- United States

- /

- Entertainment

- /

- NYSE:LYV

There's Reason For Concern Over Live Nation Entertainment, Inc.'s (NYSE:LYV) Price

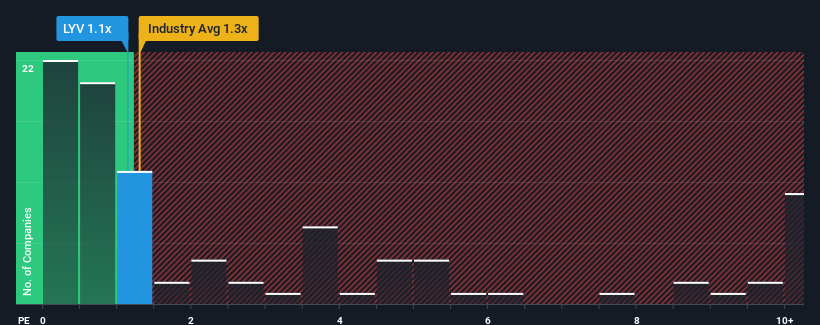

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Entertainment industry in the United States, you could be forgiven for feeling indifferent about Live Nation Entertainment, Inc.'s (NYSE:LYV) P/S ratio of 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Live Nation Entertainment

How Has Live Nation Entertainment Performed Recently?

Live Nation Entertainment could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Live Nation Entertainment.Is There Some Revenue Growth Forecasted For Live Nation Entertainment?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Live Nation Entertainment's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.1% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 11% per year growth forecast for the broader industry.

With this in mind, we find it intriguing that Live Nation Entertainment's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Live Nation Entertainment's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Live Nation Entertainment you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives