- United States

- /

- Media

- /

- NYSE:OMC

Why Omnicom Group (OMC) Is Up 6.3% After Dividend Declaration and What's Next

Reviewed by Simply Wall St

- On July 17, 2025, Omnicom Group's Board of Directors declared a quarterly dividend of US$0.70 per share, payable on October 10, 2025, to shareholders of record as of September 2, 2025.

- This continued dividend affirmation underscores the company's confidence in its financial position and commitment to ongoing shareholder returns amid industry transformation.

- We'll consider how Omnicom's regular dividend announcement reinforces confidence in its investment narrative, especially as integration and technology reshape the sector.

Omnicom Group Investment Narrative Recap

Omnicom Group’s investment case rests on its ability to deliver stable shareholder returns through industry shifts, supported by its established dividend and ongoing scale advantages. The latest quarterly dividend affirmation of US$0.70 per share reinforces management’s message of continuity, but this news alone does not have a material bearing on the most immediate catalyst, the pending Interpublic acquisition, or alter the key risks from clients adopting in-house and AI-powered models, which could pressure both revenue and margins.

The upcoming Q2 2025 earnings release, scheduled for July 15, is the announcement most relevant right now, as investors watch for signs of operating momentum and any commentary related to integration plans or expected synergies from the Interpublic deal. Solid earnings could provide fresh insight on Omnicom’s ability to maintain profitability despite ongoing margin pressures and changing client behaviors.

In contrast, investors should not overlook the risk that as brands accelerate the shift to self-service AI campaigns, Omnicom could face...

Read the full narrative on Omnicom Group (it's free!)

Omnicom Group’s outlook anticipates $17.2 billion in revenue and $1.7 billion in earnings by 2028. This implies annual revenue growth of 3.1% and a $0.3 billion increase in earnings from the current $1.4 billion.

Uncover how Omnicom Group's forecasts yield a $99.51 fair value, a 32% upside to its current price.

Exploring Other Perspectives

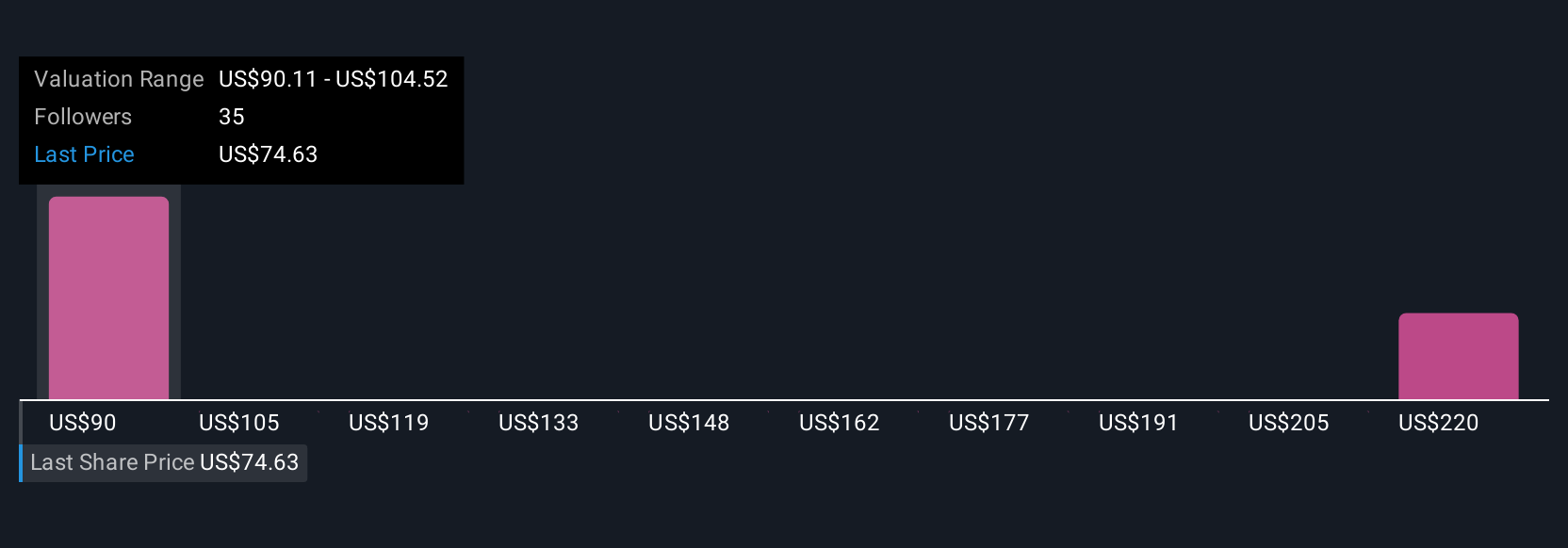

Three members of the Simply Wall St Community estimate Omnicom’s fair value between US$90.11 and US$232.37. As these views reveal a wide spectrum, remember that rapid adoption of AI by clients remains a critical variable influencing the company’s future revenue stability.

Explore 3 other fair value estimates on Omnicom Group - why the stock might be worth just $90.11!

Build Your Own Omnicom Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicom Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Omnicom Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicom Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMC

Omnicom Group

Offers advertising, marketing, and corporate communications services.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives