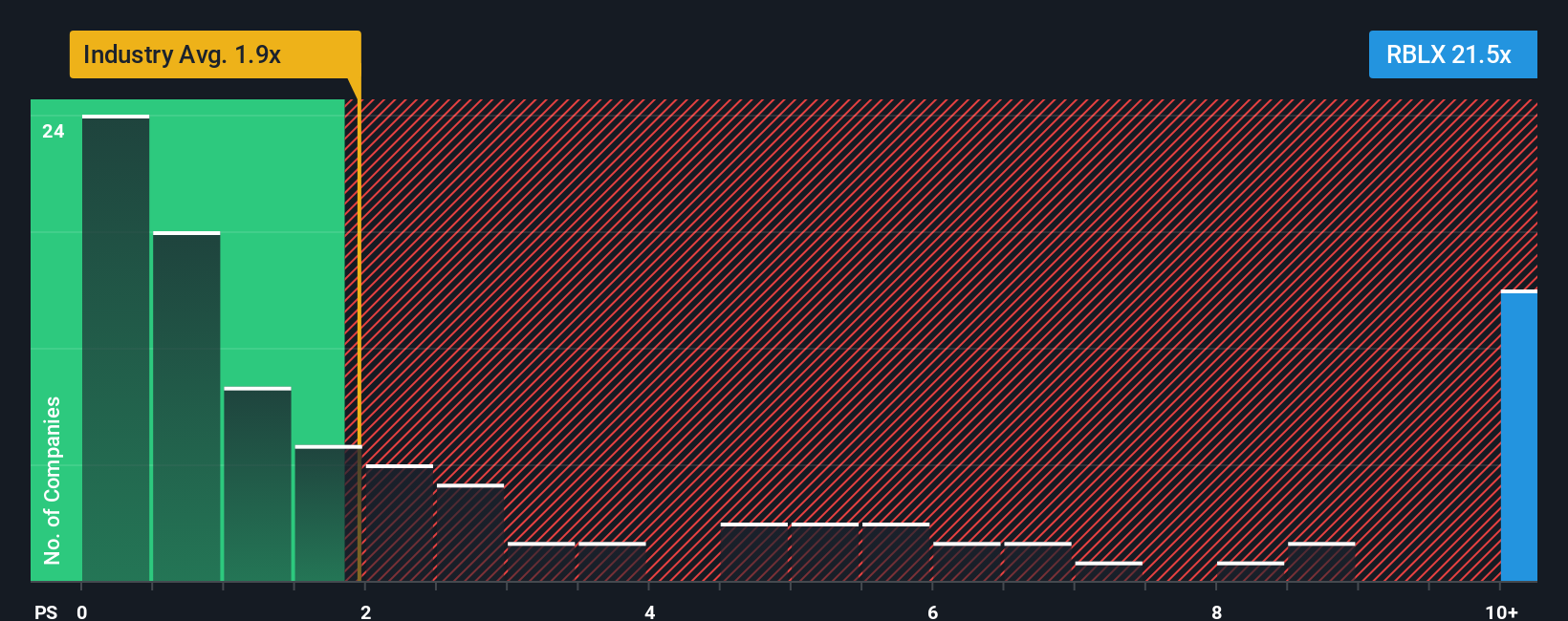

Looking at the situation from a different perspective, market valuation based on sales multiples suggests that Roblox’s share price appears steeply priced compared to others in its industry. Does this indicate a mismatch with the growth outlook mentioned above?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Roblox to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Roblox Narrative

If you think there is more to the story, or want to dig into the numbers on your own terms, you can shape your own perspective in just minutes. Do it your way

A great starting point for your Roblox research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Use the Simply Wall Street Screener to target stocks that match your strategy, so you never miss your next big winner.

- Unlock financial growth by targeting companies trading below their intrinsic value with our selection of undervalued stocks based on cash flows.

- Ride the AI revolution and spot trailblazing tech stocks transforming industries with the help of AI penny stocks.

- Generate income and stability for your portfolio by focusing on shares offering attractive payouts using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)