- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

fuboTV (NYSE:FUBO) Can Afford Driving Growth at This Pace

After an extremely volatile price action through most of the year, fuboTV ( NYSE:FUBO ) has temporarily bottomed around US$26.

While we won't speculate on price action, we will examine its cash burn to check whether it mandates further debt or shareholder dilution.

For this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for fuboTV

Q2 Earnings and Results

- Q2 Non-GAAP EPS: -US$0.38 (beat by US$0.11)

- GAAP EPS: -US$0.68 (miss by US$0.18)

- Revenue: US$130.9m (beat by US$9.47m)

- Subscription revenue: 189% increase YoY

Over the last 3 years, on average, the company's share price growth rate has exceeded its earnings growth rate by 73 percentage points per year, which is a significant difference in performance.

Even though the company is still losing money, investors liked the increase in subscriptions, revenues, and average revenue per user. After the dust has settled, shares were trading 11% higher before falling on the news of a potential stock offering .

The sale up to US$500m is significant for a company with a market cap of just US$3.8b.

Roth Capital Partners, which has been overwhelmingly bullish on the stock since its debut the last year, currently have the price target at US$42, after having it as high as US$55 in the past. The bulls have been quoting the company's focus on having the most comprehensive sports coverage and drive to be an ever-improving content aggregator.

How Long Is fuboTV's Cash Runway?

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current cash burn rate.

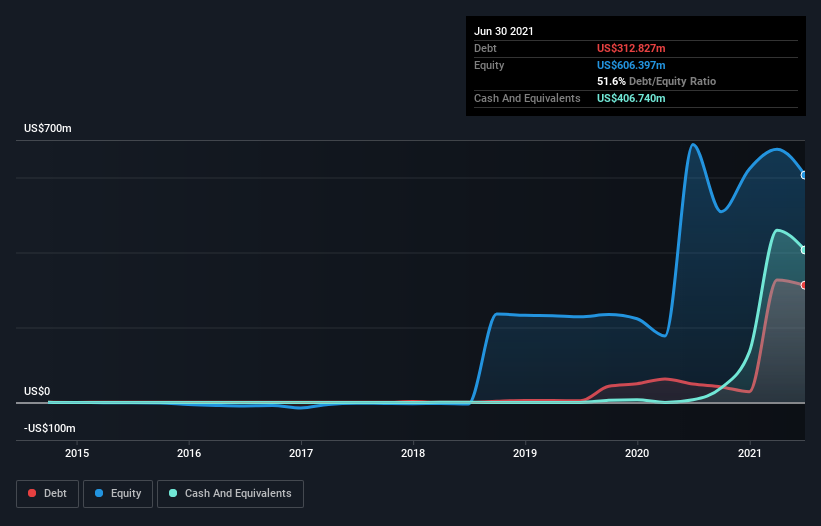

Because fuboTV has such a small amount of debt that we'll set it aside and focus on the US$407m in cash it held in June 2021. Looking at the last year, the company burnt through US$198m. That means it had a cash runway of about 2.1 years as of June 2021.

Notably, analysts forecast that fuboTV will break even (at a free cash flow level) in about 2 years.Even though it doesn't have much breathing room, it shouldn't need more cash, considering that cash burn should be continually reducing.Depicted below, you can see how its cash holdings have changed over time.

fuboTV Growth

To keep in mind, fuboTV increased its cash burn by 400% in the last twelve months. Given that operating revenue was up a stupendous 780% over the previous year, there's a good chance the investment will pay off.

In light of the data above, we're reasonably sanguine about the business growth trajectory.However, the crucial factor is whether the company will grow its business from now on. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company .

The Cost of Raising Capital

fuboTV seems to be in a reasonably good position in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to.

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares to raise cash and drive growth, and it seems that the company prefers the former. It will pay up to 3% in commissions of the gross sale price for selling up to US$500m in the new offering.

fuboTV has a market capitalization of US$3.8b and burnt through US$198m last year, which is 5.2% of the company's market value.That's a low proportion, so we figure the company would raise more cash to fund growth, with a bit of dilution, or even to borrow some money.

Is fuboTV's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way fuboTV is burning through its cash.For example, we think its revenue growth suggests that the company is on a good path.

While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide comfort when it comes to the cash burn.Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven.

Considering all the factors discussed in this article, we're not overly concerned about its cash burn, although we think shareholders should keep an eye on how it develops. On another note, fuboTV has 3 warning signs we think you should know about.

Of course, fuboTV may not be the best stock to buy . So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying .

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026