- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Advertising Costs are Increasing and Pinterest, Inc. (NYSE:PINS) may Take Some of that Pie

Pinterest, Inc. (NYSE:PINS) has been brought under the attention of investors as a possibly undervalued stock, and a company that has the ability to take some advertising revenue from Facebook. In this article, we will go over the fundamentals and see what we can expect from Pinterest in the future.

Overview

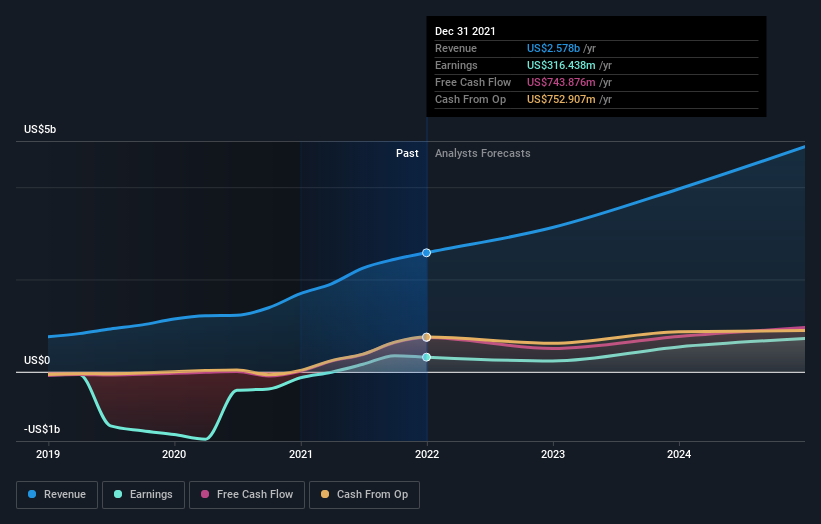

Since Pinterest became profitable, analysts have an easier time building models for the future and estimating the value of the stock.

Becoming profitable helps as it validates the business model, giving investors confidence that they are putting their money in a company that generates free cash flows.

The company's latest revenues were US$2.6b, and it posted US$316.4m in net income. Digging a bit deeper, we can see that the company is very efficient at generating cash, since free cash flows are consistently above earnings. This is a great indicator of a strong business, and one with the ability to increase future profits! The latest free cash flow was US$743.9m, more than double that of profits. Remember, that investors have a claim on the cash flows, and metrics like net income and EPS are used as a proxy for cash flows to investors.

Considering the current landscape in the tech-advertizing industry, we can see that a competitor, Meta (NASDAQ:FB) has seen a drop in their advertising algorithm efficiency. While not their doing, this has lead to increased costs for advertisers, which in turn may seek to diversify their advertising budgets and increase the usage of Pinterest as an ad platform. The upside for advertisers, is that people use the platform to discover things they like, and in doing so, they self categorize, which gives ad-targeting algorithms much more valuable information on products that people are likely to buy.

The downside is that, the platform is somewhat invasive and forceful, which makes the user experience quite poor and targeted to a specific type of person. Additionally, the social component in PINS is barely noticeable, which makes the platform less sticky, as users open it with intention, rather as part of their daily routine.

In general, it seems that Pinterest does have a growing market, although currently catering to a specific demographic. The company has managed to turn this into a profitable model, and changes in the advertising business may provide a future boost to users and revenue for Pinterest.

Analysts' Estimates

The future of the company is what determines the value of the stock today. That is why we will see how analysts are expecting Pinterest to perform, and see what that means for the stock price.

With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Pinterest

Pinterest's 28 analysts are now forecasting revenues of US$3.12b in 2022. This would be a substantial 21% improvement in sales compared to the last 12 months. Statutory earnings per share are expected pull back some 33% to US$0.32 in the same period. In the lead-up to this report, the analysts had been modelling earnings per share (EPS) of US$0.30 in 2022. The analysts seem to have become more bullish on the business, judging by their new earnings per share estimates.

There's been no major changes to the consensus price target of US$40.78, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is.

The most optimistic Pinterest analyst has a price target of US$65 per share, while the most pessimistic values it at US$20.

Another way to use analyst estimates is to include them in a valuation model. By doing this for Pinterest, we get an intrinsic value per share of US$51. This assumes that the company continues to grow and reach cash flows of US$2b by 2031. Investors that think, that this is not a far-fetched proposition, will likely find the company to be some 53% undervalued today.

It is clear that Pinterest has a long way to go before reaching that point, but a good business model which provides value to users can gain even wider adaptation.

The Bottom Line

Pinterest is profitable, growing and has understated cash flows.

The company is in a great position to expand, and possibly take some advertising revenue from Facebook. Analysts are also bullish on the future of the company, and many of them post price targets with high upside.

Our general valuation model also shows that the stock may be significantly undervalued - which does not automatically mean that the price will catch up. It is far more likely to be the case that if the company performs, then we may be able to expect a higher price.

However, before you get too enthused, we've discovered 3 warning signs for Pinterest that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives