- United States

- /

- Interactive Media and Services

- /

- NYSE:ATHM

Autohome Inc.'s (NYSE:ATHM) Share Price Boosted 29% But Its Business Prospects Need A Lift Too

Autohome Inc. (NYSE:ATHM) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.1% isn't as attractive.

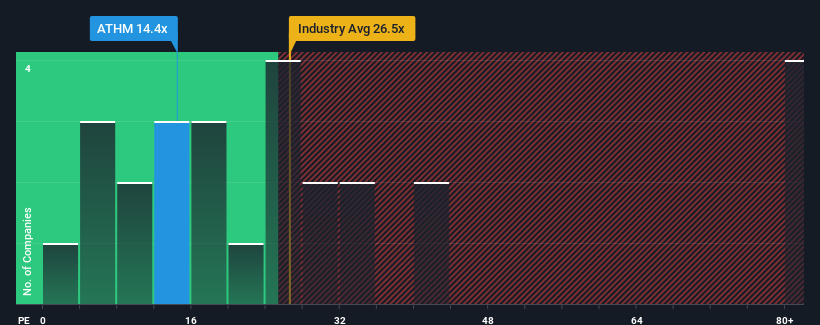

In spite of the firm bounce in price, Autohome's price-to-earnings (or "P/E") ratio of 14.4x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Autohome's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Autohome

What Are Growth Metrics Telling Us About The Low P/E?

Autohome's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.3%. As a result, earnings from three years ago have also fallen 45% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.7% each year as estimated by the analysts watching the company. That's not great when the rest of the market is expected to grow by 10% per annum.

With this information, we are not surprised that Autohome is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Autohome's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Autohome maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Autohome has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Autohome's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ATHM

Autohome

Operates as an online destination for automobile consumers in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives