- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MTCH

Match Group (MTCH): Exploring Valuation After $700M Debt Move and Gen Z User Shift

Reviewed by Simply Wall St

Match Group (MTCH) is making headlines after announcing a $700 million senior notes issuance, aiming to use the proceeds to manage its debt and fund other corporate activities. The news comes at a time when broader conversations about the company’s growth trajectory are intensifying, particularly as younger users appear to be moving away from mainstream platforms like Match and Tinder in favor of niche, exclusive dating apps. For anyone considering what to do with Match Group stock right now, these developments highlight shifting dynamics that could reshape the company’s future path.

This latest step in financial strategy comes against a backdrop of modest share performance. Match Group’s price is up 14% for the year, partially due to renewed investor optimism in recent months, but longer-term concerns remain. Over the past month, the stock has gained 8%, signaling some momentum; however, its three-year and five-year returns are still negative. While strong cash flow and cost controls have helped reduce some volatility, trends such as slowing downloads and evolving user preferences are now shifting the focus to future prospects rather than past performance.

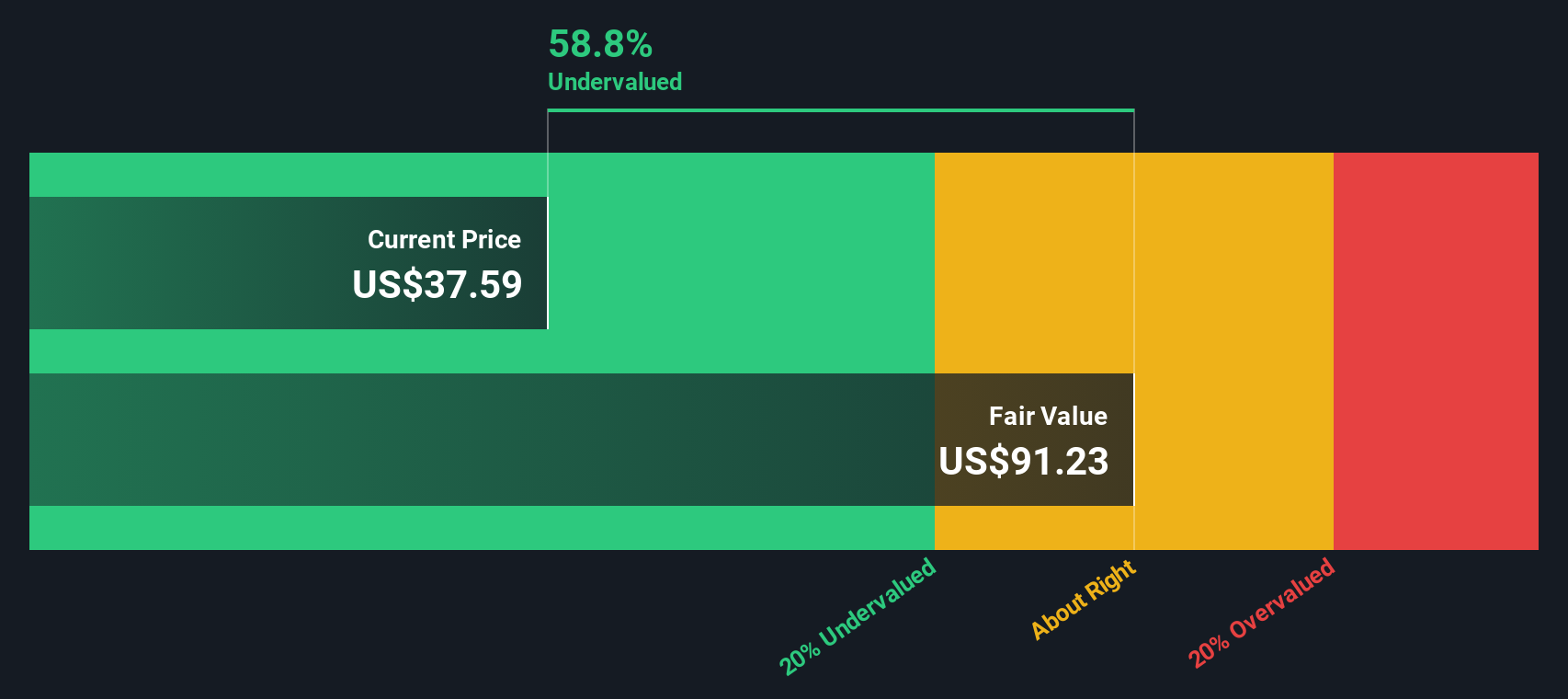

With the market weighing Match Group’s new debt issuance alongside emerging challenges to its core platforms, some are debating whether the stock is undervalued at current levels or if the recent rally already reflects any potential recovery.

Most Popular Narrative: 3% Undervalued

According to community narrative, Match Group is viewed as modestly undervalued relative to consensus analyst projections. This view is based on expectations for steady financial and operational improvement over the coming years.

*Accelerated product innovation, particularly at Tinder and Hinge with new AI-powered features, personalization, trust and safety enhancements, and lower-pressure connection options for Gen Z, is expected to revitalize user growth, increase engagement, and support higher payer conversion rates. This could lead to sustained top-line revenue and margin expansion as new features mature.*

Are you interested in how a combination of next-generation technology and ambitious global strategies could translate into a higher valuation? Explore the financial advances and strategic initiatives analysts are incorporating into their assumptions. Learn why a key profit multiple and unexpected margin expansion could play a significant role in determining Match Group’s fair value.

Result: Fair Value of $38.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in core user metrics or an overdependence on Tinder could pressure future revenue growth and challenge the optimistic outlook for Match Group.

Find out about the key risks to this Match Group narrative.Another View: Discounted Cash Flow Perspective

While the analyst consensus relies on future profit multiples, the SWS DCF model tells a different story and suggests the fair value is much higher than where the stock trades today. Why do these models diverge? What might you be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Match Group Narrative

If you want to dive deeper or come to your own conclusions, you can build and personalize your perspective on Match Group in just a few minutes, or do it your way.

A great starting point for your Match Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investing Advantage?

Smart investors never stop searching for their next winning opportunity. If you want to stay ahead of the curve, use the Simply Wall Street Screener to pinpoint stocks with the right mix of value and growth. Give yourself an edge with these three standout investment ideas, hand-picked for curious minds:

- Secure your portfolio’s future by targeting income stars yielding above 3 percent with our handpicked dividend plays in the dividend stocks with yields > 3%.

- Ride the AI boom as you uncover hidden gems in healthcare that are reshaping the industry through transformative tech using the latest breakthroughs in the healthcare AI stocks.

- Tap into tomorrow’s value by tracking opportunities that are trading below their intrinsic worth by selecting from our robust collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTCH

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives