- United States

- /

- Media

- /

- NasdaqGM:TTD

Will PubDesk Boost The Trade Desk’s (TTD) Transparency Story or Expose Strategic Challenges?

Reviewed by Sasha Jovanovic

- The Trade Desk recently launched PubDesk, a dashboard providing publishers with detailed metrics on how buyers value their inventory and the factors influencing bid pricing, as part of its ongoing efforts to enhance transparency and optimization for publishers.

- This move comes just ahead of the company’s first-quarter earnings report, following a rare miss and internal restructuring designed to restore growth and stabilize margins as it accelerates customer adoption of the Kokai platform.

- We'll explore how PubDesk's focus on supply chain and demand-side transparency could influence The Trade Desk's wider investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Trade Desk Investment Narrative Recap

Trade Desk's investment appeal is rooted in the belief that widespread adoption of the open internet and connected TV will accelerate its long-term revenue and margin growth, despite challenges from industry giants and cyclical ad spending. While the PubDesk launch underscores management's transparency focus, it is not expected to materially move the near-term earnings catalyst, which remains centered on Kokai adoption and stabilization post-restructuring; ongoing concentration in large clients continues to be a key risk.

Of the recent company updates, the release of Audience Unlimited is especially relevant as it further strengthens Trade Desk’s data-driven offerings alongside PubDesk, helping to reinforce its platform differentiation in measurable and transparent digital advertising, an area closely watched by both investors and advertisers as AI-powered solutions gain traction.

However, as promising as these technology investments sound, investors should be aware that ongoing heavy reliance on a handful of large enterprise clients means any reduction in their ad spend could quickly...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's outlook anticipates $4.3 billion in revenue and $823.2 million in earnings by 2028. This scenario is built on 17.1% annual revenue growth and a $406 million increase in earnings from $417.2 million today.

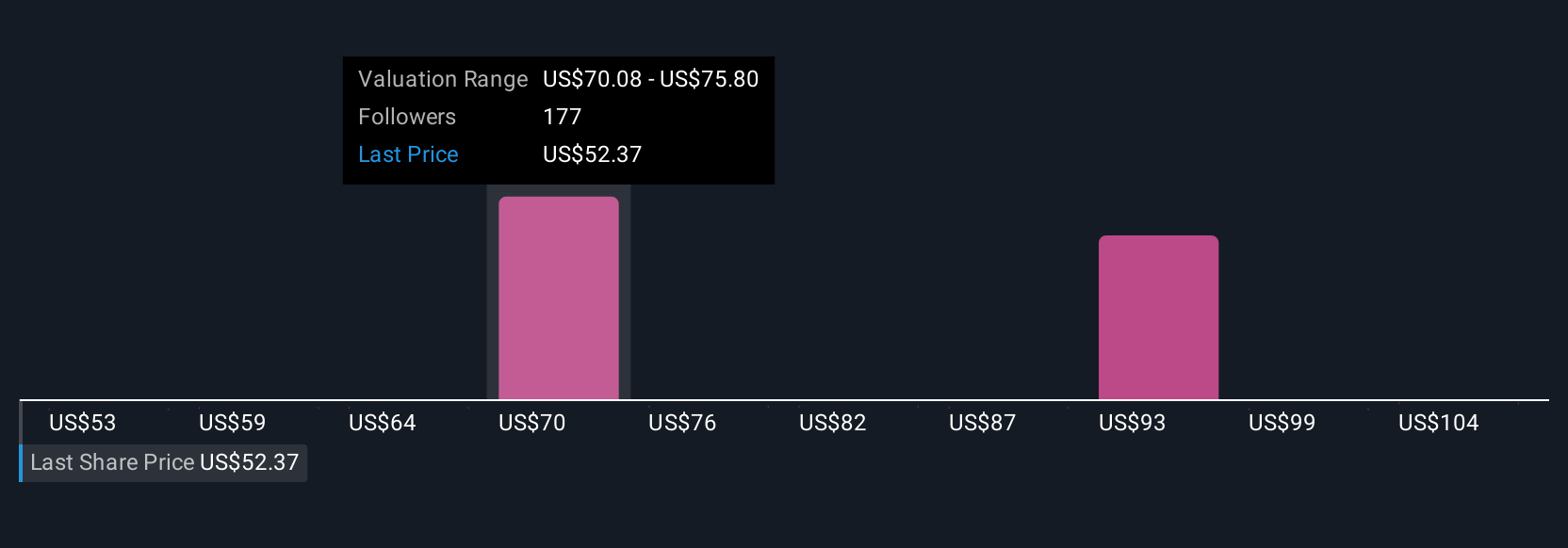

Uncover how Trade Desk's forecasts yield a $69.53 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Fair value opinions from 39 Simply Wall St Community members span from US$39.48 to US$111.31 per share. These diverse perspectives exist alongside headline risks about revenue concentration and market share competition, inviting you to weigh multiple viewpoints on Trade Desk’s outlook.

Explore 39 other fair value estimates on Trade Desk - why the stock might be worth 23% less than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives