- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney's Current Valuation Assumes a lot will go Right in the Next Year

Reviewed by Michael Paige

Key takeaways from this analysis:

- Disney’s share price has fallen as much as 55% from last year’s high and retraced 95% of its rally from the March 2020 low

- Investors have been disappointed as rising revenues have failed to translate into profits

- To improve margins the company will need to cut costs or raise prices without losing subscribers

Disney ( NYSE: DIS ) has been a major disappointment for investors. In 2020 and 2021 the share became the leading ‘reopening play’ as investors bet that the reopening of amusement parks, cinemas, and tourism combined with strong growth from Disney+ would drive profit growth. The reality is that spending at Disney+ is acting as a drag on margins. It seems investors will need to be patient if they want to see the true potential realized.

See our latest analysis for Walt Disney

Highlights from the Full year and fourth quarter earnings release:

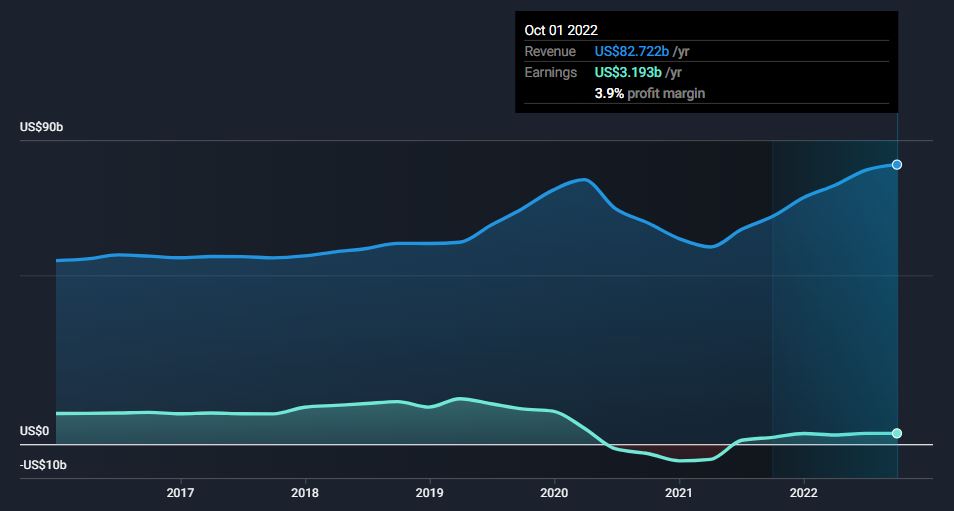

- Revenue: FY up 23% to $82.7 bln, Q4 revenue up 8.72% to $20.2 bln

- EPS: FY up 56% to $1.75, Q4 flat from a year ago at $0.09, but down 88% from the previous quarter.

- Record revenue at the Parks, Experiences, and Products segment

- Subscriber growth of 57 million taking total subscriber numbers to 235 mln.

- Disney+ records a $1.47 bln loss, more than double the loss in 2021.

The chart below summarizes Disney's last five years and clearly shows why investors have been disappointed. While revenues have increased, earnings have drifted lower.

What’s the Right P/E ratio for Disney?

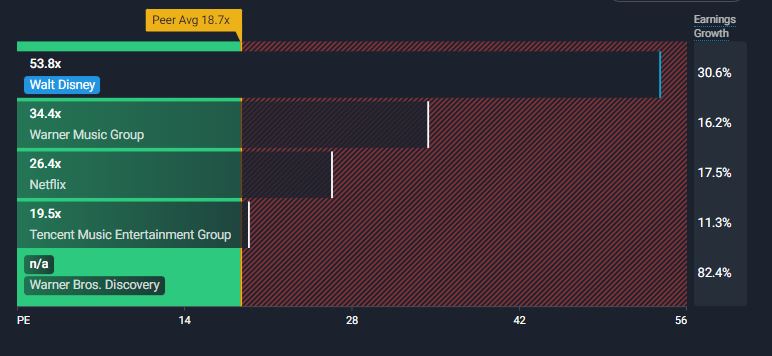

When Disney+ was officially announced in 2018 the stock was trading on a P/E ratio below 14x. By the time the service was launched a year later the ratio was approaching 25x.

The widely accepted narrative was that Disney+ would be a higher-margin business, with faster growth, and therefore deserved to trade on a higher multiple. What’s happened since has been muddied by the effect of the pandemic on Disney’s legacy business. However, now that operations at the non-media businesses have returned to normal, revenue is up strongly, but the profit margin is well below the 2019 level. Disney+ has delivered the growth that was hoped for - just not the improved margin - at least not yet.

Despite the stock price declining by 55%, the trailing P/E is still 53x. While this seems unreasonably high, perhaps it's not an accurate reflection of what the company can earn in the future.

Analysts are now expecting EPS of $3.18 next year, which puts the stock on a forward P/E of 29x, which happens to be the same as Netflix’s ( Nasdaq: NFLX ) forward P/E.

A forward P/E of 29x is nearly twice that of the S&P 500 index but might seem fair if the company can increase EPS from $1.75 to $3.18 (that’s an 80% increase). But how realistic is that estimate?

Threading the Needle at Disney+

To produce EPS of $3.18, net income needs to increase by about $2.5 bln. And for the increase to be sustainable it would also need to mostly come from the direct-to-consumer division, rather than cost-cutting throughout the entire business.

Disney’s streaming businesses already have over 230 mln paying subscribers which means it will probably struggle to add large numbers of new subscribers. So any significant improvements in the margin will come down to cost cutting, price increases, and ad revenue from the new ad-supported packages - all of which the company has mentioned. This requires a delicate balance as all three options are likely to result in some subscribers canceling or downgrading their subscriptions.

What this means for Investors

Ultimately, it seems the market is discounting significant improvements to the margin going forward. It's certainly not impossible for Disney to pull this off, but given how competitive the streaming market has become, and the current economic environment, it isn’t a sure thing either - and the current valuation doesn’t seem to fully reflect that.

It’s likely that a lot of investors are taking a longer-term view. Disney does have excellent assets, and in time should be able to rationalize the business to improve margins. But investors may have to be patient and tolerate more volatility over the next few years.

Check out our full analysis of Disney to learn more about the company.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:DIS

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives