- United States

- /

- Media

- /

- NasdaqGM:TTD

Did Analyst Downgrades and Kokai Adoption Hesitancy Just Shift Trade Desk's (TTD) Growth Narrative?

Reviewed by Simply Wall St

- In recent weeks, The Trade Desk has faced analyst downgrades and growing concerns about weaker digital advertising demand amid economic uncertainty.

- An important development has been client hesitancy around adopting the new Kokai platform, as some agencies resist transitioning from the older interface, raising questions about user experience and platform adoption.

- We'll examine how these analyst actions and digital ad spending pressures could reshape Trade Desk's investment narrative and long-term growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trade Desk Investment Narrative Recap

To be a shareholder in The Trade Desk, you need to believe in the ongoing shift of advertising budgets toward data-driven and connected TV channels, as well as the company’s ability to outpace industry trends. Recent analyst downgrades and revenue growth concerns create pressure around adoption of Kokai, making client uptake the key short-term catalyst, while resistance to platform changes and ongoing softness in digital ad demand remain the biggest risks to the business right now.

One relevant recent announcement is the company’s Q2 2025 results, which showed increased revenue and earnings year over year despite the market’s negative reaction and volatility. These results may offer context for evaluating whether ad spend trends or platform adoption disruptions are having a material impact on near-term performance, especially in the face of client hesitancy about migrating to Kokai.

On the flip side, investors should be aware that as core clients push back on Kokai’s rollout and overall digital ad budgets remain uncertain ...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's narrative projects $4.2 billion revenue and $823.2 million earnings by 2028. This requires 16.5% yearly revenue growth and a $406 million earnings increase from $417.2 million today.

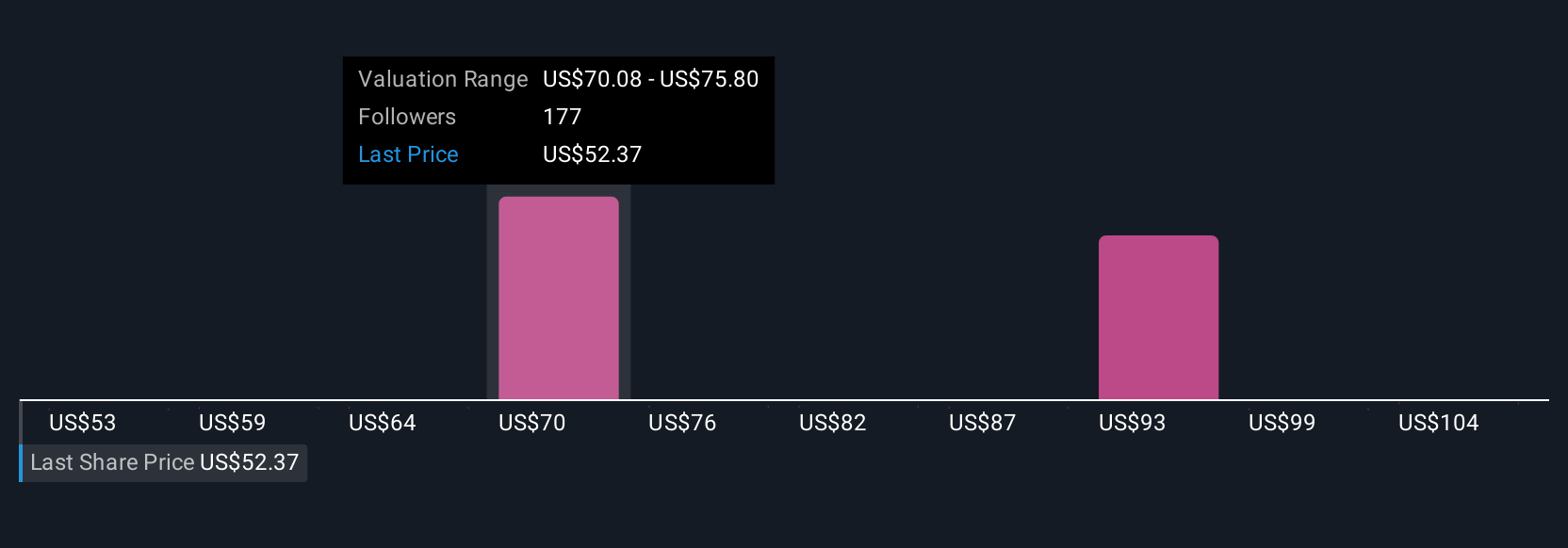

Uncover how Trade Desk's forecasts yield a $75.79 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Over 30 Simply Wall St Community members estimate The Trade Desk’s fair value from US$52.92 to US$110.13 per share, showing striking differences in outlook. With client adoption of the Kokai platform now a central issue, you can explore how a variety of views approach the challenge of evolving technology and digital ad demand.

Explore 31 other fair value estimates on Trade Desk - why the stock might be worth just $52.92!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives