- United States

- /

- Entertainment

- /

- NYSE:DIS

Here's Why Walt Disney (NYSE:DIS) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Walt Disney (NYSE:DIS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

We check all companies for important risks. See what we found for Walt Disney in our free report.Walt Disney's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Walt Disney's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 49%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

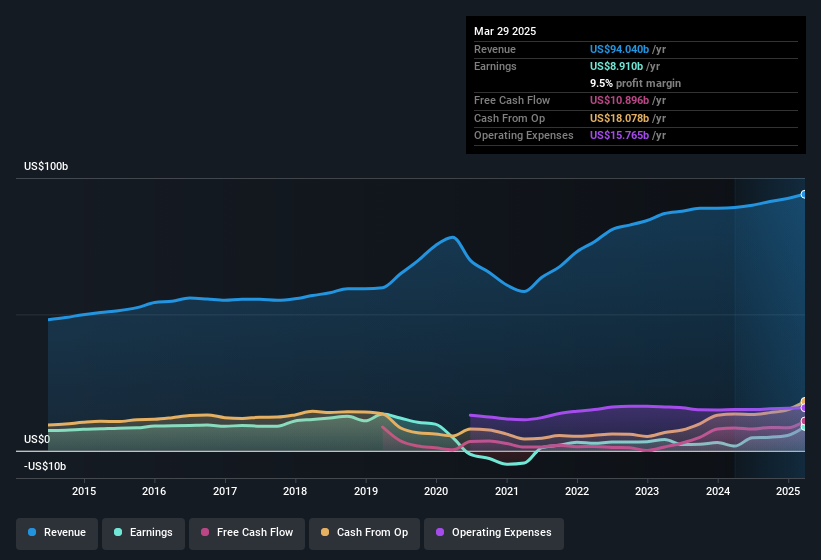

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Walt Disney shareholders is that EBIT margins have grown from 12% to 15% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Walt Disney

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Walt Disney's future profits.

Are Walt Disney Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$1m that the Independent Director, Calvin McDonald spent acquiring shares. The average price of which was US$85.06 per share. Insider buying like this is a rare occurrence and should stoke the interest of the market and shareholders alike.

Along with the insider buying, another encouraging sign for Walt Disney is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$46m. That's a lot of money, and no small incentive to work hard. Despite being just 0.02% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Walt Disney To Your Watchlist?

Walt Disney's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Walt Disney deserves timely attention. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Walt Disney. You might benefit from giving it a glance today.

The good news is that Walt Disney is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DIS

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives