- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRUE

Take Care Before Jumping Onto TrueCar, Inc. (NASDAQ:TRUE) Even Though It's 26% Cheaper

To the annoyance of some shareholders, TrueCar, Inc. (NASDAQ:TRUE) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

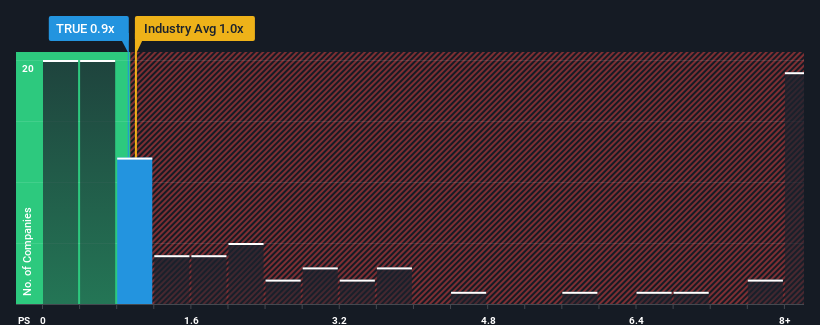

In spite of the heavy fall in price, there still wouldn't be many who think TrueCar's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in the United States' Interactive Media and Services industry is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for TrueCar

How TrueCar Has Been Performing

Recent times haven't been great for TrueCar as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TrueCar.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, TrueCar would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 24% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that TrueCar's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following TrueCar's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at TrueCar's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for TrueCar that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TrueCar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRUE

TrueCar

Operates as an internet-based information, technology, and communication services company in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives