- United States

- /

- Biotech

- /

- NasdaqGM:CLGN

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed performance amid fluctuating interest rate expectations and economic data releases, investors are keenly observing potential opportunities in various sectors. Penny stocks, often representing smaller or emerging companies, continue to attract attention due to their potential for significant value creation when supported by strong financials. Despite being an older term, penny stocks remain relevant for those seeking to uncover promising investments in less-established firms with robust growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.79M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.93B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.7257 | $11.81M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.77M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.49 | $44.59M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $28.91M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.97 | $91.74M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.45 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 727 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lisata Therapeutics (NasdaqCM:LSTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lisata Therapeutics, Inc. is a clinical-stage pharmaceutical company dedicated to discovering, developing, and commercializing innovative therapies for solid tumors and other diseases, with a market cap of $31.31 million.

Operations: Lisata Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $31.31M

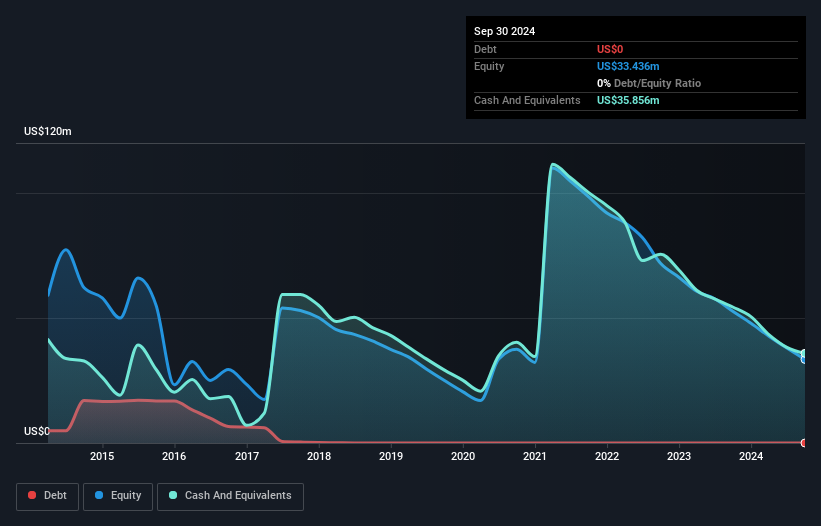

Lisata Therapeutics is a pre-revenue company with a market cap of US$31.31 million, focusing on innovative cancer therapies. Recent strategic moves include a collaboration with Kuva Labs for advanced imaging agents and the completion of patient enrollment in its CENDIFOX trial, which could enhance its research capabilities. Despite being debt-free and having sufficient cash runway for over a year, Lisata remains unprofitable with earnings forecasted to decline by 3.2% annually over the next three years. Shareholder dilution has occurred recently, but short-term assets comfortably cover liabilities, indicating financial stability amidst ongoing challenges in achieving profitability.

- Jump into the full analysis health report here for a deeper understanding of Lisata Therapeutics.

- Evaluate Lisata Therapeutics' prospects by accessing our earnings growth report.

CollPlant Biotechnologies (NasdaqGM:CLGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CollPlant Biotechnologies Ltd. is a regenerative and aesthetic medicine company specializing in 3D bioprinting of tissues and organs, with a market cap of $51.22 million, operating in the United States, Canada, Israel, Europe, and internationally.

Operations: CollPlant Biotechnologies generates its revenue primarily from its biotechnology segment, amounting to $0.65 million.

Market Cap: $51.22M

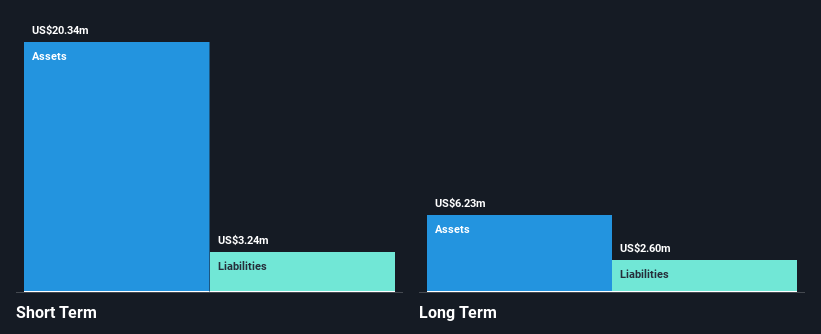

CollPlant Biotechnologies, with a market cap of US$51.22 million, is pre-revenue and unprofitable but holds promise in the regenerative medicine sector. Despite reporting minimal sales of US$0.65 million, its short-term assets of US$16.5 million comfortably exceed both short-term and long-term liabilities, indicating solid financial health without debt concerns. The management team is experienced with an average tenure exceeding eight years, while the board also brings substantial experience to strategic oversight. Although revenue growth is forecasted at 37% annually, profitability remains elusive over the next three years amidst increasing losses and stable shareholder positions without significant dilution.

- Navigate through the intricacies of CollPlant Biotechnologies with our comprehensive balance sheet health report here.

- Understand CollPlant Biotechnologies' earnings outlook by examining our growth report.

trivago (NasdaqGS:TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V., along with its subsidiaries, operates a hotel and accommodation search platform in various countries including the United States, Germany, and Japan, with a market cap of approximately $160.85 million.

Operations: The company's revenue is primarily generated from three geographical segments: Developed Europe (€192.69 million), Americas (€170.90 million), and Rest of World (€87.92 million).

Market Cap: $160.85M

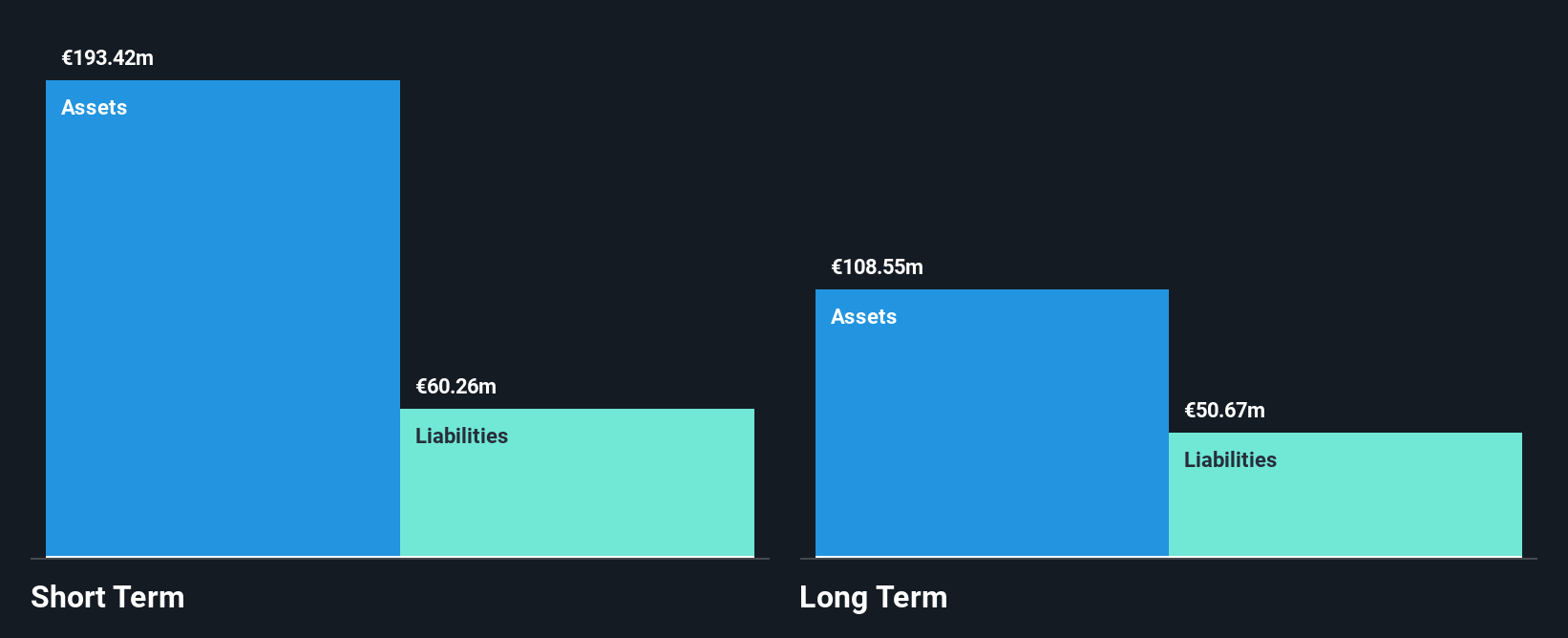

trivago N.V., with a market cap of approximately $160.85 million, operates in the competitive hotel search platform sector and is currently unprofitable. Despite this, it maintains a robust cash runway exceeding three years due to positive free cash flow. The company trades at a significant discount to its estimated fair value and holds no debt, which enhances its financial stability. Recent earnings reports indicate reduced losses compared to the previous year; however, impairments in intangible assets have been noted. While management is relatively new with limited tenure, the board provides experienced oversight.

- Dive into the specifics of trivago here with our thorough balance sheet health report.

- Gain insights into trivago's future direction by reviewing our growth report.

Next Steps

- Access the full spectrum of 727 US Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLGN

CollPlant Biotechnologies

A regenerative and aesthetic medicine company, focuses on three-dimensional (3D) bioprinting of tissues and organs, and medical aesthetics in the United States, Canada, Israel, Europe, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives