- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney, Zoom and Manchester United: - Our lukewarm takes on some of last weeks biggest market stories

(“What’s a lukewarm take?” you ask – well, it’s definitely not a hot take – we would like to think it’s a more considered, insightful, and useful take on the news.)

Disney - Bob Iger’s return is good and bad news

Disney’s (NYSE: DIS) share price has risen nearly 8% on the news that former CEO Robert Iger is replacing Bob Chapek as CEO. Disney’s share price has collapsed over the last few months as spending at Disney+ offset the recovery in the parks and experiences division.

The chart below shows the share price performance under Bob Iger and then Bob Chapek, along with the performance of the S&P 500 index. It’s easy to see why bringing Iger back should restore investor confidence.

Our take: This is probably a good move for now. However, it also suggests the board views Disney’s recent performance as very concerning. As we recently pointed out, the current valuation assumes a lot will go right in the next year. Cutting costs without losing revenue won't be easy, and investors may need to be patient and tolerate some more volatility.

See our latest analysis for Walt Disney

Zoom still needs to prove new investments will pay off

There wasn’t much to be excited about when Zoom Video Communications (Nasdaq: ZM) released third-quarter results last week. Yes, normalized EPS were well ahead of consensus estimates, but those estimates have been revised sharply lower over the course of the year.

GAAP EPS were in line, but a lot lower than the normalized figures.

There were also two particularly concerning aspects to the results:

-

Operating expenses were up 56.4% from a year ago, while revenue rose just 6.6%. Most of this increase was made up of selling, general and admin expenses which rose 46%. In other words, Zoom is spending a lot to achieve very modest sales growth.

-

Stock based compensation increased by 156%. The share price is now ~80% below its all time high which means most employee stock options are likely a long way from their strike prices. The company has therefore had to issue new options to retain key talent. This may be necessary, but it ultimately costs shareholders.

On the positive side, the company is seeing demand for its new products, Zoom Phone, and Zoom Rooms. Zoom now has 64 customers with more than 10,000 people using Zoom Phone. The company is facing increased competition from Microsoft and Alphabet, and differentiating itself with new products will be key to revenue growth in the future.

Our take: Zoom isn’t a ‘one-hit wonder’ that got lucky with the pandemic, as some may assume. The company executed incredibly well (and profitably too) prior to 2020, by building a product that stood out amongst other video conferencing tools. But the competition has caught up and Zoom is having to reinvent itself with an evolving portfolio of tools.

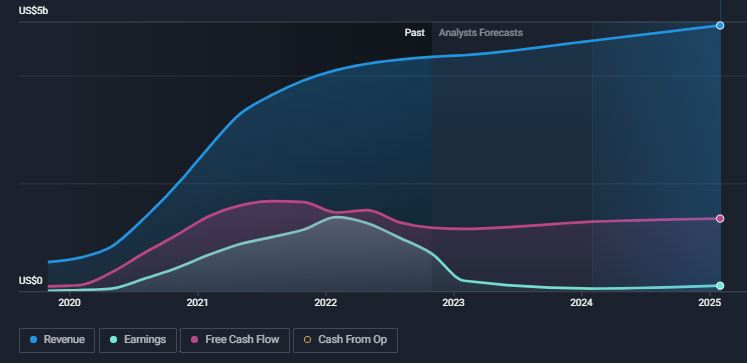

Right now it's going through an investment phase, which will hopefully result in renewed profit growth down the line. The chart below illustrates the gap between EPS and cash flows, which are still reasonable. Hopefully, the EPS line turns up, rather than the cash flow line turning down. Until there is some resolution on this the stock price is likely to remain under pressure, but still deserves a place on watchlists.

Manchester United is in play

Shares of Manchester United (NYSE: MANU) rallied 62% last week after the majority owners, the Glazer family, indicated that they were open to selling the club. After the rally in the share price, the company has a market value of just under $3.5 bln. The Glazer family had previously said they would only sell for over $7 bln, but now appear to be open to more realistic offers.

One report suggested Apple may want to buy the club, although this has also been denied according to MacRumours. More likely potential buyers are billionaire Jim Ratcliffe, and consortiums including the likes of Jim O’Neil and David Beckham.

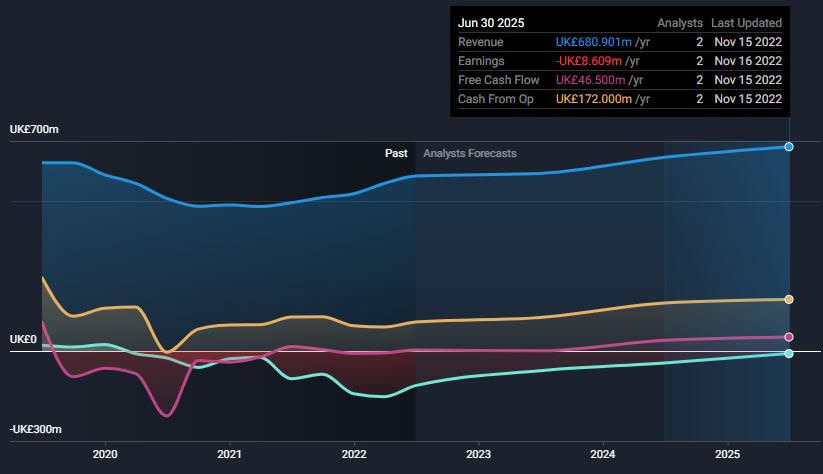

Our take: The Simply Wall St dashboard for Manchester United paints a gloomy picture of the business. Margins are negative (though cash flow is positive), debt is around four times equity and there’s little reason to expect growth anytime soon.

The real value here is the brand which could have strategic value for another company. More often though, sports clubs are bought by billionaires and not exclusively for their economic value. With egos and intangible assets involved, a deal could occur at a much higher price than makes economic sense. However, if there was a buyer prepared to pay more than $7 bln, the deal would probably have already happened.

The risk for minority investors is that the Glazers end up holding out for an unrealistic price, leaving the share’s risk skewed to the downside.

If you're looking to trade Walt Disney, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:DIS

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives