- United States

- /

- Entertainment

- /

- NYSE:EB

The Market Doesn't Like What It Sees From Eventbrite, Inc.'s (NYSE:EB) Revenues Yet As Shares Tumble 30%

The Eventbrite, Inc. (NYSE:EB) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

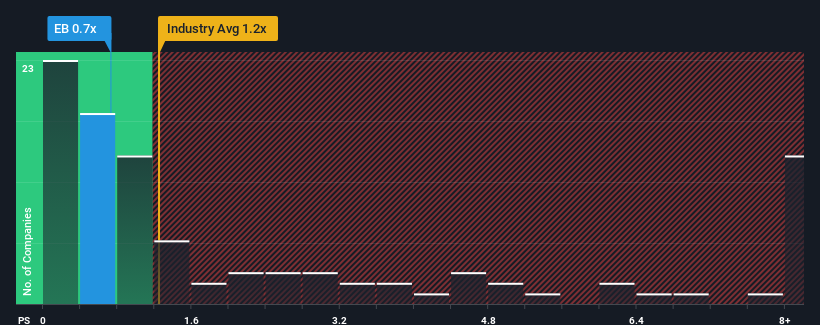

Since its price has dipped substantially, Eventbrite's price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Entertainment industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Eventbrite

How Eventbrite Has Been Performing

Eventbrite could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Eventbrite's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Eventbrite's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 74% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 5.4% each year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 11% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why Eventbrite is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Eventbrite's P/S

Eventbrite's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Eventbrite's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Eventbrite that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eventbrite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EB

Eventbrite

Operates a two-sided marketplace that provides self-service ticketing and marketing tools for event creators in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives