- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

Is Grindr’s Stock Set for a Rebound After Recent Price Dip?

Reviewed by Bailey Pemberton

If you are taking a fresh look at Grindr stock right now, you are not alone. The stock has been a bit of a rollercoaster lately, with short-term dips and surprising long-term strength that have left investors debating their next move. Over the past week, shares slipped 6.3%, and the 30-day decline sits at 3.5%. But zoom out, and a more striking story emerges. Year-to-date, Grindr is down 17.8%. Yet when you look at the one-year and three-year horizons, the stock is up 25.5% and a massive 42.1%, respectively. That kind of volatility has everything to do with the shifting perceptions of risk and opportunity in today's market, as tech and communications stocks face new challenges and fresh interest.

With all that action in the rearview mirror, the real question now centers on value. Based on our valuation analysis, Grindr earns a value score of 4 out of 6, meaning it is undervalued on four separate checks. That is a promising sign if you are weighing whether to buy, hold, or sell. But what does that score really say about Grindr’s long-term potential, and what valuation approaches should you trust? Let’s break down each method and stick around, because at the end, there is a smarter perspective on judging value that every investor should consider.

Why Grindr is lagging behind its peers

Approach 1: Grindr Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today based on its expected future cash flows, which are projected out and then discounted back to the present. This approach gives investors a way to see beyond market noise and focus on a business's underlying fundamentals.

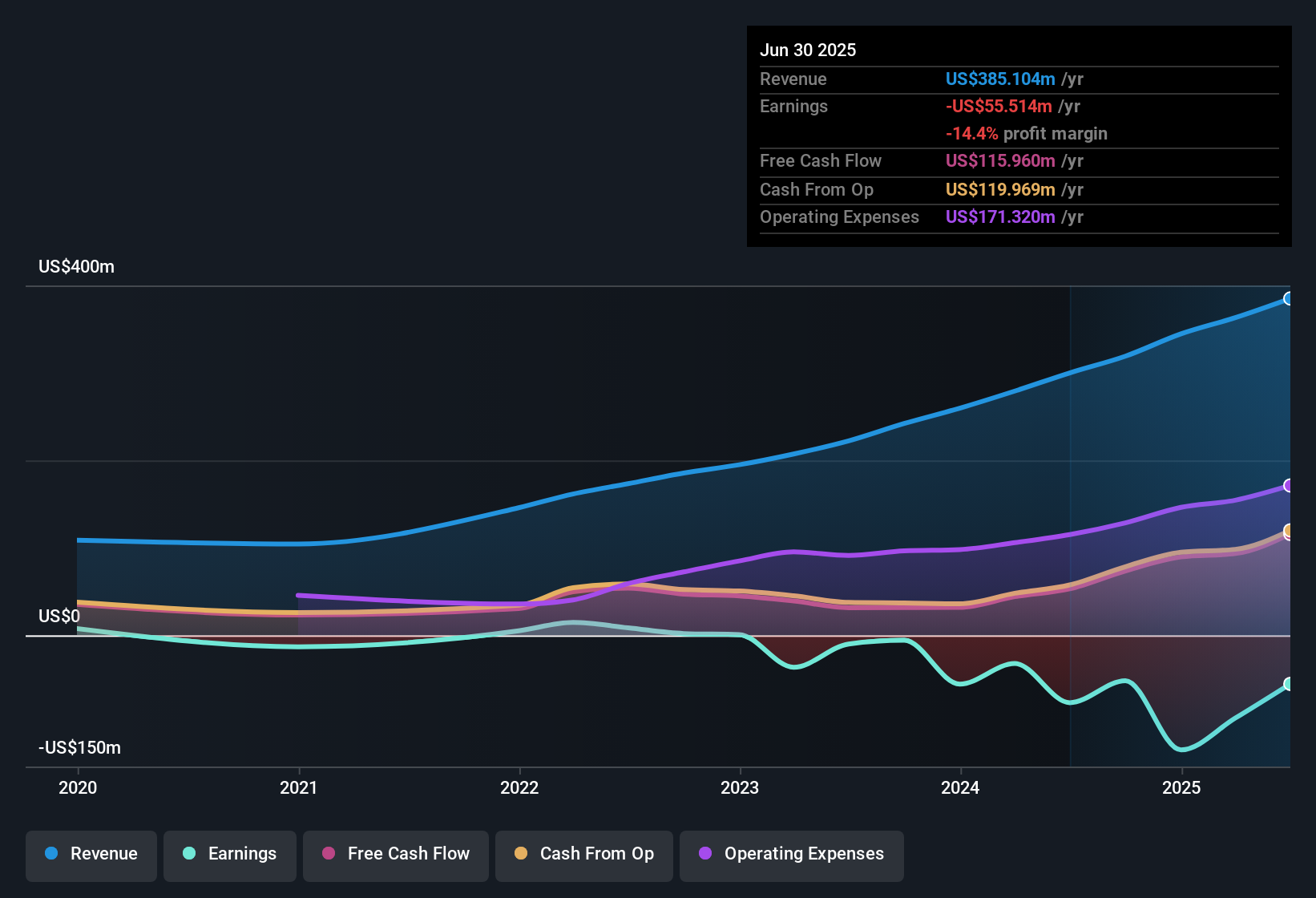

For Grindr, the current Free Cash Flow sits at $113.8 Million. Analysts have forecasted annual increases, with Free Cash Flow expected to climb to $329.2 Million by 2029. Looking further out, projections from Simply Wall St extrapolate even higher cash flows, reaching nearly $498.2 Million by 2035. This model uses a 2 Stage Free Cash Flow to Equity method, combining analyst estimates for the next five years with longer-term growth assumptions beyond that period.

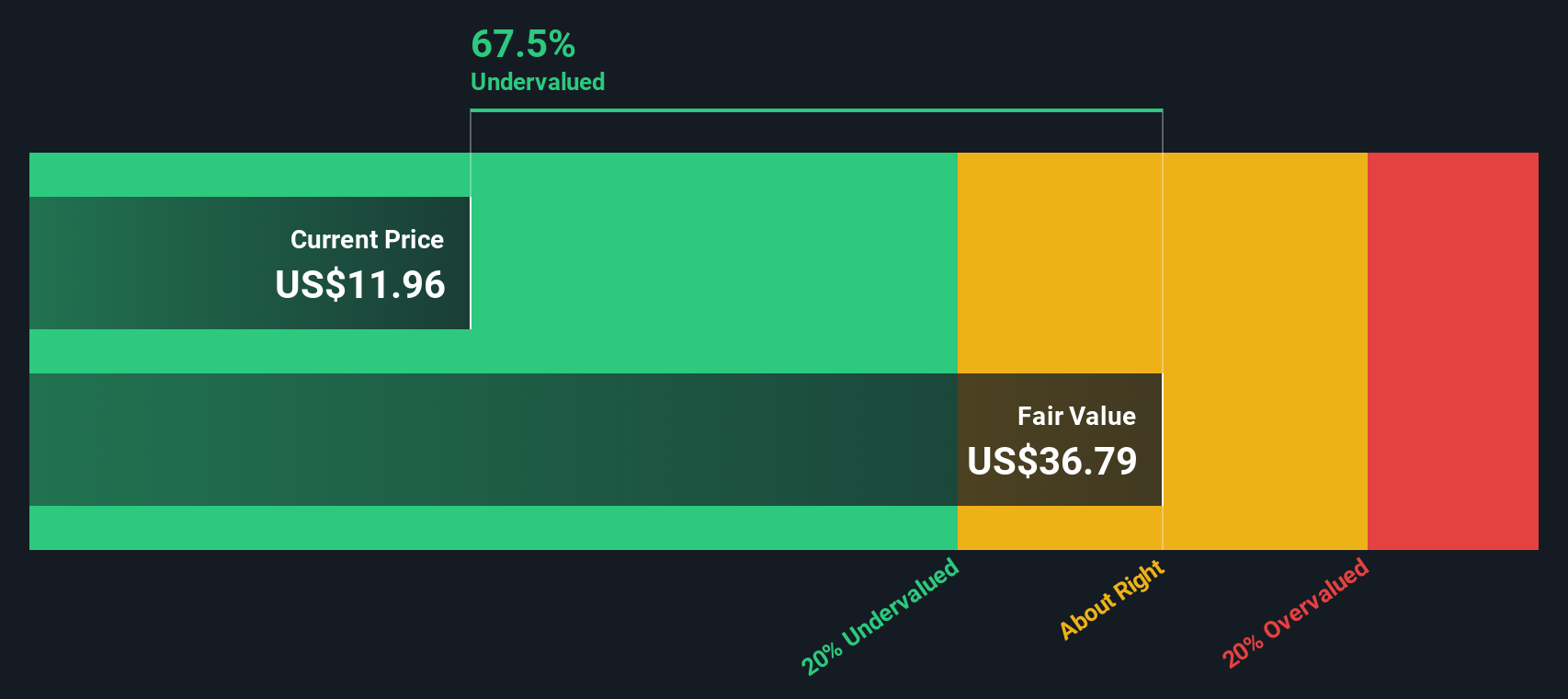

Based on these calculations, the estimated intrinsic value for Grindr is $36.29 per share. Compared to today’s stock price, this analysis indicates the stock is about 59.3% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Grindr is undervalued by 59.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Grindr Price vs Sales (P/S) Ratio

The Price-to-Sales (P/S) ratio is especially useful for valuing companies like Grindr that may not yet be profitable at the bottom line but are generating significant revenues. This metric helps investors assess how much they are paying for each dollar of sales, which is a valuable perspective when profits are not the primary driver or are still on the horizon.

The P/S ratio also provides insight because it adjusts for both growth expectations and the perceived risk associated with the business. Generally, a higher P/S ratio is justified for companies with rapid growth or robust, predictable sales, while riskier or slower-growing firms tend to trade at lower multiples.

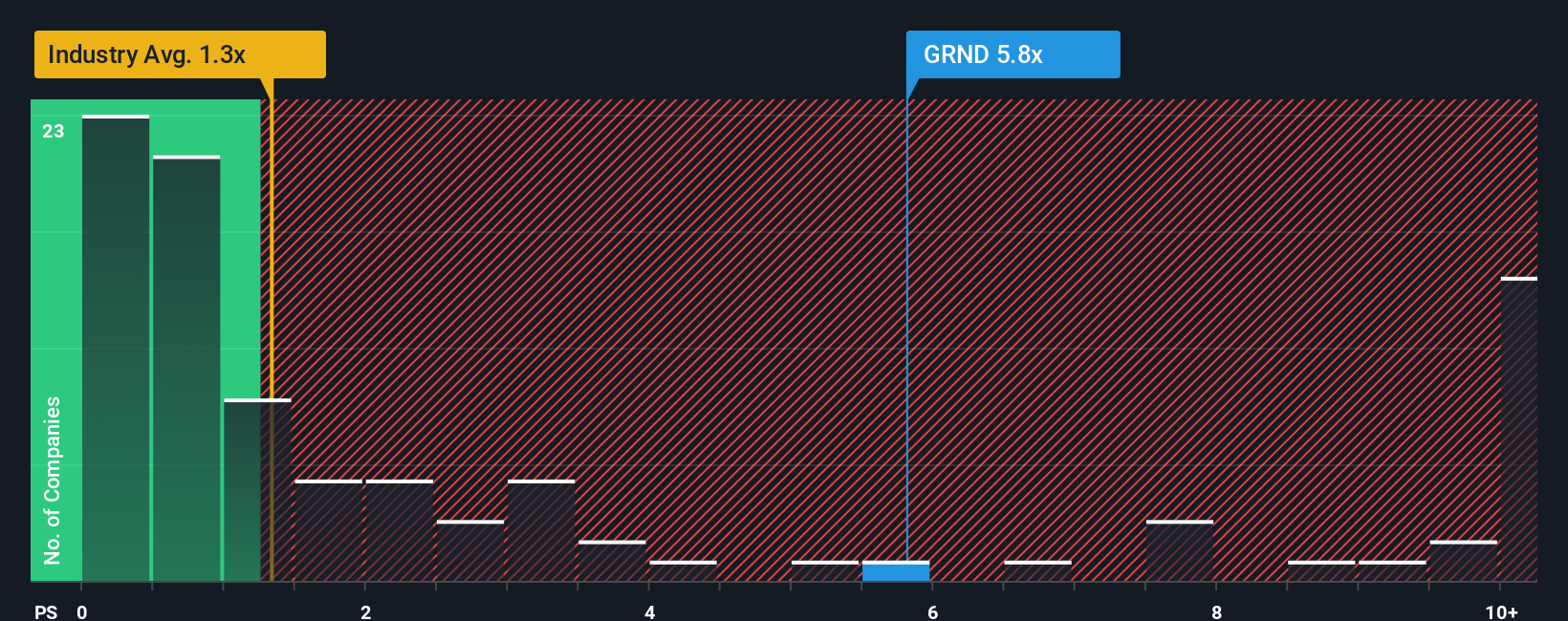

Currently, Grindr is trading at a P/S ratio of 7.36x. To put this in context, the industry average sits at just 1.29x, while the average among Grindr's peers is slightly higher at 8.04x. Simply Wall St takes this a step further by calculating a "Fair Ratio" for Grindr, which for this company stands at 3.34x. This proprietary figure goes beyond simple peer or industry comparison by factoring in Grindr’s sales growth, risk profile, profit margins, industry grouping, and market capitalization.

The Fair Ratio provides a more nuanced assessment, as it considers company-specific fundamentals instead of assuming every firm in an industry or peer set deserves the same valuation. In Grindr's case, its actual P/S of 7.36x is more than double the Fair Ratio of 3.34x, suggesting the stock is priced well above what would be considered fair given its prospects and risks.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Grindr Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story or viewpoint about a company’s future. You pull together your expectations for revenue growth, profit margins, and what you believe is a fair market price, based on the factors you think matter most.

This approach powerfully connects a company’s big-picture story to concrete financial forecasts and then to a fair value per share, helping you understand not just where the numbers come from, but why they make sense from your perspective. Narratives are designed to be simple and intuitive, and on Simply Wall St’s Community page, millions of investors already use them to organize and share how they see the future unfolding for stocks like Grindr.

By using Narratives, you can quickly compare your estimate of Fair Value with the actual price, helping you decide if a stock is a buy or a sell based on your own insights and what matters most to you. Narratives stay dynamic, as they update automatically as fresh information like quarterly earnings or major news hits the market. This provides you with a living snapshot of sentiment and opportunity.

- For example, some investors believe Grindr could be worth as much as $26.00 per share if its international expansion and AI strategy pay off, while others see a more cautious fair value closer to $20.00, focusing on regulatory risks and slowing user growth.

Do you think there's more to the story for Grindr? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)