- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MASS

US Penny Stocks: 908 Devices Leads This Trio

Reviewed by Simply Wall St

As the U.S. stock market responds to recent election results with significant gains across major indices, investors are exploring diverse opportunities within this evolving landscape. Penny stocks, a term that might seem outdated, continue to hold relevance for those seeking affordable entry points and potential growth in smaller or emerging companies. In light of current market conditions, we examine three penny stocks that stand out for their financial resilience and potential appeal to investors looking beyond traditional large-cap investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.81M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.58 | $603.4M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.21M | ★★★★★★ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $2.40 | $99.68M | ★★★★☆☆ |

| Flexible Solutions International (NYSEAM:FSI) | $4.04 | $50.42M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.56 | $51.48M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.46 | $128.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.12 | $99.38M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

908 Devices (NasdaqGM:MASS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 908 Devices Inc. is a commercial-stage technology company that offers handheld and desktop mass spectrometry devices for analyzing unknown materials in fields such as life sciences research, bioprocessing, pharma/biopharma, and forensics, with a market cap of approximately $115.75 million.

Operations: The company generates its revenue from the Scientific & Technical Instruments segment, amounting to $52.69 million.

Market Cap: $115.75M

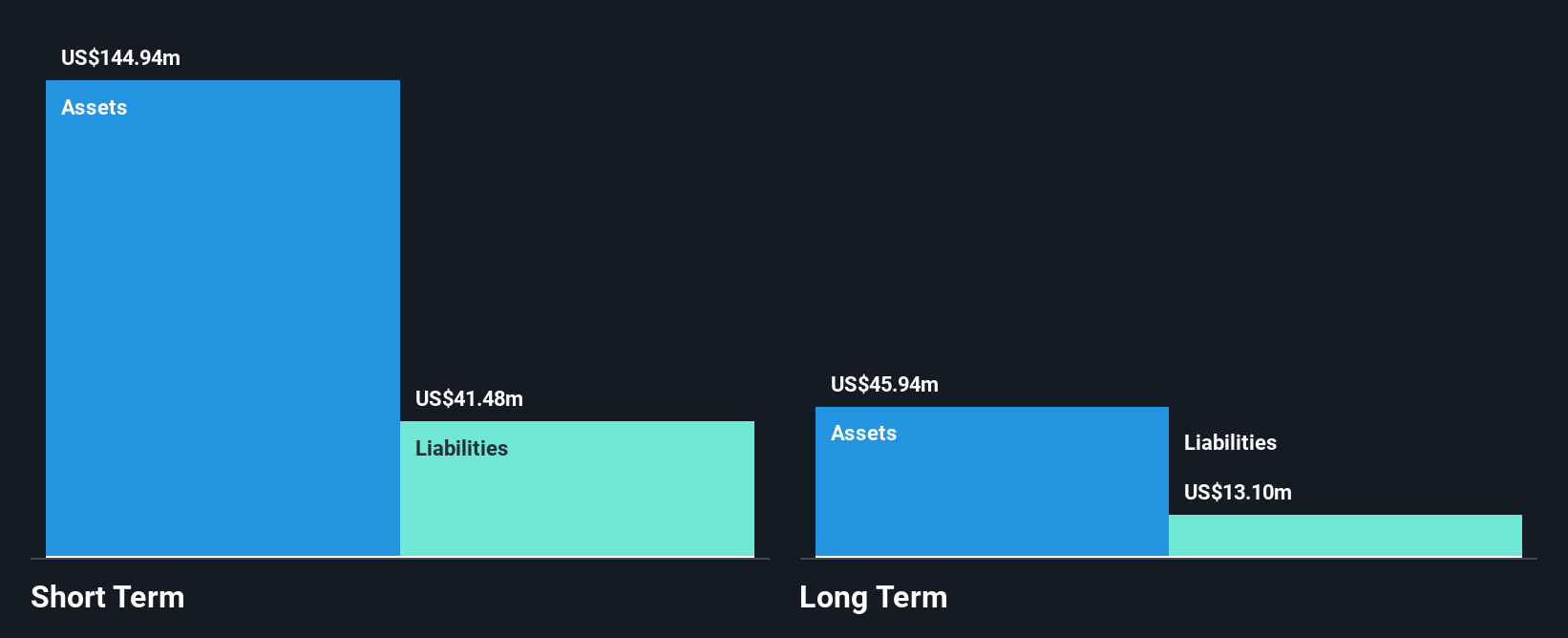

908 Devices Inc., with a market cap of approximately US$115.75 million, is debt-free and has a seasoned management team. Despite being unprofitable, it shows revenue growth potential, forecasting an annual increase of 19.31%. The company reported second-quarter revenue of US$14.05 million, up from US$12.09 million the previous year, although net losses widened to US$12.55 million from US$9.35 million. Short-term assets significantly exceed liabilities, providing financial stability for operations over the next few years without additional funding needs despite shareholder dilution over the past year by 7.2%.

- Get an in-depth perspective on 908 Devices' performance by reading our balance sheet health report here.

- Examine 908 Devices' earnings growth report to understand how analysts expect it to perform.

Quantum-Si (NasdaqGM:QSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quantum-Si, a life sciences company with a market cap of $107.85 million, develops a single-molecule detection platform for Next Generation Protein Sequencing (NGPS).

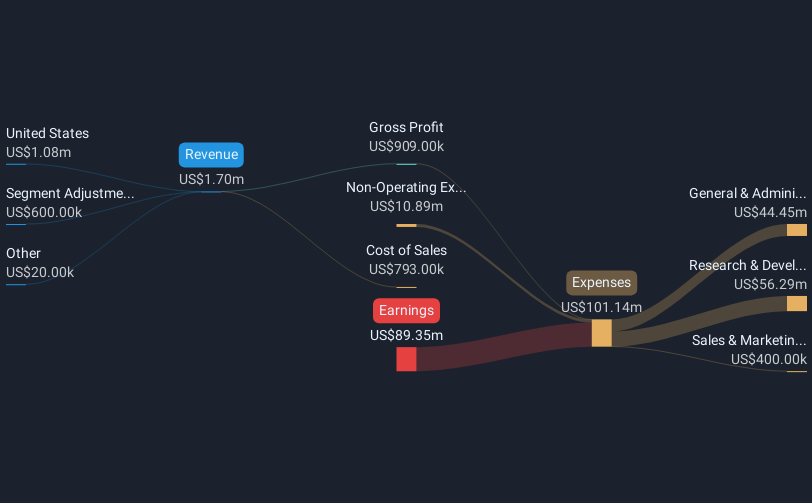

Operations: The company generates revenue from its Biotechnology (Startups) segment, totaling $1.70 million.

Market Cap: $107.85M

Quantum-Si, with a market cap of US$107.85 million, is debt-free but remains pre-revenue with limited revenue generation of US$1.70 million from its Biotechnology segment. The company has sufficient cash runway for over a year despite being unprofitable and not expected to achieve profitability in the next three years. Recent developments include the integration of its Platinum NGPS into Liberate Bio's platform, enhancing gene therapy precision and efficiency. Leadership changes bring experienced industry professionals on board, potentially strengthening commercial strategies. Quantum-Si's innovative protein sequencing technology continues to evolve with new product releases anticipated by year-end 2024.

- Click to explore a detailed breakdown of our findings in Quantum-Si's financial health report.

- Evaluate Quantum-Si's prospects by accessing our earnings growth report.

trivago (NasdaqGS:TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V., along with its subsidiaries, operates a hotel and accommodation search platform across various countries including the United States, Germany, the United Kingdom, Canada, and Japan, with a market cap of approximately $117.39 million.

Operations: The company's revenue is primarily derived from three geographical segments: Developed Europe (€197.94 million), the Americas (€178.95 million), and the Rest of World (€85.46 million).

Market Cap: $117.39M

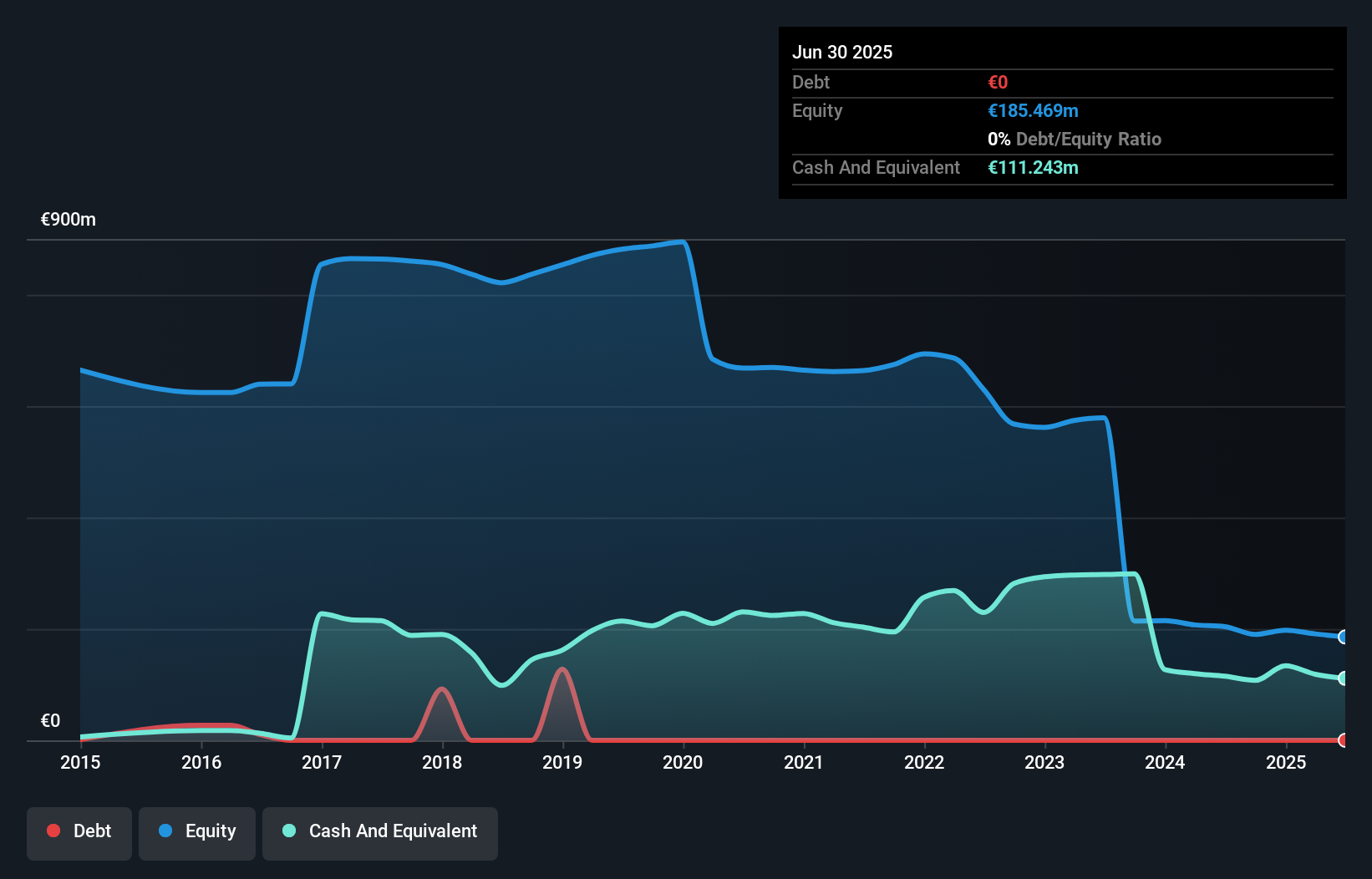

trivago N.V., with a market cap of approximately $117.39 million, operates within the hotel search platform industry and is currently unprofitable, having reported a net loss of €15.43 million for Q3 2024. Despite this, the company trades at good value compared to peers and has not diluted shareholders over the past year. Its cash runway exceeds three years due to positive free cash flow growth of 20.5% annually, providing financial stability despite ongoing losses. While its short-term assets significantly surpass liabilities, management's relative inexperience could impact strategic execution moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of trivago.

- Learn about trivago's future growth trajectory here.

Next Steps

- Investigate our full lineup of 755 US Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 908 Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MASS

908 Devices

A commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices to interrogate unknown and invisible materials in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets.

Flawless balance sheet slight.