- United States

- /

- IT

- /

- NasdaqGM:GDS

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.8%, contributing to a 25% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential in alignment with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 238 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

GDS Holdings (NasdaqGM:GDS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GDS Holdings Limited, along with its subsidiaries, is engaged in the development and operation of data centers in the People's Republic of China, with a market capitalization of approximately $3.82 billion.

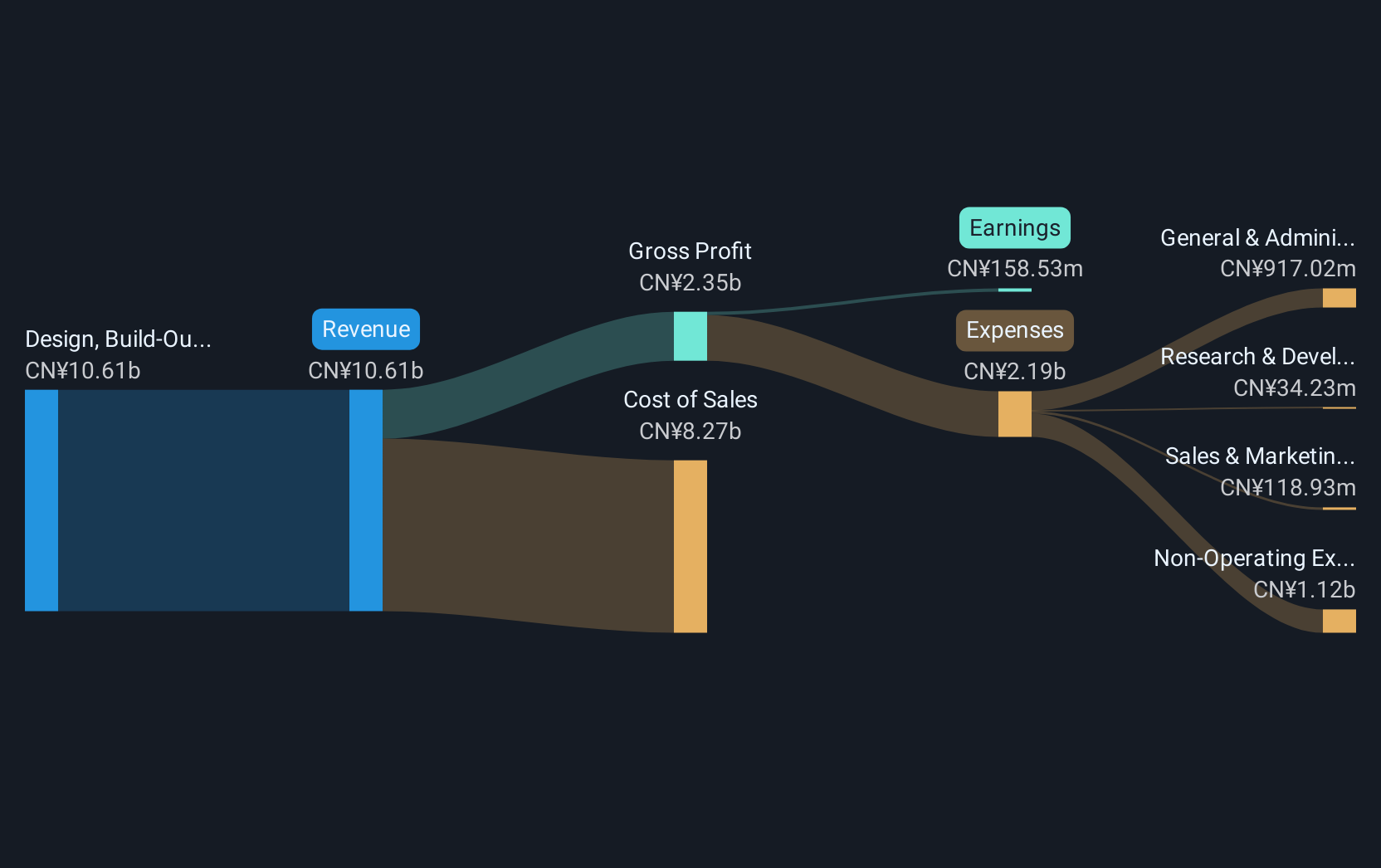

Operations: GDS Holdings generates revenue primarily from the design, build-out, and operation of data centers in China, amounting to CN¥10.98 billion. The company focuses on providing colocation and managed services to its clients within these facilities.

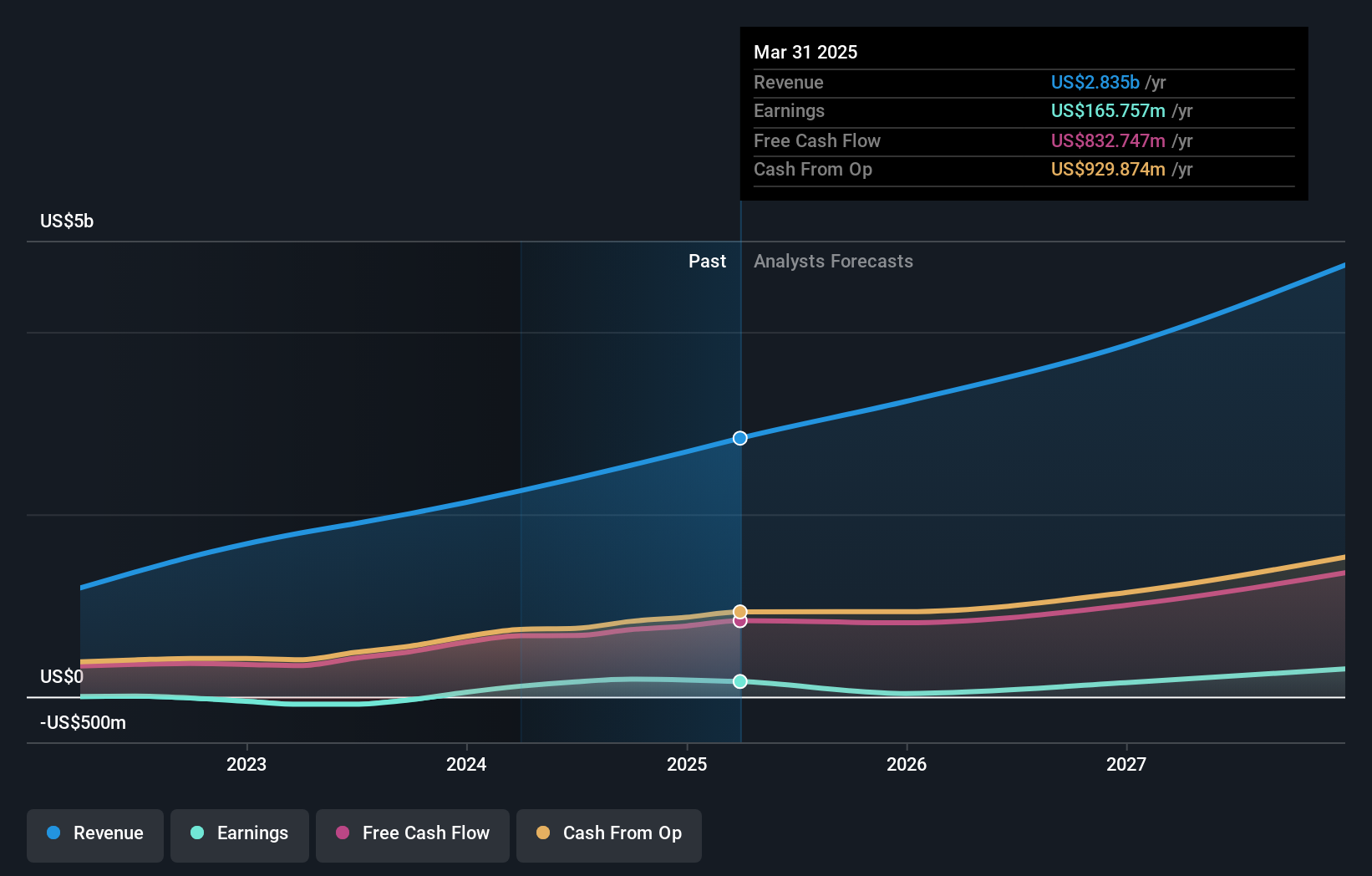

GDS Holdings, amidst a challenging fiscal landscape marked by a significant reduction in net losses from CNY 421.18 million to CNY 192.34 million year-over-year for Q3, is navigating its path toward profitability with strategic precision. This shift is underscored by an impressive annual revenue growth rate of 15.5%, signaling robust demand for its data center services despite broader market volatility. The company's commitment to innovation and expansion is evident in its steady R&D investment, aligning with industry trends towards enhancing technological infrastructure capabilities. Moreover, the recent legal settlement proposal indicates GDS's proactive stance on resolving disputes, potentially clearing hurdles for future operational clarity and investor confidence.

- Click here to discover the nuances of GDS Holdings with our detailed analytical health report.

Examine GDS Holdings' past performance report to understand how it has performed in the past.

Datadog (NasdaqGS:DDOG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Datadog, Inc. provides an observability and security platform for cloud applications across North America and globally, with a market capitalization of $50.41 billion.

Operations: The company generates revenue primarily from its Information Technology (IT) Infrastructure segment, amounting to $2.54 billion.

Datadog's trajectory in the tech landscape is marked by robust financial and operational growth, with a notable 18% annual revenue increase and an impressive 22.8% forecast in earnings growth per year, outpacing the US market average of 15.3%. This performance is underpinned by strategic R&D investments that not only align with but drive sector innovations, particularly in cloud and database monitoring solutions. Recent expansions include enhancing MongoDB support within their Database Monitoring product, ensuring comprehensive visibility across multiple database systems—a move critical for optimizing tech infrastructure amidst growing data demands. The firm also recently bolstered its board, hinting at a strategic alignment for future governance and innovation pathways.

- Navigate through the intricacies of Datadog with our comprehensive health report here.

Understand Datadog's track record by examining our Past report.

Ibotta (NYSE:IBTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ibotta, Inc. is a technology company that provides the Ibotta Performance Network for consumer packaged goods brands to offer digital promotions, with a market cap of $1.99 billion.

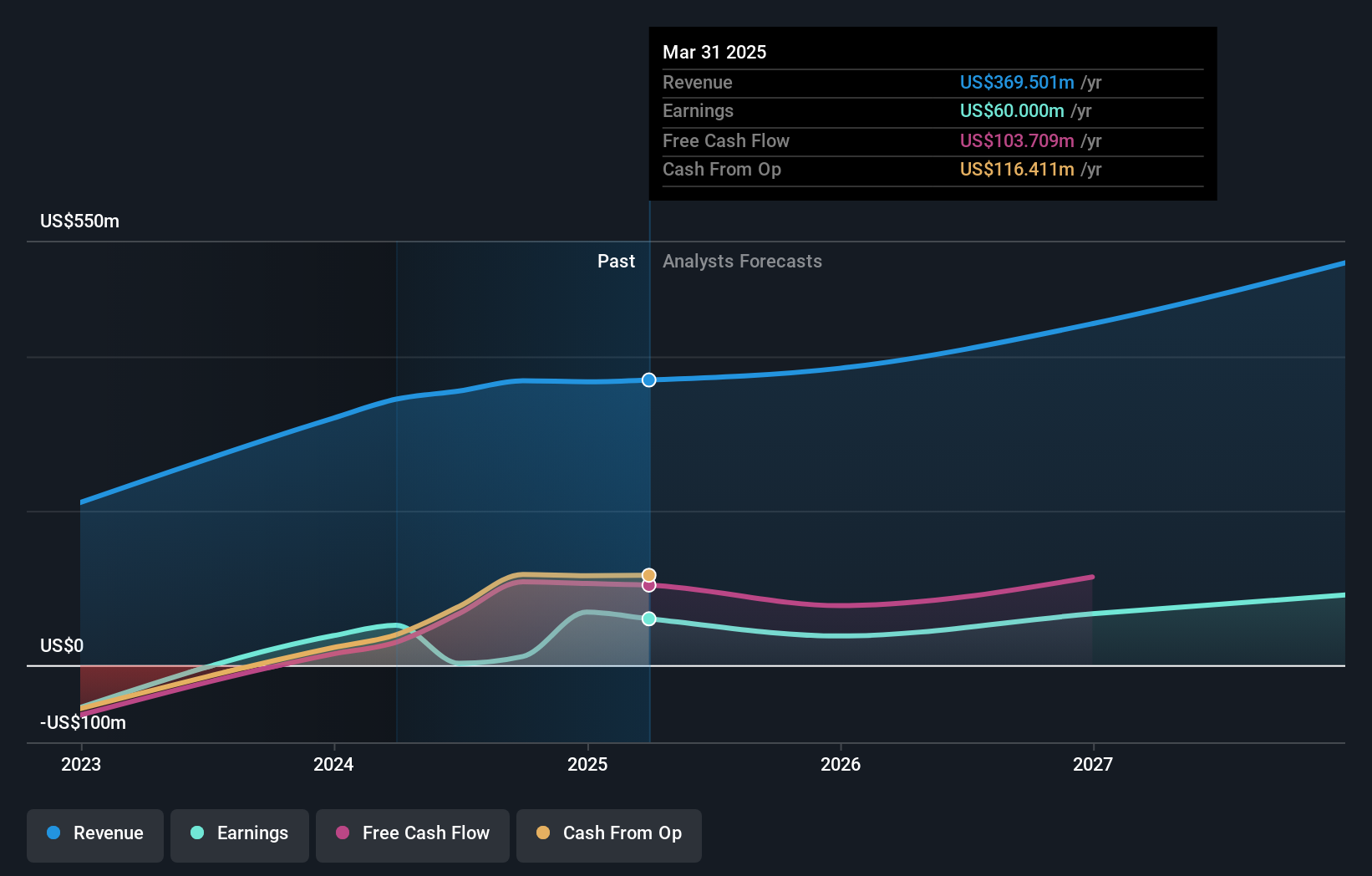

Operations: Ibotta generates revenue primarily through its Internet Software segment, which contributed $368.55 million. The company's business model focuses on enabling consumer packaged goods brands to deliver digital promotions directly to consumers via the Ibotta Performance Network.

Ibotta stands out in the tech sector with a projected annual revenue growth of 15.7%, indicating robust market performance despite a challenging economic backdrop. However, its earnings have seen a dip by 23.6% over the past year, contrasting sharply with an industry average growth of 33.2%. On the innovation front, Ibotta is not shying away from investing in its future; R&D expenses have been significant, aligning with its strategic goals to enhance product offerings and maintain competitive edge in the digital coupon space. Recent executive team expansions and substantial financial maneuvers like securing a $100 million credit facility signal Ibotta's aggressive plans for scaling operations and possibly exploring new market segments to bolster future earnings by an impressive forecast of 64.9% annually.

Seize The Opportunity

- Gain an insight into the universe of 238 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Reasonable growth potential with imperfect balance sheet.