- United States

- /

- Media

- /

- NasdaqCM:QMMM

What QMMM Holdings (QMMM)'s SEC Trading Suspension Over Crypto Treasury Plans Means for Shareholders

Reviewed by Sasha Jovanovic

- The U.S. Securities and Exchange Commission (SEC) recently suspended trading in QMMM Holdings following concerns of potential market manipulation linked to the company's announcement of a $100 million cryptocurrency treasury initiative.

- This regulatory action underscores increased scrutiny on the intersection of crypto strategies and social media-driven trading activity in publicly listed companies.

- We'll explore how the SEC's intervention amid crypto-related announcements could reshape QMMM Holdings' broader investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is QMMM Holdings' Investment Narrative?

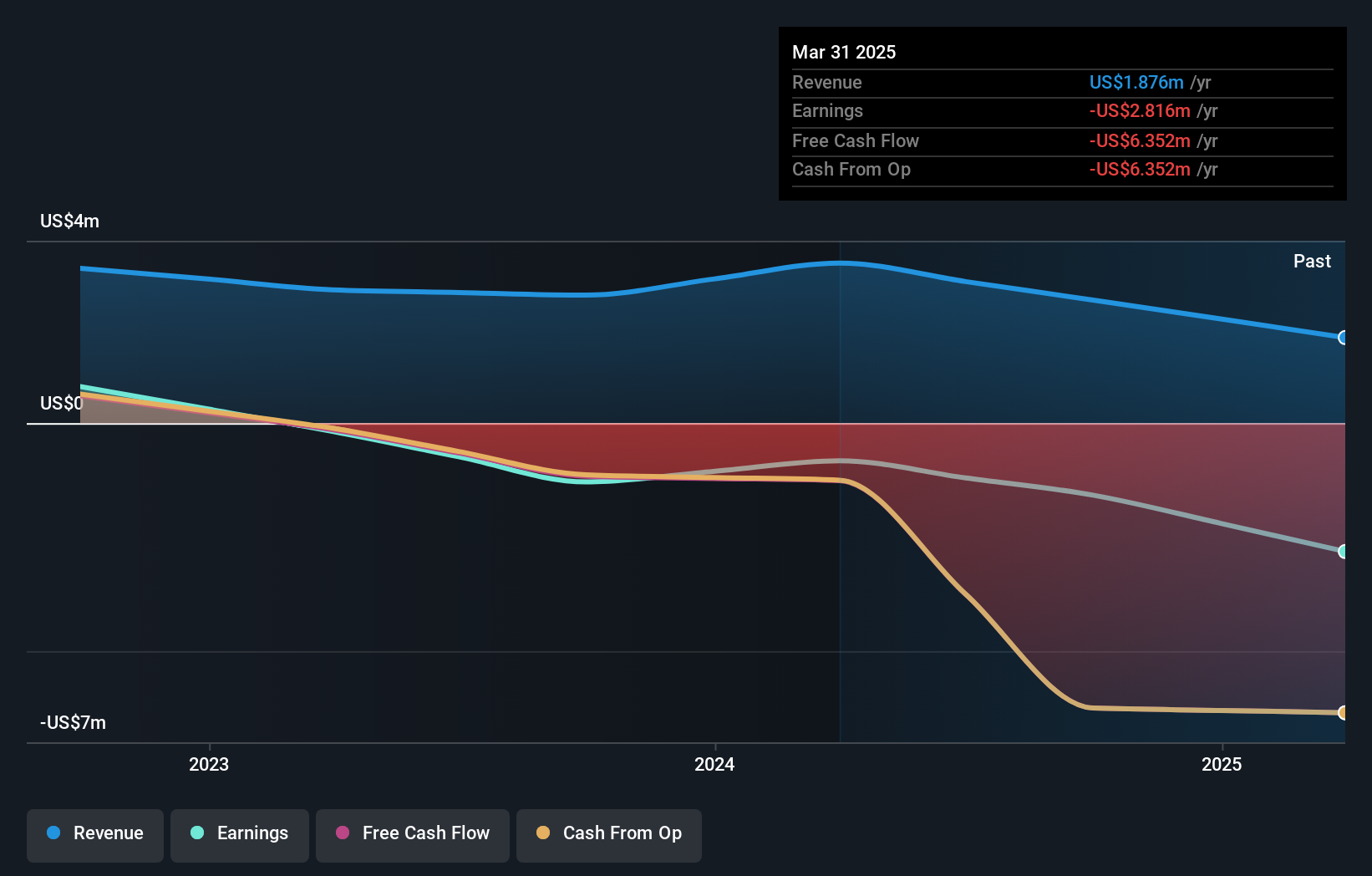

The QMMM Holdings story has always hinged on a big-picture bet: that its pivot into AI-powered crypto analytics and a $100 million digital asset treasury can transform both the business and its long-term prospects. Until now, near-term catalysts included progress toward these crypto ambitions, success in regaining Nasdaq compliance, and rebuilding financial stability after significant losses and boardroom turnover. But this latest SEC action, prompted by sharp price swings and claims of social media-driven manipulation, casts a shadow over all of these factors. The suspension doesn’t just create immediate uncertainty; it questions the credibility of recent price moves and highlights a significant regulatory risk for companies making sudden crypto pivots. Progress on project launches, treasury expansion and compliance could be stalled or reprioritized as QMMM navigates this scrutiny, which now stands as the business’s biggest risk and short-term overhang. In sharp contrast, risks around lasting regulatory scrutiny are now even more important for anyone following QMMM’s next steps.

Our valuation report here indicates QMMM Holdings may be overvalued.Exploring Other Perspectives

Explore another fair value estimate on QMMM Holdings - why the stock might be worth less than half the current price!

Build Your Own QMMM Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QMMM Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free QMMM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QMMM Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if QMMM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QMMM

QMMM Holdings

Through its subsidiaries, provides digital media advertising and marketing production services primarily in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)