David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Gray Television, Inc. (NYSE:GTN) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Gray Television

What Is Gray Television's Debt?

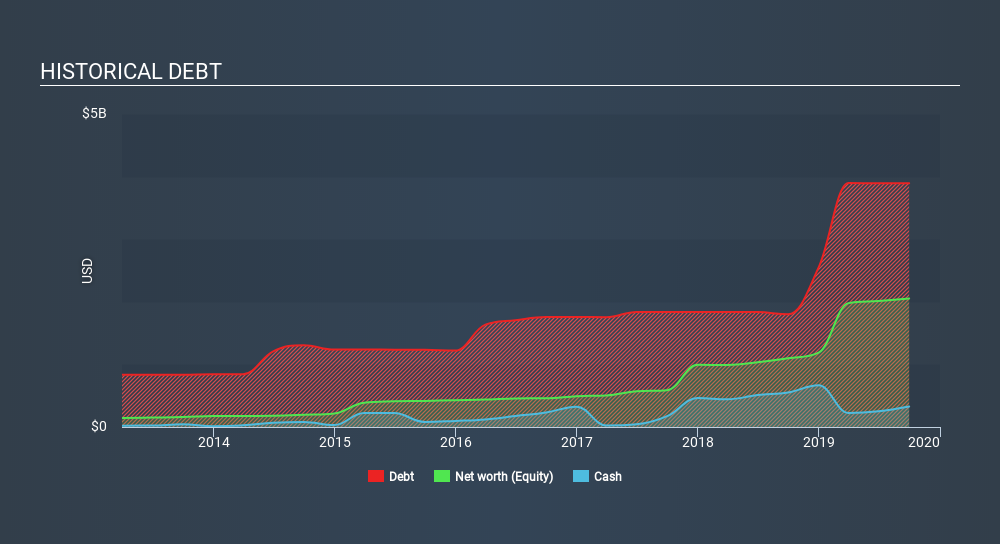

The image below, which you can click on for greater detail, shows that at September 2019 Gray Television had debt of US$3.90b, up from US$1.8k in one year. However, it also had US$326.0m in cash, and so its net debt is US$3.57b.

How Strong Is Gray Television's Balance Sheet?

We can see from the most recent balance sheet that Gray Television had liabilities of US$292.0m falling due within a year, and liabilities of US$4.76b due beyond that. On the other hand, it had cash of US$326.0m and US$402.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.32b.

The deficiency here weighs heavily on the US$2.20b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Gray Television would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Gray Television shareholders face the double whammy of a high net debt to EBITDA ratio (5.5), and fairly weak interest coverage, since EBIT is just 2.3 times the interest expense. This means we'd consider it to have a heavy debt load. Looking on the bright side, Gray Television boosted its EBIT by a silky 66% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Gray Television can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Gray Television recorded free cash flow worth 80% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

While Gray Television's level of total liabilities has us nervous. For example, its EBIT growth rate and conversion of EBIT to free cash flow give us some confidence in its ability to manage its debt. Taking the abovementioned factors together we do think Gray Television's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Gray Television (of which 1 is a bit unpleasant!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GTN

Gray Media

A multimedia company, owns and/or operates television stations and digital assets in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives