- United States

- /

- Media

- /

- NasdaqCM:QMMM

QMMM Holdings (QMMM) Is Up 44.1% After Launching $100M Cryptocurrency Treasury Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, QMMM Holdings announced it is expanding into cryptocurrency and blockchain AI, unveiling a US$100 million cryptocurrency treasury focused on Bitcoin, Ethereum, and Solana.

- This move has sparked both increased attention from investors and caution from analysts, who question the long-term support from the company's underlying business fundamentals.

- We'll explore how QMMM Holdings' decision to allocate substantial capital to cryptocurrencies alters its investment narrative and future direction.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is QMMM Holdings' Investment Narrative?

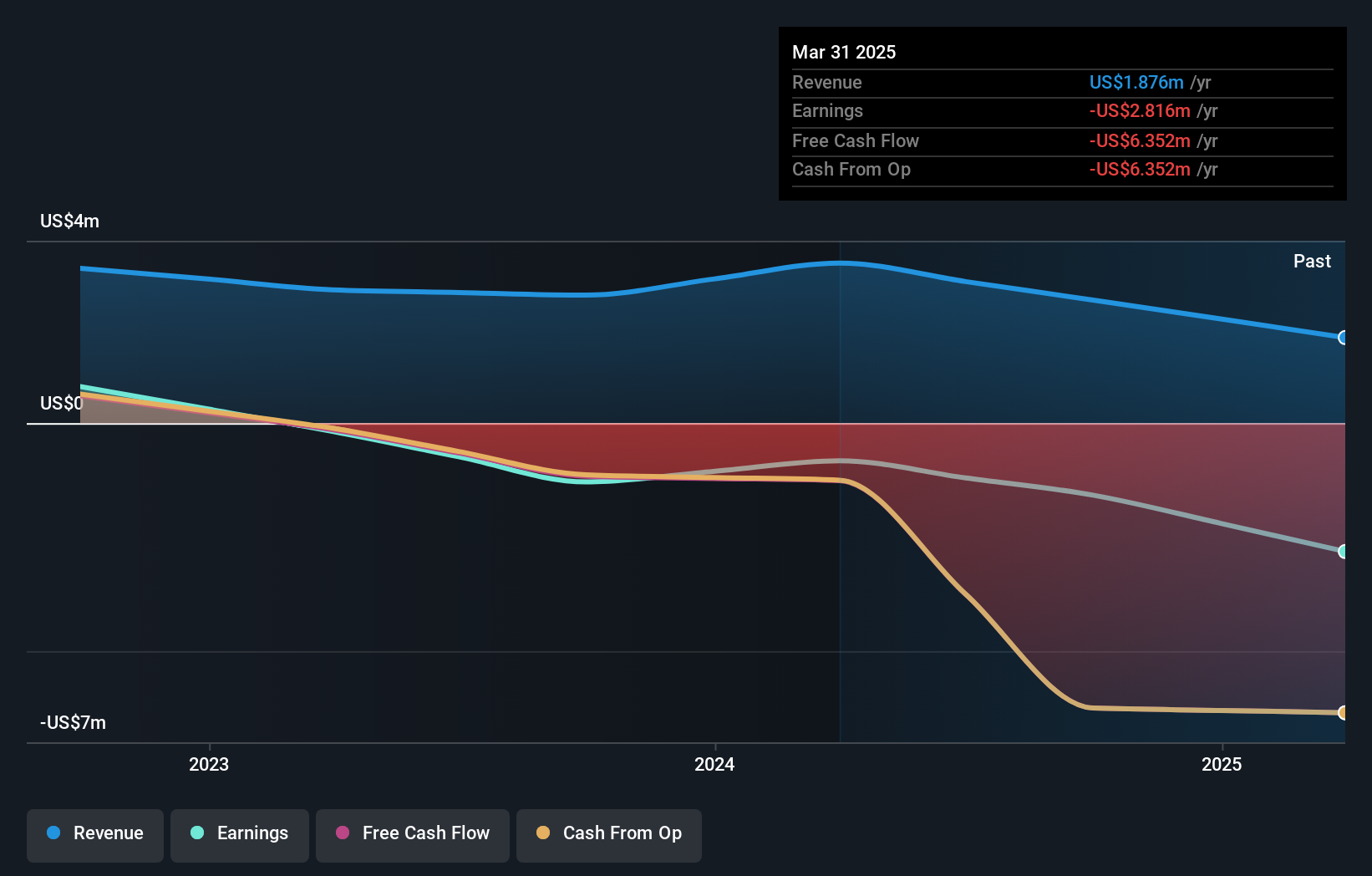

For QMMM Holdings, the core belief an investor has to adopt right now is confidence in the company's pivot into cryptocurrency and blockchain AI as a catalyst for fundamental change. Previously, the main short-term risks revolved around recurring losses, elevated share price volatility, board turnover, and compliance hurdles. However, after QMMM’s US$100 million cryptocurrency treasury was revealed, the share price spiked to extreme highs before sharply reversing, suggesting that sentiment is now being driven more by speculation than by improvements in the underlying business. This move introduces fresh risks tied to cryptocurrency price swings and execution in a completely new sector for the company, while capital allocation risk grows larger. For now, the company's financials remain challenged, and the future now depends on translating crypto enthusiasm into sustainable business results, a tall order given QMMM’s limited revenue and increasing losses before this shift.

But high volatility isn’t the only issue investors need to keep in mind...

Exploring Other Perspectives

Explore another fair value estimate on QMMM Holdings - why the stock might be worth as much as $0.22!

Build Your Own QMMM Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QMMM Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free QMMM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QMMM Holdings' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QMMM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QMMM

QMMM Holdings

Through its subsidiaries, provides digital media advertising and marketing production services primarily in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)