- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Three Stocks Possibly Trading Below Estimated Value In June 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.0%, contributing to a 12% climb over the past year, with earnings forecasted to grow by 14% annually. In this environment of steady growth, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking potential gains in alignment with these positive market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mid Penn Bancorp (NasdaqGM:MPB) | $26.26 | $52.26 | 49.8% |

| Horizon Bancorp (NasdaqGS:HBNC) | $14.80 | $29.53 | 49.9% |

| Central Pacific Financial (NYSE:CPF) | $26.14 | $51.99 | 49.7% |

| Peoples Financial Services (NasdaqGS:PFIS) | $47.66 | $93.66 | 49.1% |

| Excelerate Energy (NYSE:EE) | $28.82 | $57.35 | 49.7% |

| e.l.f. Beauty (NYSE:ELF) | $113.77 | $225.34 | 49.5% |

| Lincoln Educational Services (NasdaqGS:LINC) | $23.08 | $45.81 | 49.6% |

| Pagaya Technologies (NasdaqCM:PGY) | $16.72 | $33.10 | 49.5% |

| Lyft (NasdaqGS:LYFT) | $15.27 | $30.29 | 49.6% |

| Clearfield (NasdaqGM:CLFD) | $37.91 | $74.94 | 49.4% |

Let's uncover some gems from our specialized screener.

Celsius Holdings (NasdaqCM:CELH)

Overview: Celsius Holdings, Inc. is engaged in the development, processing, manufacturing, marketing, selling, and distribution of functional energy drinks globally with a market cap of approximately $9.76 billion.

Operations: The company's revenue primarily comes from its Non-Alcoholic Beverages segment, totaling $1.33 billion.

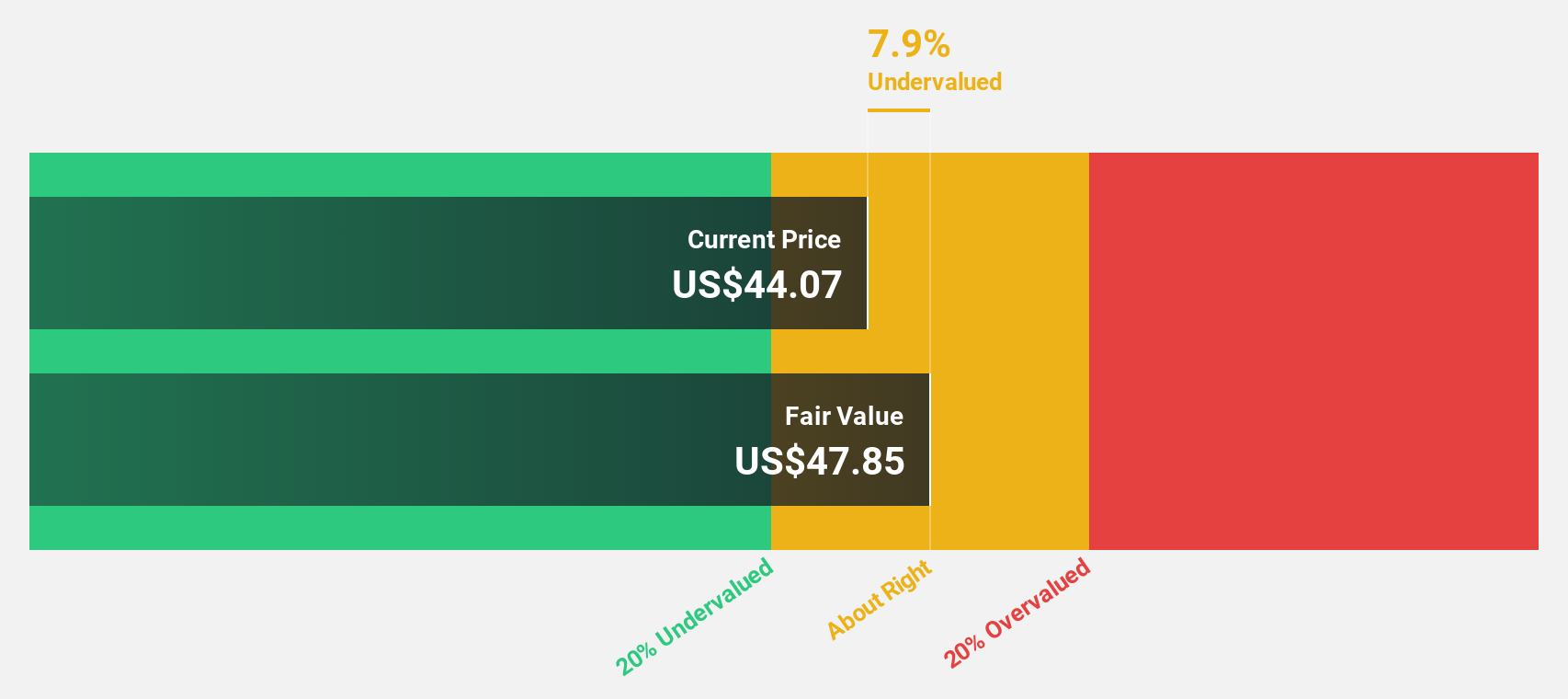

Estimated Discount To Fair Value: 20.1%

Celsius Holdings is trading at US$38.10, below its estimated fair value of US$47.71, suggesting it may be undervalued based on cash flows. Despite a recent dip in profit margins to 5.8% from 15.2% last year, earnings are forecast to grow significantly at 31.7% annually, outpacing the broader US market's growth expectations. However, revenue is projected to grow slower than 20%, which could temper some investor enthusiasm despite the stock's apparent undervaluation.

- The analysis detailed in our Celsius Holdings growth report hints at robust future financial performance.

- Dive into the specifics of Celsius Holdings here with our thorough financial health report.

Trade Desk (NasdaqGM:TTD)

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for digital ad buyers, with a market cap of approximately $36.98 billion.

Operations: The company's revenue is primarily generated from its advertising technology platform, which accounts for $2.57 billion.

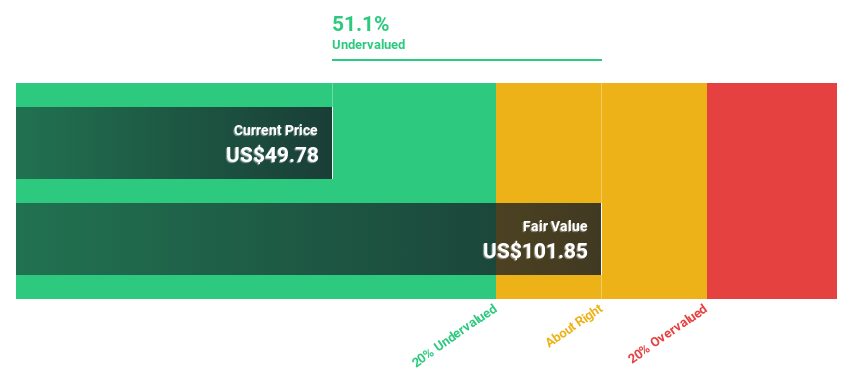

Estimated Discount To Fair Value: 10.8%

The Trade Desk is trading at US$74.77, slightly below its estimated fair value of US$83.83, indicating potential undervaluation based on cash flows. Recent earnings show strong growth with net income rising to US$50.68 million from US$31.66 million a year ago, and revenue expected to grow faster than the broader market at 15.6% annually. However, the stock's undervaluation is not significant enough to overshadow its slower projected revenue growth compared to top-performing peers.

- According our earnings growth report, there's an indication that Trade Desk might be ready to expand.

- Click here to discover the nuances of Trade Desk with our detailed financial health report.

Zillow Group (NasdaqGS:ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $16.15 billion.

Operations: Zillow Group's revenue primarily comes from its Internet, Media & Technology (IMT) segment, excluding mortgages, which generated $2.31 billion.

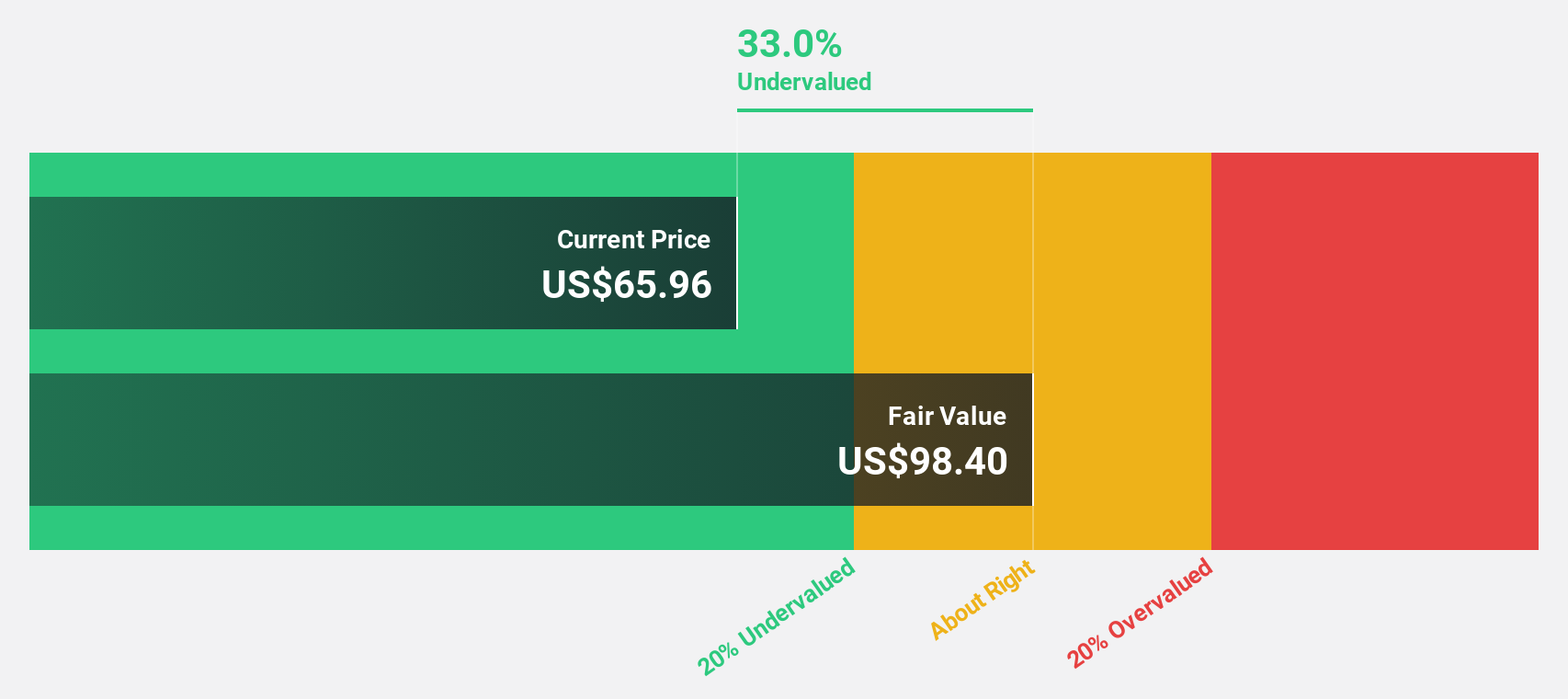

Estimated Discount To Fair Value: 31.8%

Zillow Group, priced at US$67.35, is trading significantly below its estimated fair value of US$98.82, suggesting it may be undervalued based on cash flows. The company reported a shift to profitability with net income of US$8 million in Q1 2025 and forecasts robust earnings growth of 53% annually. While revenue growth is projected at 12.6% per year—faster than the market—their return on equity remains low at 10.2%. Recent strategic partnerships are expected to drive further revenue acceleration, particularly in Rentals.

- Our expertly prepared growth report on Zillow Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Zillow Group stock in this financial health report.

Make It Happen

- Click here to access our complete index of 165 Undervalued US Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives