- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

fuboTV (NYSE:FUBO) Surges 68% Despite Projected US$1,623M Revenue in 2024

Reviewed by Simply Wall St

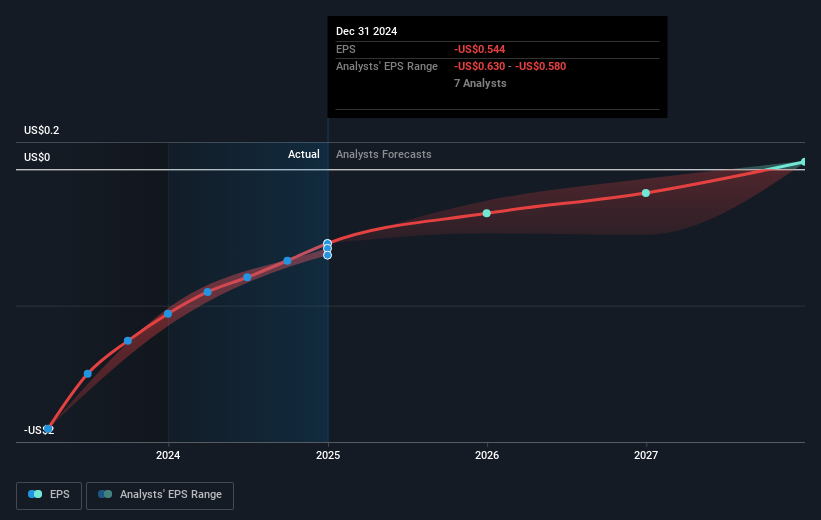

fuboTV (NYSE:FUBO) recently announced its first-quarter 2025 revenue guidance, projecting a 5% YoY decline, alongside expectations of a significant 16% reduction in subscriber numbers. Despite these forecasts, fuboTV's share price surged by 68% over the past quarter. The share price performance may reflect optimism stemming from fuboTV's recent expansions, such as launching the Fubo Sports Network across multiple regions and introducing CHCH TV to enhance Canadian content. Additionally, the company reported significant financial improvements in 2024, including a revenue increase to $1,623 million and a reduced net loss, which may have boosted investor confidence. These strides come amid a broader market sentiment grappling with U.S. tariff impacts, which caused notable declines in major indices. As other sectors face uncertainty, fuboTV's focus on expanding content delivery and regional presence could have been attractive to investors seeking growth prospects amidst market volatility.

Take a closer look at fuboTV's potential here.

Over the past year, fuboTV's total shareholder returns reached 53.51%, significantly outperforming both the US market, which returned 13.1%, and the Interactive Media and Services industry, which saw a 26% return. Several factors likely contributed to this performance. In October 2024, fuboTV strengthened its market presence with a partnership with The Athletic, positioning itself as the official live TV streaming partner. This agreement created more mobile content and co-marketing opportunities. Additionally, a new multi-year agreement with TEGNA in the same month expanded fuboTV's reach in broadcasting local sports content, further enhancing its offerings.

Product advancements also played a crucial role in fuboTV's performance. In November, the launch of 18 NBCU FAST channels added depth to its content library. New interactive ad formats introduced around the same time may have bolstered viewer engagement. Furthermore, the introduction of Hallmark+ in December diversified its subscription services, contributing to the company's growth and appeal to investors. These developments likely bolstered investor confidence, driving the stock's strong returns.

- See whether fuboTV's current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for fuboTV in our thorough risk analysis report.

- Have a stake in fuboTV? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives