- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MOMO

Hello Group (NasdaqGS:MOMO) Margin Compression Reinforces Bearish Community Narrative After Q3 2025 Results

Reviewed by Simply Wall St

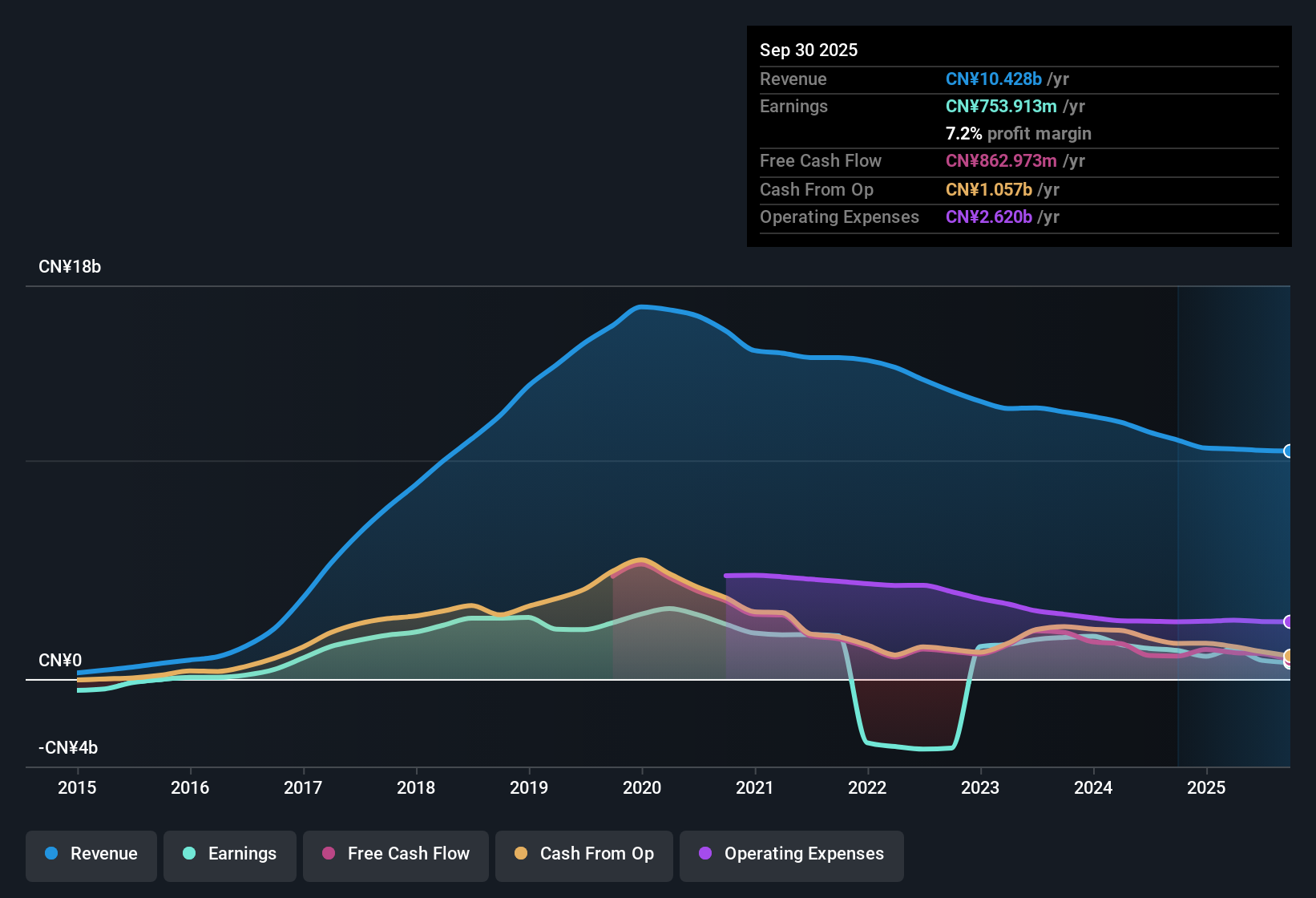

Hello Group (NasdaqGS:MOMO) just posted its Q3 2025 scorecard, with revenue of CNY 2.7 billion and EPS of CNY 2.10 setting the tone after a volatile first half that included a negative EPS print. The company has seen revenue hold in a tight band between about CNY 2.5 billion and CNY 2.7 billion over the last six quarters, while quarterly EPS has swung from CNY 2.58 and CNY 2.20 levels in 2024 to a mix of positive and negative readings in 2025. This puts the spotlight squarely on how durable its margins really are this time around.

See our full analysis for Hello Group.With the headline numbers on the table, the next step is to see how this margin story lines up with the market’s prevailing narratives and what the community on Simply Wall St has been expecting.

See what the community is saying about Hello Group

Margins Under Pressure From 11.9 percent To 7.2 percent

- Trailing net profit margin has slipped from 11.9 percent to 7.2 percent, even though trailing twelve month revenue is about CNY 10.4 billion and net income is about CNY 754 million.

- Critics highlight that overseas expansion and higher payouts are squeezing profitability, and the latest figures give that some support:

- The drop in trailing margin to 7.2 percent sits below the earlier 11.9 percent level, which fits with concerns about rising costs as new markets are developed.

- Q3 2025 net income of about CNY 349 million, compared with CNY 449 million in Q3 2024 on similar revenue, points to thinner profitability even before any further overseas scaling.

Earnings Growth Story Versus 0.5 percent Revenue Outlook

- Over the last five years, earnings have grown about 5.8 percent per year and are forecast to grow roughly 17 percent annually, while revenue is only expected to rise about 0.5 percent per year.

- Supporters argue that product tweaks, AI tools, and better marketing can keep earnings growing even with slow top line, and the numbers partly back that view:

- Trailing twelve month revenue of around CNY 10.4 billion versus analysts expecting about 2.2 percent annual growth over the next few years suggests the focus is on margin and mix, not big volume gains.

- Forecast earnings of about CNY 1.2 billion and EPS of roughly CNY 7.6 by 2028, compared with about CNY 1.4 billion today, reflect the bullish idea that efficiency and product quality will matter more than headline revenue growth.

Low 9.8x P or E With DCF Fair Value At CNY 11.99

- The stock trades on a trailing price to earnings ratio of 9.8 times at a share price of CNY 6.68, versus a DCF fair value of CNY 11.99 and industry and peer averages of 17.9 times and 23 times.

- Consensus narrative notes that analysts still see value despite margin pressure, and the data underline that valuation gap:

- With the DCF fair value at CNY 11.99, the current price of CNY 6.68 implies a sizeable discount even after factoring in lower trailing margins at 7.2 percent.

- An analyst price target of CNY 8.87, above today’s price, assumes earnings of about CNY 1.2 billion by 2028 and a future multiple of 9.6 times, which is still below the current industry level of 16.9 times.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hello Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light and think the story should read another way? Share that view in a quick, focused narrative: Do it your way.

A great starting point for your Hello Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Hello Group’s shrinking margins, uneven earnings trajectory, and muted revenue outlook highlight how vulnerable returns can be when profitability depends heavily on cost control.

If you want steadier compounding instead of worrying about margin swings, use our stable growth stocks screener (2093 results) to quickly find businesses delivering more consistent revenue and earnings progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hello Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MOMO

Hello Group

Provides mobile-based social and entertainment services in the People’s Republic of China and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in