- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

fuboTV (NYSE:FUBO) Projects Revenue Dip Despite 19% YoY Growth Unveils CHCH TV Launch

Reviewed by Simply Wall St

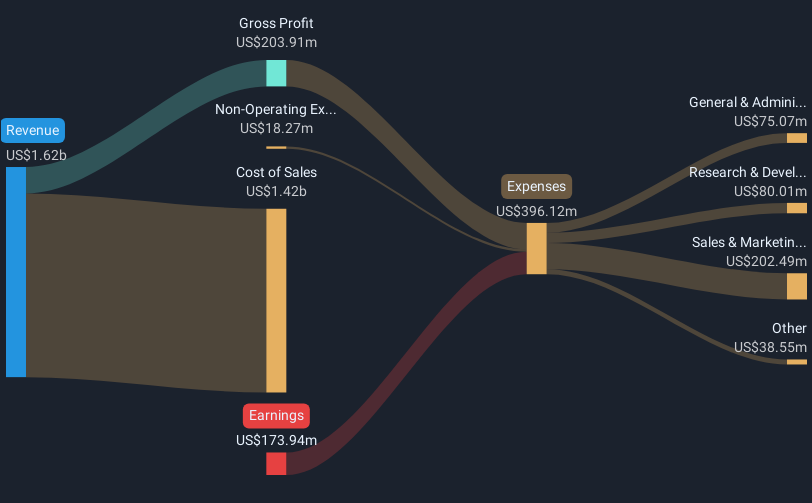

fuboTV (NYSE:FUBO) experienced a significant 119% price increase over the last quarter. The company's financial health showed improvement with a full year revenue of $1,623 million, up from $1,368 million, and a reduced net loss, underlined by the latest earnings report. However, future projections are less optimistic, with expected revenue and subscriber counts both indicating a year-over-year decline. This conflicting outlook comes amidst broader market volatility, influenced by rising inflation concerns and recently enacted tariffs. Meanwhile, fuboTV's new product initiatives, including the launch of CHCH TV and Hallmark+, position it to cater to diverse viewer preferences in the evolving digital media landscape. These developments, alongside favorable market movements at times, such as a benign inflation reading reviving investor sentiment, likely contributed to the stock's impressive quarterly performance against a backdrop of mixed market signals.

Take a closer look at fuboTV's potential here.

Over the past year, fuboTV achieved a total shareholder return of 70.05%, significantly outperforming both the US Interactive Media and Services industry, which returned 25.3%, and the broader US market, which saw a 14.7% return. This strong performance came despite the company being unprofitable, partially attributed to its price-to-sales ratio of 0.8x, making it more attractive compared to industry peers. Furthermore, strategic initiatives such as the multi-year agreement with TEGNA for enhanced local sports coverage and the expansion of Fubo Sports across over 100 OTA stations likely strengthened investor confidence.

The earnings reports throughout the year recorded consistent revenue growth, with full-year revenue reaching US$1.62 billion, up from US$1.37 billion, coupled with a reduced net loss from the previous year. Additionally, the announcement of a potential merger with Disney's Hulu + Live TV business in January sparked market interest, supporting the stock’s attractive positioning in a competitive landscape.

- See whether fuboTV's current market price aligns with its intrinsic value in our detailed report

- Discover the key vulnerabilities in fuboTV's business with our detailed risk assessment.

- Are you invested in fuboTV already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Undervalued very low.

Similar Companies

Market Insights

Community Narratives