- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Assessing Valuation After a Sharp Pullback in the Share Price

Reviewed by Simply Wall St

Netflix Stock Performance In Context

Netflix (NFLX) has quietly slipped about 4% in the past day and roughly 10% over the past week, extending a near 18% pullback this month that is starting to test investors patience.

See our latest analysis for Netflix.

That slide comes after a strong run, with the share price still up modestly year to date while the three year total shareholder return above 200% shows the longer term momentum story remains very much intact.

Given how quickly sentiment can shift around big tech, it is worth scanning other high growth opportunities in high growth tech and AI stocks while Netflix works through this cooling phase.

With the share price now well below consensus targets but growth in revenue and profits still robust, the key question is whether Netflix remains undervalued or if the market is already pricing in its future expansion.

Most Popular Narrative Narrative: 31% Undervalued

With the narrative fair value near $134 per share versus Netflix's $92.71 last close, the storyline backs a meaningful upside if assumptions hold.

Enhanced user experience from a major UI/UX refresh, combined with advanced personalization and recommendation features leveraging generative AI improves member engagement and content discovery, which is likely to increase retention rates and viewing time, leading to higher revenue and better operating margins.

Curious how much earnings power this assumes, or how rich a future profit multiple it needs to work. Want the exact playbook behind that upside narrative.

Result: Fair Value of $134.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and soaring content costs could pressure margins and slow subscriber growth, which could quickly erode the upside implied in this bullish narrative.

Find out about the key risks to this Netflix narrative.

Another Lens On Value

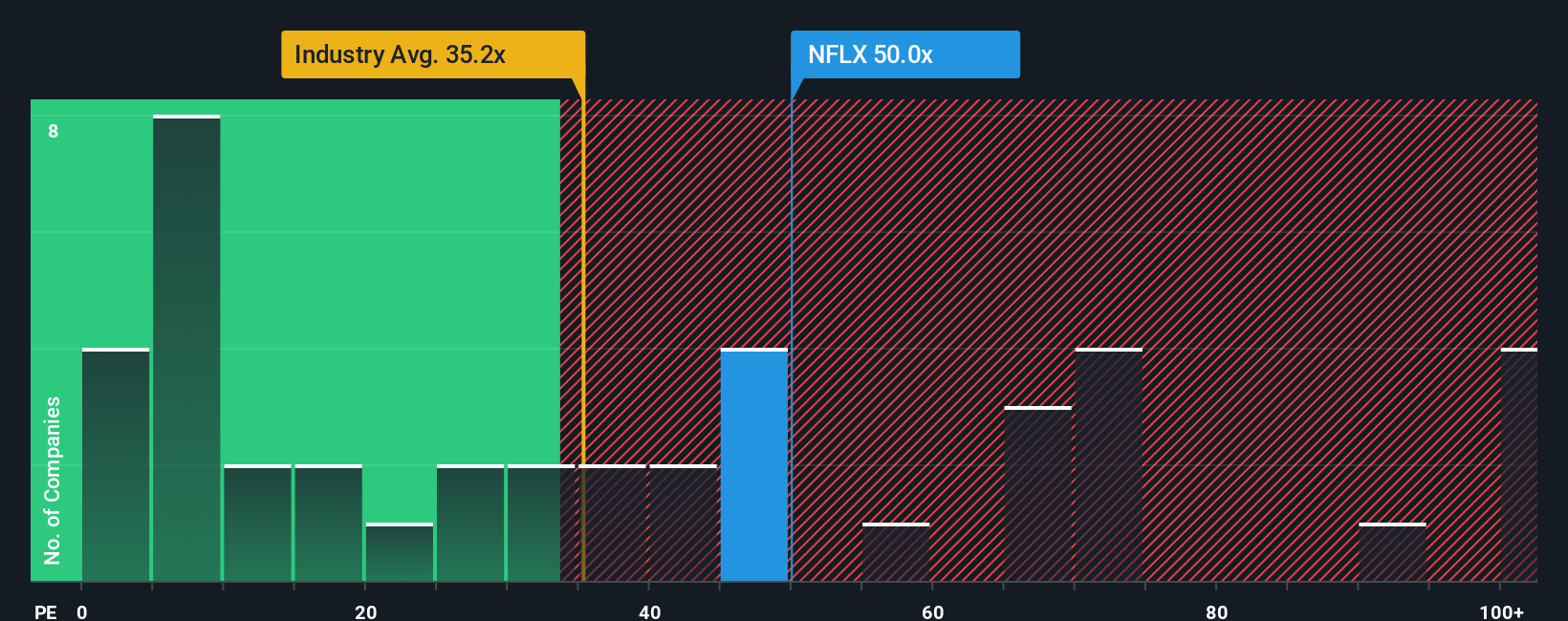

While the narrative fair value points to upside, the price to earnings check sends a cooler signal. Netflix trades on 40.6 times earnings versus an estimated fair ratio of 33.1 times and a 21.8 times industry average, leaving less room for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a complete view in minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Ready To Act On Your Next Move?

Do not stop at Netflix when the rest of the market is brimming with potential. Use the Simply Wall Street Screener to uncover your next edge.

- Capture underappreciated opportunities by targeting companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows before other investors catch on.

- Ride long-term trends by focusing on innovators involved in intelligent automation with these 26 AI penny stocks.

- Seek cash returns by zeroing in on companies offering income via these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026