- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Tripadvisor (TRIP): Assessing Valuation After Recent Weak Share Price Performance

Reviewed by Simply Wall St

Tripadvisor (TRIP) has struggled to hold gains despite steady revenue and faster growing earnings, leaving the stock drifting after a weak past 3 months and a sharp slide over five years.

See our latest analysis for Tripadvisor.

Over the past year, Tripadvisor’s modest 1 year to date share price return of 1.2 percent contrasts with a stronger 1 year total shareholder return of 10.17 percent. This suggests dividends and reinvested returns have done more of the heavy lifting than recent price momentum.

If Tripadvisor’s muted share price action has you rethinking where growth and conviction might come from next, it could be worth exploring fast growing stocks with high insider ownership.

With earnings growing faster than revenues and the shares still trading at a sizable discount to analyst targets and intrinsic value estimates, is Tripadvisor quietly undervalued, or is the market already counting on that future growth?

Most Popular Narrative Narrative: 16.5% Undervalued

With Tripadvisor last closing at $15.17 against a narrative fair value of about $18.16, the current price assumes a much more cautious future.

The analysts have a consensus price target of $18.162 for Tripadvisor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $13.5.

Curious how steady top line growth, rising margins and shrinking share count can still add up to a double digit discount? The narrative lays out a precise earnings roadmap, a tighter future multiple, and a specific hurdle rate that has to be cleared to justify that fair value. Want to see how all three pieces fit together into one valuation thesis?

Result: Fair Value of $18.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent traffic headwinds at Brand Tripadvisor and rising competitive pressure from larger travel platforms could easily derail this optimistic growth and valuation path.

Find out about the key risks to this Tripadvisor narrative.

Another View: Multiples Flash a Caution Sign

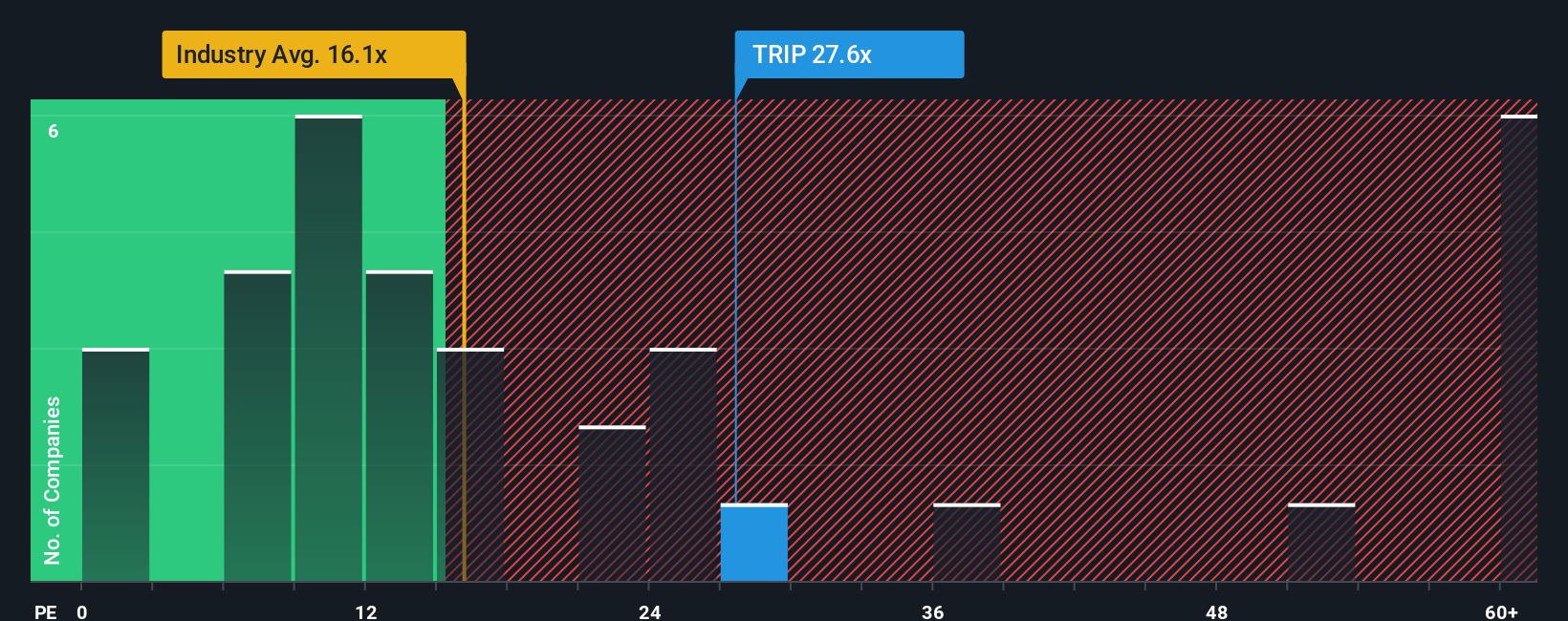

While narratives and intrinsic value work suggest upside, Tripadvisor trades on a 22.4 times earnings multiple versus a 20.7 times fair ratio and 17.6 times for the US Interactive Media and Services industry, implying the market already prices in a lot of improvement. Is that margin for error big enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tripadvisor Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Tripadvisor feels fully priced or too uncertain, do not wait on the sidelines. Use powerful screeners now to uncover your next high conviction opportunity.

- Target faster potential gains by hunting for mispriced growth using these 908 undervalued stocks based on cash flows that may be flying under the market's radar right now.

- Capitalize on structural trends by focusing on these 30 healthcare AI stocks harnessing data, automation, and intelligent diagnostics in one of the world's most resilient sectors.

- Ride the frontier of innovation by zeroing in on these 27 quantum computing stocks shaping tomorrow's computing power, security, and problem solving capabilities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)