Stock Analysis

- United States

- /

- Banks

- /

- NYSEAM:EVBN

Exploring Top Dividend Stocks In June 2024

Reviewed by Simply Wall St

As global markets navigate through a period of heightened volatility, with US equity futures showing declines amidst political uncertainties in Europe, investors are increasingly focused on stability and reliable returns. In such times, dividend stocks often come into the spotlight as they can offer potential income and relative safety compared to growth-oriented securities.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.73% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.23% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.90% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.12% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 5.02% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.02% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.87% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 5.06% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.79% | ★★★★★★ |

| Union Bankshares (NasdaqGM:UNB) | 6.26% | ★★★★★☆ |

Click here to see the full list of 211 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

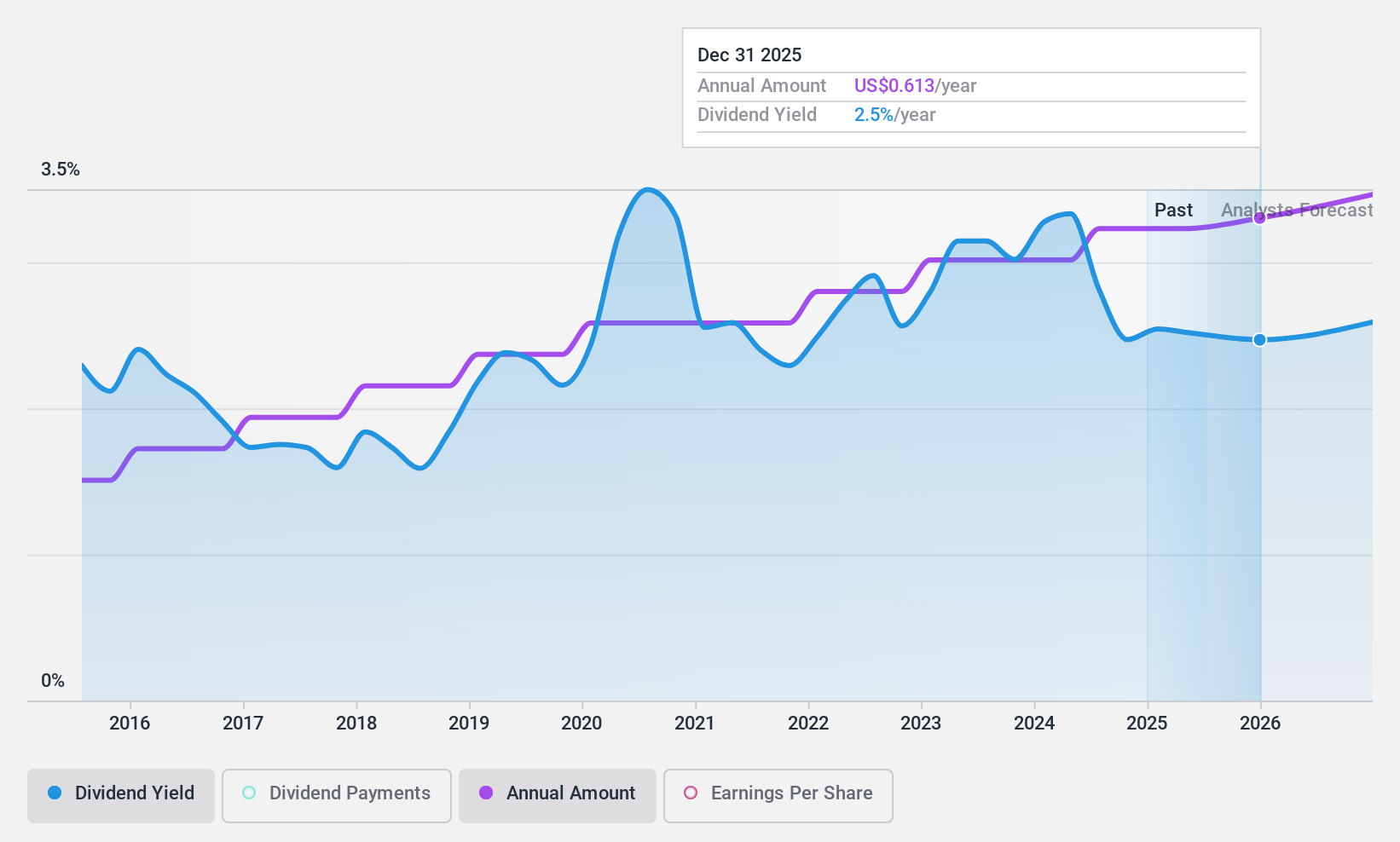

First Community (NasdaqCM:FCCO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Community Corporation, operating as the holding company for First Community Bank, offers a range of banking products and services to small-to-medium sized businesses, professionals, and individuals with a market cap of approximately $131.60 million.

Operations: First Community Corporation generates its revenue primarily through Commercial and Retail Banking, which contributes $50.66 million, followed by Investment Advisory and Non-Deposit services at $4.80 million, Corporate Segment at $4.23 million, and Mortgage Banking at $4.18 million.

Dividend Yield: 3.2%

First Community's dividend yield of 3.25% trails behind the top US dividend payers, yet its consistency and growth over the past decade bolster its appeal. The dividends are well-supported by a payout ratio of 38.7%, indicating sustainability against earnings. Recent strategic moves include a $7.1 million stock buyback program valid until May 2025, affirming management's confidence in the company’s value, currently perceived to be trading at a significant discount of 42.8% below fair value.

- Unlock comprehensive insights into our analysis of First Community stock in this dividend report.

- The valuation report we've compiled suggests that First Community's current price could be inflated.

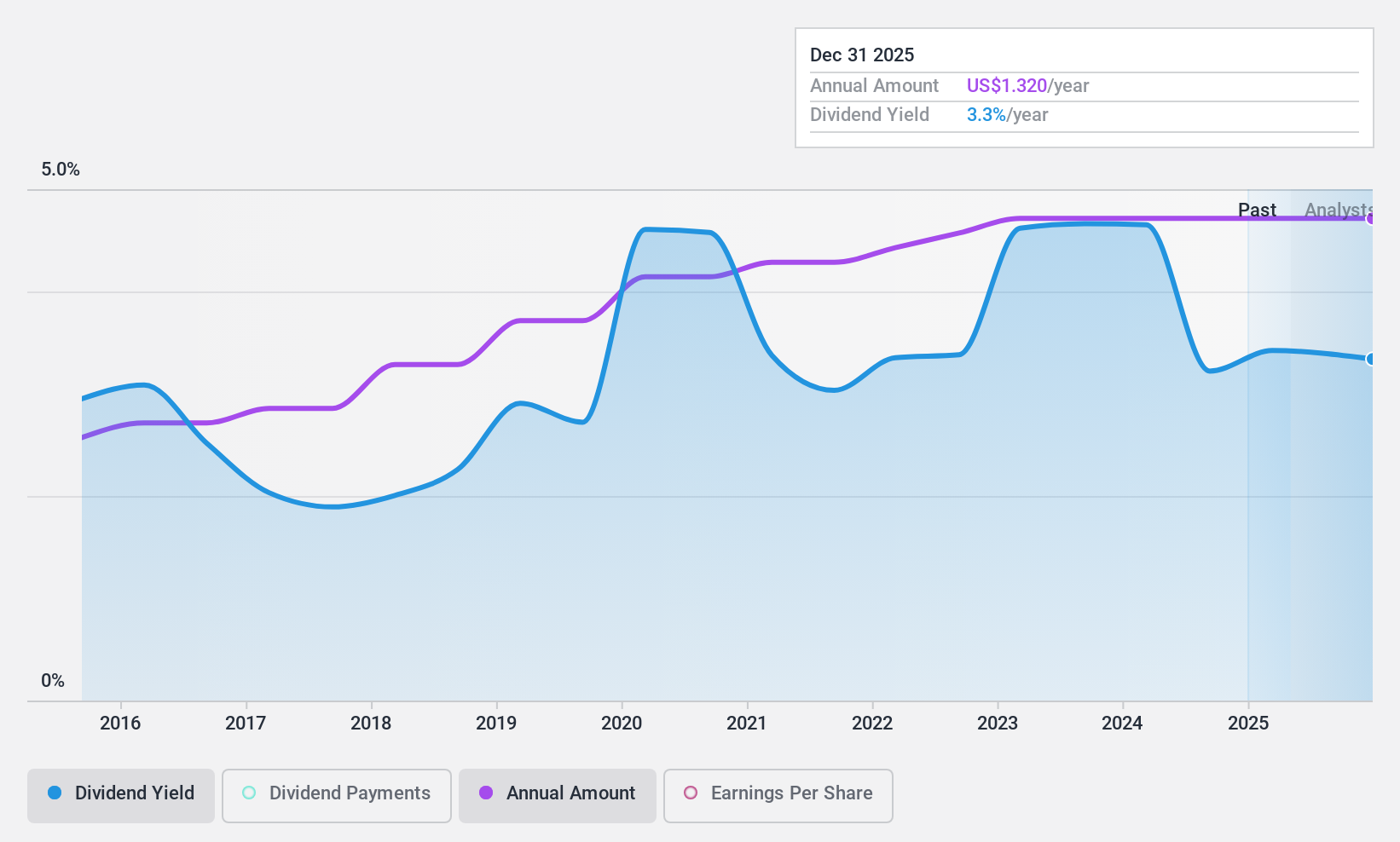

Evans Bancorp (NYSEAM:EVBN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evans Bancorp, Inc. serves primarily as a financial holding company for Evans Bank, N.A., with a market capitalization of approximately $148.29 million.

Operations: Evans Bancorp, Inc. generates its revenue primarily through banking activities, which amounted to $60.36 million.

Dividend Yield: 4.9%

Evans Bancorp offers a robust dividend yield of 4.86%, ranking in the top 25% of US dividend payers, supported by a sustainable payout ratio of 34.3%. Despite recent financial setbacks with net interest income and net income declining to US$13.91 million and US$2.33 million respectively in Q1 2024, the company's dividends have shown growth and stability over the past decade. However, earnings are projected to decrease annually by 30.8% over the next three years, raising concerns about future dividend sustainability amidst significant insider selling noted recently.

- Navigate through the intricacies of Evans Bancorp with our comprehensive dividend report here.

- Our valuation report unveils the possibility Evans Bancorp's shares may be trading at a discount.

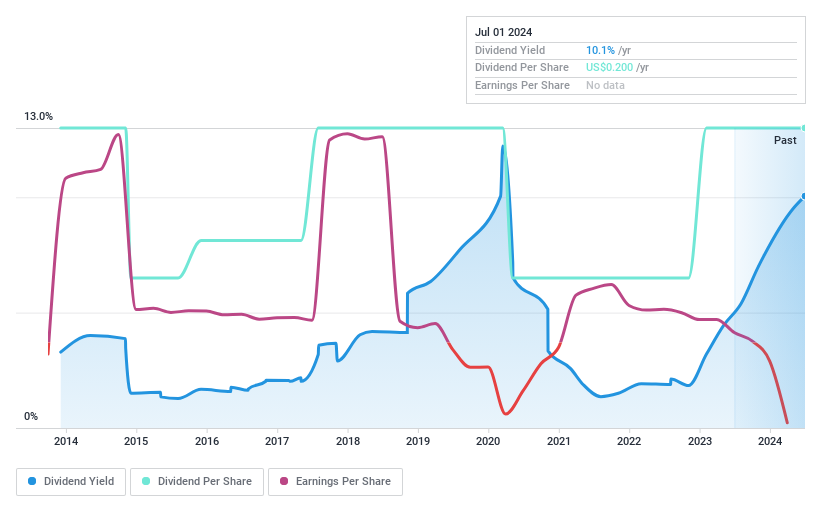

Entravision Communications (NYSE:EVC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Entravision Communications Corporation, a global advertising solutions, media, and technology company, has a market capitalization of approximately $188.43 million.

Operations: Entravision Communications Corporation generates its revenues primarily through three segments: Audio, which brought in $52.39 million, Digital at $973.74 million, and Television with $119.17 million in earnings.

Dividend Yield: 9.5%

Entravision Communications maintains a quarterly dividend, recently affirming a US$0.05 per share payout totaling US$4.5 million, despite reporting a significant Q1 2024 net loss of US$48.89 million from sales of US$277.45 million. The company's dividends have been stable over the past decade but haven't shown growth, and while the cash payout ratio stands at 37%, suggesting reasonable coverage by cash flows, overall profitability issues pose risks to future sustainability. Recent executive reshuffles add an element of uncertainty regarding strategic direction and operational stability.

- Get an in-depth perspective on Entravision Communications' performance by reading our dividend report here.

- Our expertly prepared valuation report Entravision Communications implies its share price may be lower than expected.

Next Steps

- Take a closer look at our Top Dividend Stocks list of 211 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Evans Bancorp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:EVBN

Evans Bancorp

Primarily operates as financial holding company for Evans Bank, N.A.

Excellent balance sheet established dividend payer.