- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

Grindr (GRND): Reassessing Valuation After Board Fiduciary Duty Investigation and Governance Questions

Reviewed by Simply Wall St

Grindr (GRND) is back in the spotlight after law firm Johnson Fistel launched an investigation into whether the Board breached fiduciary duties when it ended talks with the company’s controlling stockholder.

See our latest analysis for Grindr.

That backdrop helps explain why sentiment has cooled, with a 90 day share price return of minus 15.58 percent and a year to date share price return of minus 26.02 percent. Even so, the three year total shareholder return remains strongly positive at 131.76 percent, suggesting long term momentum is intact but currently pausing as investors reassess governance risk.

If governance questions at Grindr have you rethinking concentration risk, this could be a good moment to widen your watchlist and explore fast growing stocks with high insider ownership.

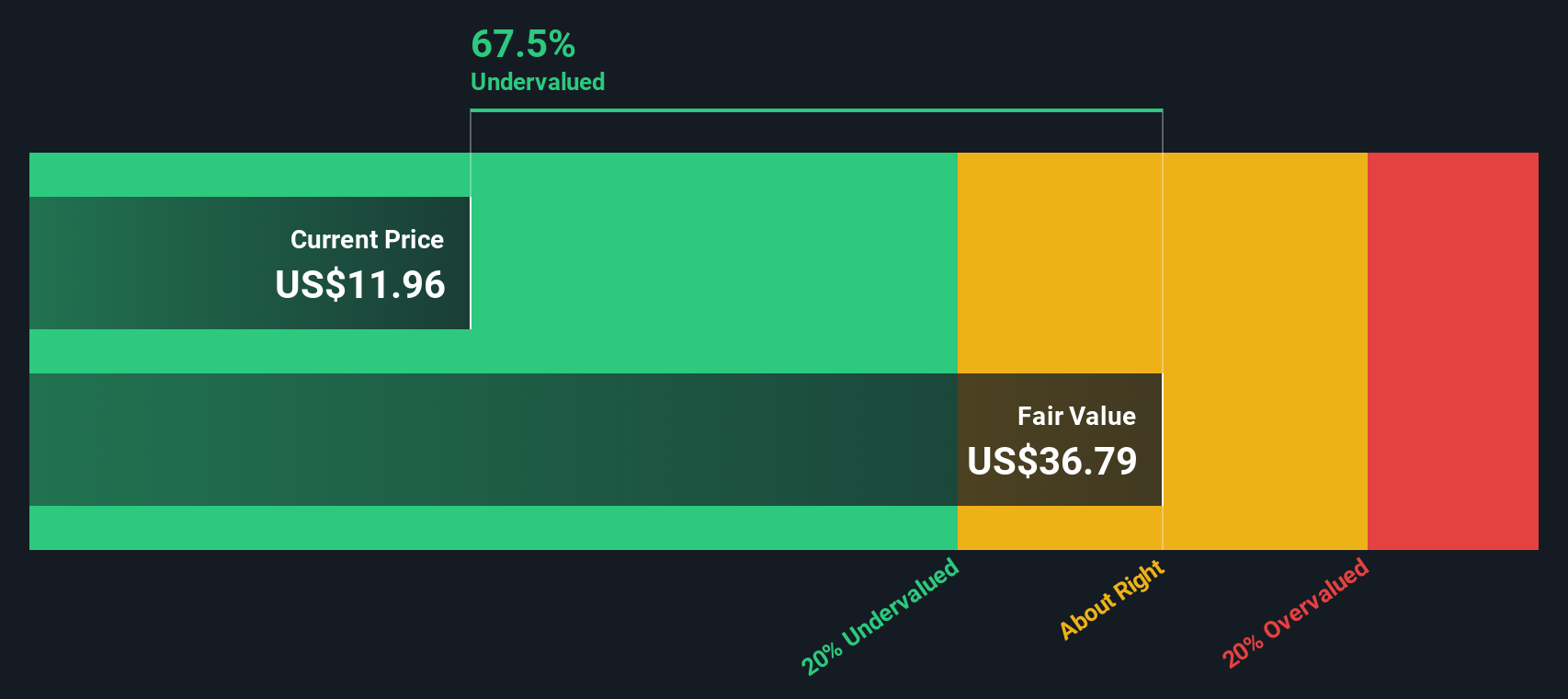

With shares trading well below analyst estimates despite solid revenue and earnings growth, the key question now is whether governance concerns are masking genuine undervaluation, or whether the market is wisely pricing in future risks and limited upside.

Most Popular Narrative: 38.9% Undervalued

With Grindr last closing at $13.28 against a narrative fair value of $21.75, the implied upside rests on aggressive, long term growth execution.

Ongoing shift toward value added premium tiers, coupled with planned pricing experiments and the introduction of more differentiated features (e.g., mapping, intentions based products, A List), positions Grindr to lift ARPU and improve net margins over time.

Investments in proprietary AI infrastructure (gAI) and enhanced in app experiences (such as mapping and local discovery) provide durable differentiation and are likely to increase user engagement and retention, thereby supporting stable, recurring revenues and long term earnings growth.

Want to see how richer subscriptions, new AI tools, and rising margins supposedly add up to that higher value, and what future profits they are banking on?

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and ongoing governance uncertainty could quickly erode margin expectations and undermine the bullish case for rapid, profitable expansion.

Find out about the key risks to this Grindr narrative.

Another Angle on Value

While the narrative fair value sits at $21.75, our SWS DCF model presents a more optimistic perspective and suggests Grindr is trading about 61 percent below its estimated fair value of $34.38. Is the market overly cautious on governance, or underestimating long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Grindr Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a fully custom narrative in just a few minutes: Do it your way.

A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Keep your money working harder by scanning fresh opportunities on Simply Wall Street’s Screener before the crowd moves on to the next wave of winners.

- Capture income potential by targeting dependable payers with these 13 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Ride structural growth by focusing on innovators powering intelligent automation through these 26 AI penny stocks before sentiment fully prices in their momentum.

- Hunt for mispriced opportunities using these 903 undervalued stocks based on cash flows to spot quality businesses trading at a discount to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)