- United States

- /

- Electrical

- /

- NYSEAM:HYLN

3 Penny Stocks With Market Caps Under $2B To Consider

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of anticipation around potential interest rate cuts, with indices like the S&P 500 and Nasdaq recently hitting new highs before pulling back, investors are keenly assessing opportunities across various sectors. Amid these conditions, penny stocks—often smaller or newer companies—remain an intriguing area for those looking to uncover hidden value. Though the term 'penny stock' might sound like a relic of past trading days, these investments can still offer significant potential when backed by strong financials and promising growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.20 | $475.76M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.26 | $212.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.52 | $233.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.79 | $22.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.96824 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.80 | $85.42M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.95 | $651.74M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 382 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

GoodRx Holdings (GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides tools and information for consumers in the United States to compare prices and save on prescription drugs, with a market cap of approximately $1.42 billion.

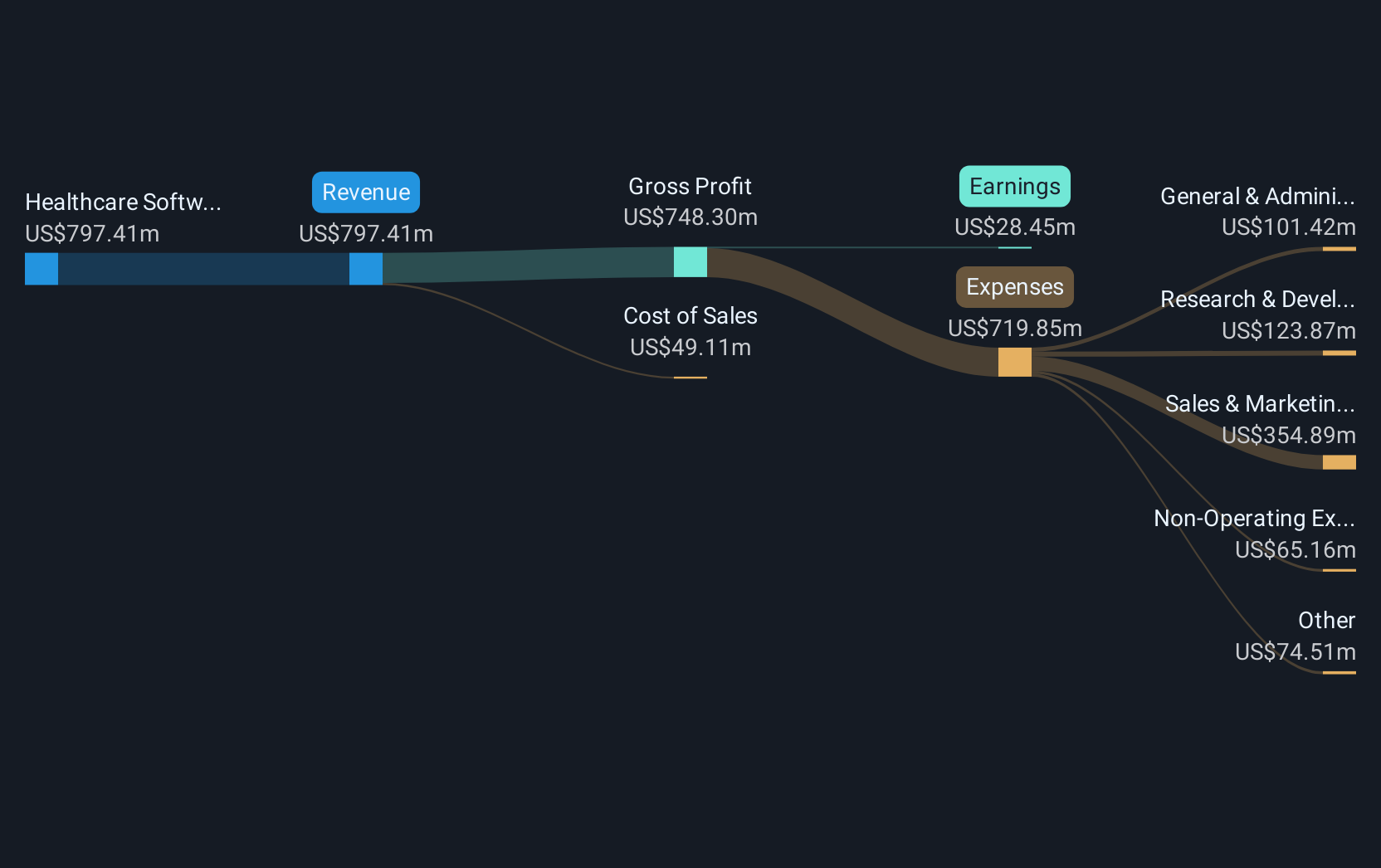

Operations: The company's revenue primarily comes from its Healthcare Software segment, generating $799.87 million.

Market Cap: $1.42B

GoodRx Holdings has recently become profitable, with earnings growing by 47.3% annually over the past five years. The company reported US$203.07 million in sales for Q2 2025 and a net income of US$12.84 million, reflecting improved financial performance compared to last year. GoodRx's short-term assets significantly exceed its liabilities, and its debt is well-covered by operating cash flow. Additionally, the company has been actively repurchasing shares and recently announced a collaboration with Novo Nordisk to provide affordable access to popular GLP-1 medications like Ozempic® and Wegovy®, enhancing its market position in prescription drug savings solutions.

- Click here and access our complete financial health analysis report to understand the dynamics of GoodRx Holdings.

- Assess GoodRx Holdings' future earnings estimates with our detailed growth reports.

Hyliion Holdings (HYLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyliion Holdings Corp. designs and develops power generators for stationary and mobile applications, with a market cap of approximately $305.26 million.

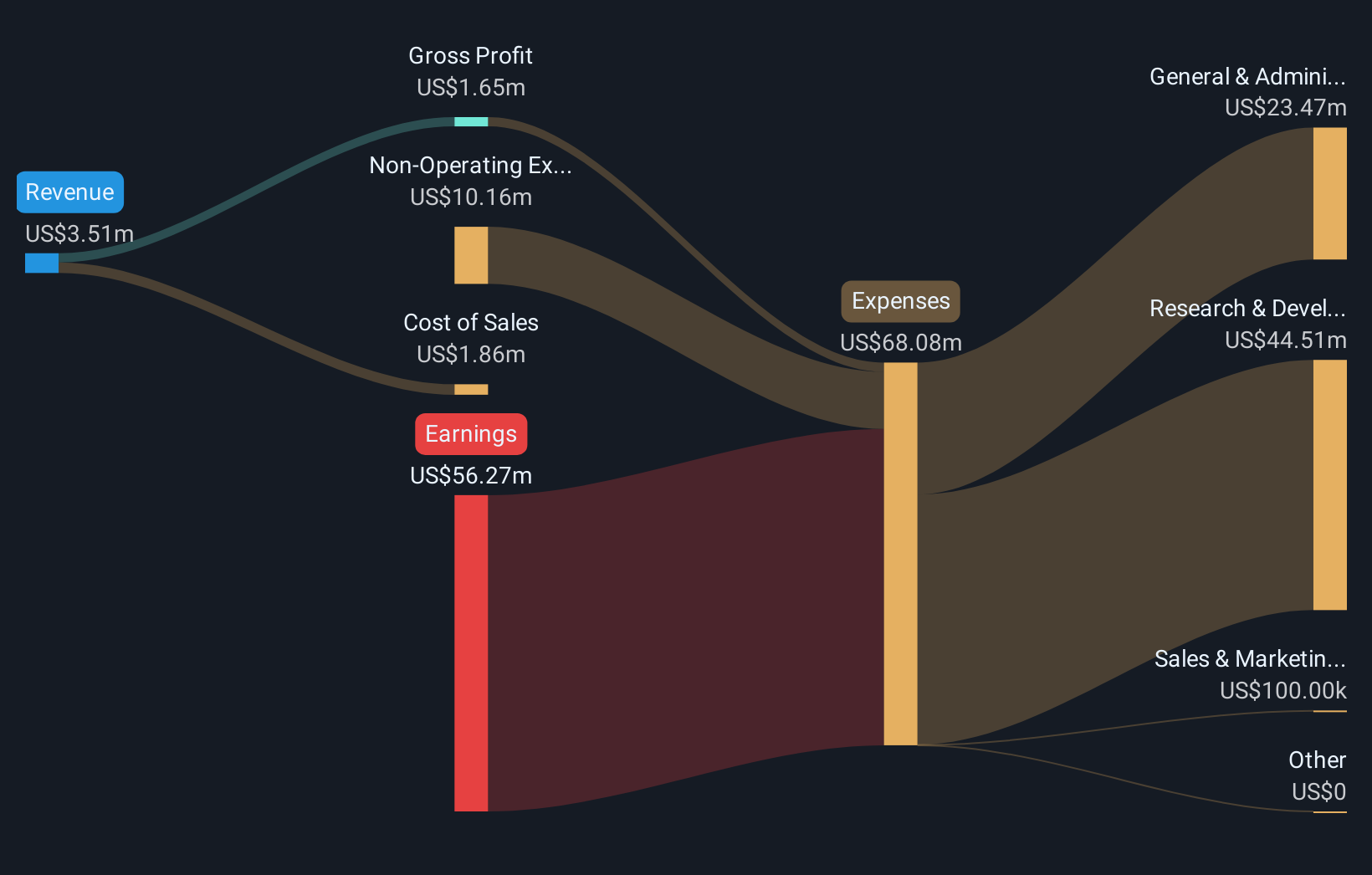

Operations: Hyliion Holdings Corp. has not reported any specific revenue segments.

Market Cap: $305.26M

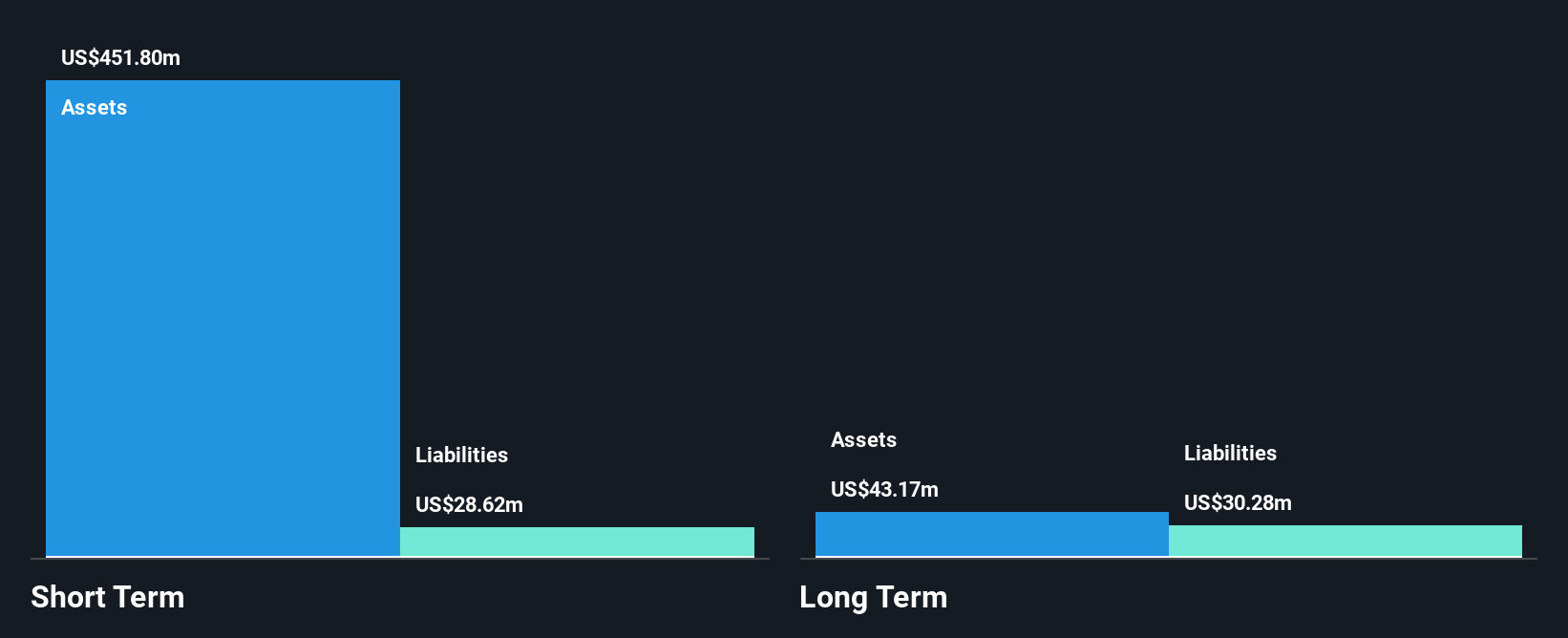

Hyliion Holdings Corp., with a market cap of US$305.26 million, is navigating the penny stock landscape with its innovative KARNO™ Power Module, recently receiving favorable regulatory clarity from the EPA. Despite being pre-revenue and unprofitable, Hyliion forecasts significant revenue growth of 97.6% annually, although earnings are expected to decline by 3% over the next three years. The company’s short-term assets comfortably cover both its short and long-term liabilities, providing a stable financial base. Recent developments include a US$1.5 million contract from the U.S. Navy and plans for strategic deployment in various sectors through partnerships like MMR Power Solutions.

- Click here to discover the nuances of Hyliion Holdings with our detailed analytical financial health report.

- Learn about Hyliion Holdings' future growth trajectory here.

Nextdoor Holdings (NXDR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of $828.74 million.

Operations: The company generates revenue of $250.11 million from its Internet Information Providers segment.

Market Cap: $828.74M

Nextdoor Holdings, Inc., with a market cap of US$828.74 million, is making strides in the penny stock realm by focusing on neighborhood connectivity and expanding its advertising reach into Canada. The company reported second-quarter sales of US$65.09 million, showing modest growth from the previous year while reducing its net loss significantly to US$15.36 million from US$42.78 million a year ago. Despite being unprofitable, Nextdoor remains debt-free and has a cash runway exceeding three years due to positive free cash flow. Recent strategic moves include workforce restructuring for cost savings and product enhancements targeting local community engagement.

- Get an in-depth perspective on Nextdoor Holdings' performance by reading our balance sheet health report here.

- Gain insights into Nextdoor Holdings' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Explore the 382 names from our US Penny Stocks screener here.

- Interested In Other Possibilities? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyliion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:HYLN

Hyliion Holdings

Designs and develops power generators for stationary and mobile applications.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion