- United States

- /

- Media

- /

- NasdaqGS:SIRI

Is Sirius XM a Bargain Opportunity After the Liberty Media Merger Announcement?

Reviewed by Simply Wall St

Are you trying to figure out whether Sirius XM Holdings stock deserves a spot in your portfolio right now? You are not alone. In a market full of noise and shifting sentiment, SIRI's recent performance has plenty of investors looking for clarity. After all, while most media stocks have had a roller-coaster year, Sirius XM Holdings has seen its share price swing in both directions. Over the past three months, the stock has gained about 7.3%, even as it sits almost 23% lower than a year ago. These moves hint at both changing risk perceptions and the long-term potential that some investors still see in the business.

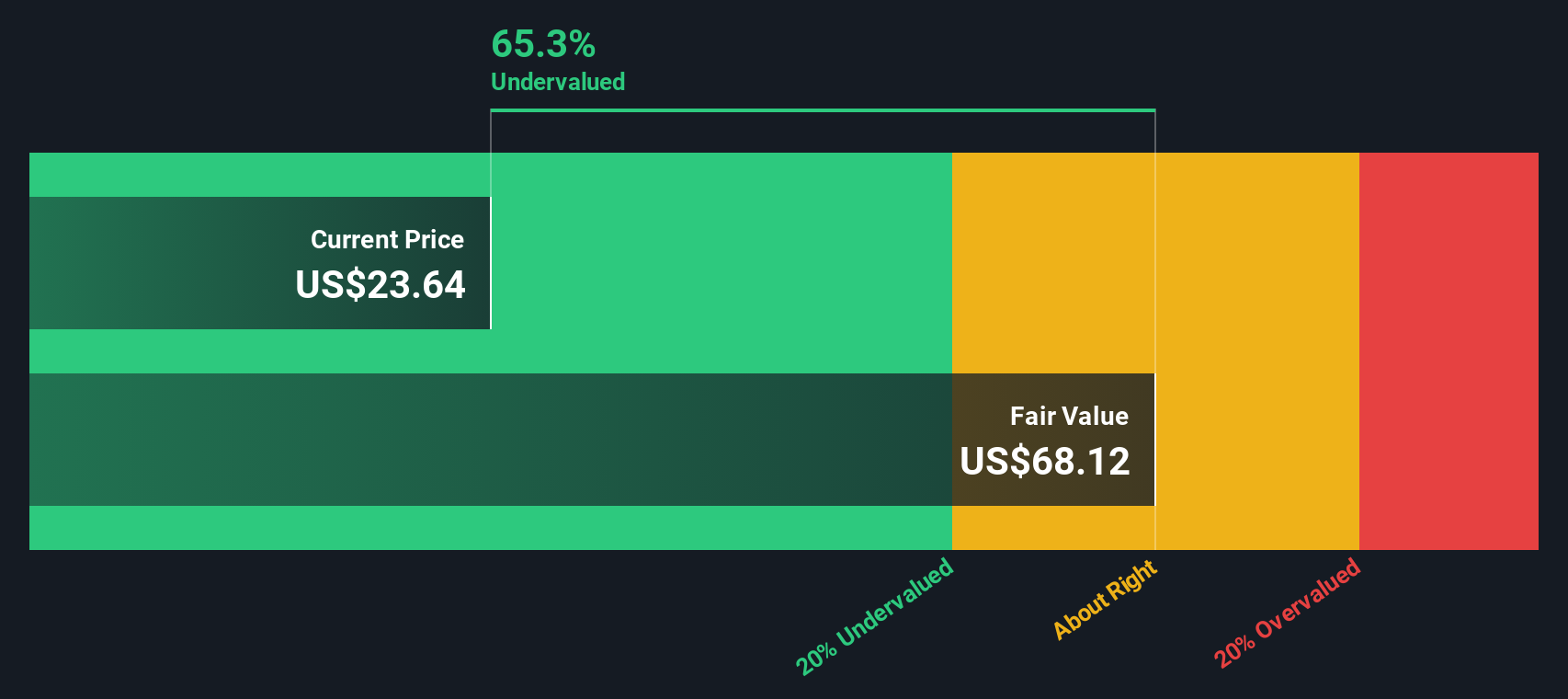

Looking deeper, the numbers get more interesting. Sirius XM's annual net income growth has increased by an impressive 46%, despite essentially flat revenue year over year. Still, the market continues to discount the company's valuation, with the price trading at a substantial 64.8% below what analysts consider its intrinsic value. Based on a six-point valuation checklist, Sirius XM qualifies as undervalued in five out of six categories, earning it a solid 5 out of 6 on our value score.

So, what is really behind this valuation case? In the sections that follow, we will break down the different methods analysts use to measure whether SIRI is a bargain or a value trap. Stay tuned, because at the end of this article, I will share a smarter way to make sense of valuation that goes beyond the usual numbers.

Sirius XM Holdings delivered -23.3% returns over the last year. See how this stacks up to the rest of the Media industry.Approach 1: Sirius XM Holdings Cash Flows

The Discounted Cash Flow (DCF) model is one of the most widely used ways to value a stock. It estimates what a company is worth today by projecting its future cash flows and then discounting them back to a present value. This helps investors understand what the business could be worth based on its ability to generate cash over time.

Sirius XM Holdings is currently producing Free Cash Flow (FCF) of $1.15 billion, a figure that has seen robust annual growth. Looking ahead, analyst projections show FCF rising to $1.55 billion by 2029, and model estimates suggest consistent increases out to 2035. All of these projected cash flows are analyzed using a two-stage DCF calculation to estimate the company’s intrinsic value.

Based on this analysis, Sirius XM’s intrinsic value is estimated at $66.61 per share. When compared to its current share price, this suggests the stock is trading at a 64.8% discount to its estimated fair value. In other words, the stock appears to be 64.8% undervalued according to the DCF method.

Result: UNDERVALUED

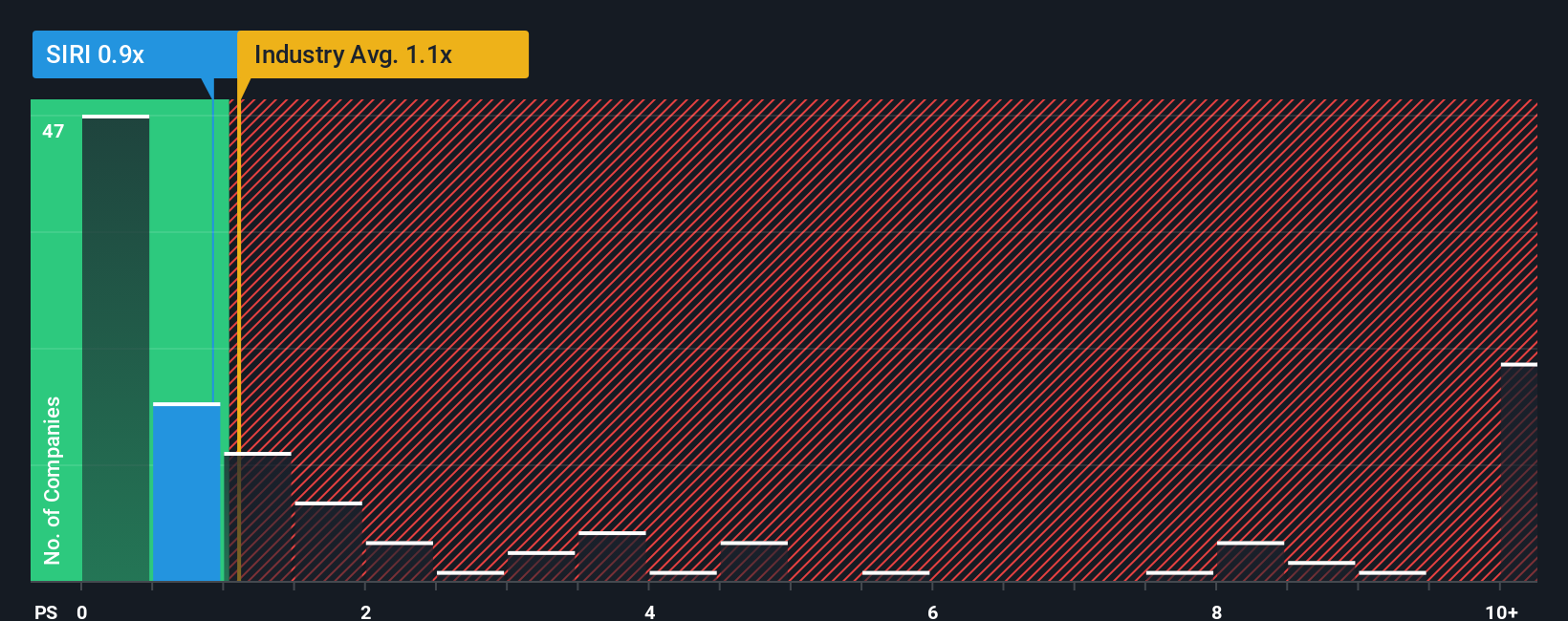

Approach 2: Sirius XM Holdings Price vs Sales

For many profitable companies, the Price-to-Sales (P/S) ratio is a practical way to gauge whether a stock is appropriately valued. This metric helps investors see how much they are paying for every dollar of revenue. It is especially useful for businesses like Sirius XM Holdings, where sales growth and recurring revenue play a significant role in long-term value.

Typically, a company's growth outlook and risk profile shape what is considered a "normal" or "fair" P/S ratio. Faster-growing companies or those with stronger competitive advantages can command higher multiples. In contrast, riskier or slower growers tend to trade at lower ones.

Sirius XM Holdings is currently trading at a P/S ratio of 0.92x. For perspective, this multiple is below both the media industry average of 1.02x and the peer average of 4.68x. Simply Wall St’s proprietary Fair Ratio for Sirius XM, which accounts for its growth, profit margins, industry position, and various risks, comes in at 1.31x. In comparison, the company's actual P/S multiple is noticeably lower than this fair benchmark.

The takeaway is clear: Sirius XM’s shares are trading at a discount to what could be considered a fair value, at least based on revenue multiples. This suggests the stock may offer value at today’s levels for investors willing to look beyond short-term volatility.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sirius XM Holdings Narrative

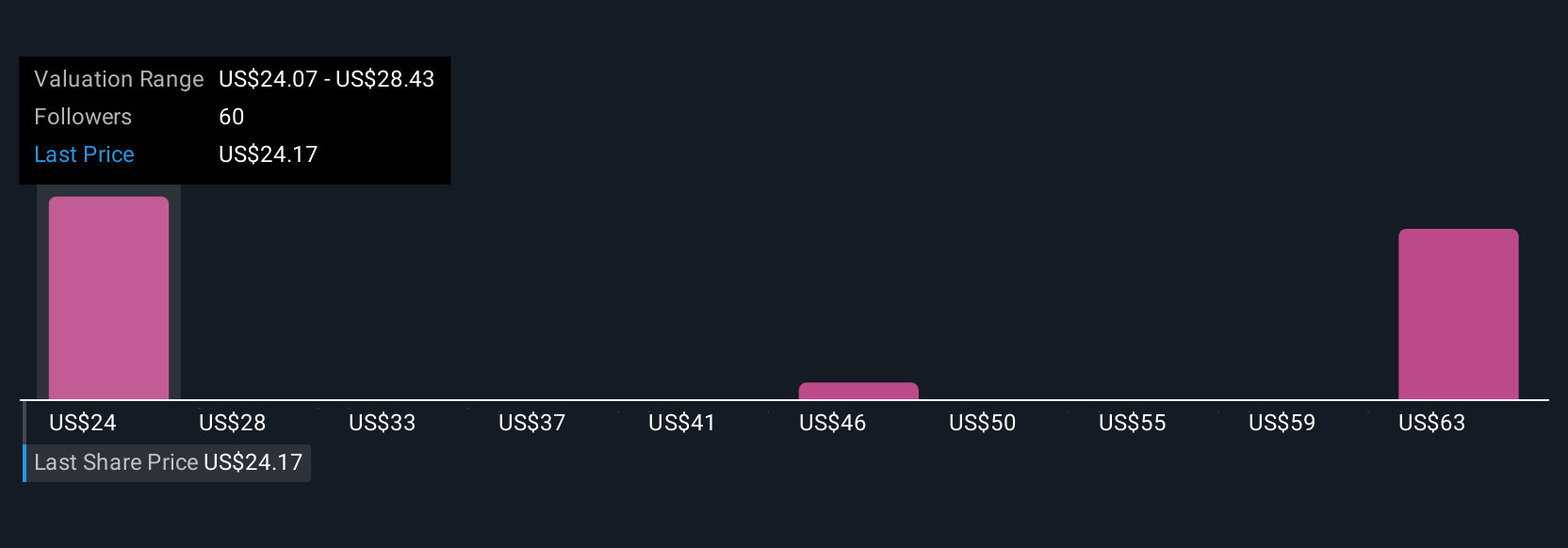

Narratives are the stories investors tell themselves to make sense of a company. They weave together unique perspectives on the business, its prospects, and risks into concrete expectations for future revenue, earnings, and fair value.

Rather than just relying on the numbers, Narratives help you connect Sirius XM Holdings’ business story to a financial forecast and then directly to an estimated fair value. This makes your investment thesis both personal and actionable.

On Simply Wall St, millions of investors use Narratives to visualize and compare different viewpoints with a few clicks. This makes it easy to see how a stock’s story translates to its price and helps determine when it might be the right time to buy or sell.

Narratives update dynamically as fresh financial results or news emerges, providing timely insight and helping you adapt your strategy as new information becomes available.

For example, while some investors see Sirius XM’s fair value as high as $50, betting on resilient cash flow and strong competitive advantages, others estimate it at $23.64, reflecting cautious growth expectations and industry challenges.

Do you think there's more to the story for Sirius XM Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives