- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Why Gaming may Become a Growth Avenue for Netflix (NASDAQ:NFLX)

Netflix, Inc. (NASDAQ:NFLX) is slowly testing the waters for their entry into gaming. The company seeks to extend the content life-cycle by supplementing it with gaming. Netflix has been funding content growth with around a US$17b spend in 2021. In this article, we are going to explore the growth expectations for Netflix and their start in gaming.

Gaming Expansion

Up until the end of fiscal year 2021, Netflix scaled revenues positively over costs, but their original content expenses may create a dent in the free cash flows, even though the company estimates a return to breakeven in 2022.

While content is being created, it seems that Netflix is looking for a way to capture engagement on the platform for people that may be interested in games related to their favorite shows.

In March, the company made an offer to acquire Next Games for EUR63.1m as their entry into the gaming market tarts taking ground. Previously, Next Games made the mobile puzzle game Stranger Things: Puzzle Tales in collaboration with Netflix.

Netflix also acquired "Boss Fight Games" on 24th March 2022, a private game development outlet.

While these are small outlets, it may indicate the preparations which Netflix is making in order to derive the maximum from their future content projects. The games can be based on already popular Netflix content, and posted on the platform - possibly circumventing app stores in the future, while the popularity already gives them a boost to marketing the games.

Risks and Opportunity in Gaming

We need to note that content derived games were tried in the "early days" from Disney (NYSE:DIS), and were not as successful as the company imagined. Meta (NASDAQ:FB) also leverages its platform to produce games, however advertising revenue is still a primary income source.

We can see that the entry into gaming, seems like the logical approach for Netflix, and has been tried in the past by others with mixed results.

The advantage of connecting content with gaming, is to allow the conversation around content to keep going and engage clients for a longer period - possibly between seasons. One of the notable trade-offs of the Netflix model is that they lose the conversation which traditional content creators had between episodes, in order to compensate for this, some of Netflix's series have been known to be intense or controversial.

Not everything is as it once was, mobile games are growing in popularity and the advancement of technology is shortening the development time. With Netflix owning the rights of their original content, and design resources that can easily be translated onto the mobile screen, it is possible to make this into a higher return venture.

Forward Growth

As Netflix prepares future investments, Analysts are making their growth predictions. The company must still grow to capture more of their total addressable market (TAM) of 750 million users, while currently they have 221.8 million users (p. 20) - a 29.5% market share. Considering that attaining growth at a substantial market share like this is harder, it is likely a normal progression to seek to diversify and expand the potential user base.

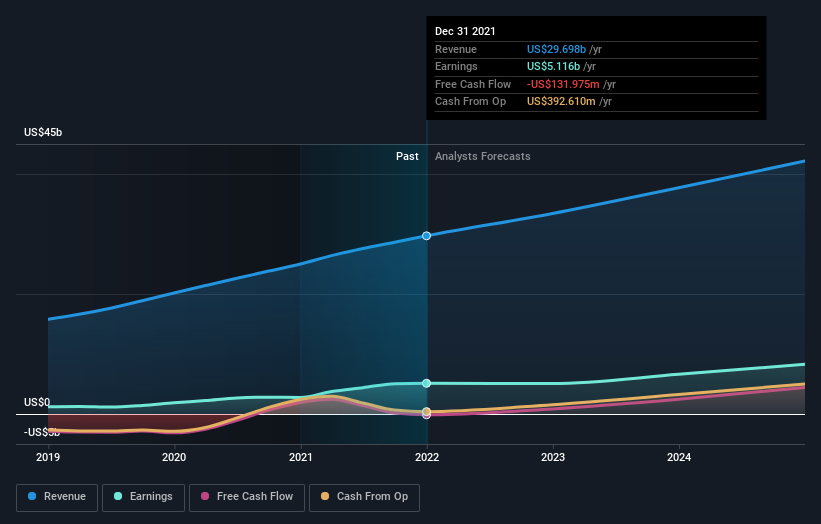

Given Netflix's growth potential, we have gathered future forecasts from the 40 analysts covering the company, and can see what they are expecting in the next 3 years in the chart below:

View our latest analysis for Netflix

The average forecast is for revenues of US$33.4b in 2022, which would reflect a meaningful 13% improvement in sales compared to the last 12 months. Statutory earnings per share are forecast to shrink 3.0% to US$11.18 in the same period.

Conclusion

In the worst case scenario, gaming may become a cheap accessory to Netflix's content, while in the most optimal case it will become an extra revenue stream on the platform.

If investors trust management to produce content that will earn a consistent return, then they will be inclined to be even more bullish on the growth forecasts. On the other hand, investors that cannot see the justification for the high content spend, may be worried that this will erode future free cash flows and shrink margins.

The next step is to take a deep dive at the fundamentals of Netflix in order to see which are the company's strengths and where most of the risk can be found.

If you're looking to trade Netflix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives