- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NASDAQ:META) : Past Performance is not Indicative of Future Returns

Key Takeaways from This Analysis:

- Meta Platforms will be reporting 2nd quarter results on Wednesday 27th July.

- The company is facing numerous challenges, but this is reflected in the current valuation.

- There is however still a lot of uncertainty about Meta's long-term growth potential.

Meta Platforms' (NASDAQ: META) share price fell 7.6% on Friday after SNAP Inc's (NYSE: SNAP) 2nd quarter financial results pointed to a slowdown in digital ad spend. The prospect of a recession may put further pressure on the advertising industry too. The market is already expecting Meta's EPS to be down around 29% year-on-year, and revenues to be flat to slightly lower. Some analysts now believe the results may be worse than previously expected.

Current Challenges

It's no secret that Meta is facing a number of challenges. In addition to the slowdown affecting the entire ad industry, we can summarize these challenges as follows:

- With nearly 3 billion users, the company is not adding users at the rate it used to. In fact, in February, the company reported its first-ever decline in users.

- Meta and other social media platforms are facing increased competition from TikTok.

- Changes to Apple's iOS operating system have prevented Facebook from targeting ads as effectively as it could in the past.

- Meta's pivot to the Metaverse has cost the company $10.2 billion (and counting) and this investment could take years to generate a return.

- Concerns about poor ethical leadership and potential antitrust action.

View our latest analysis for Meta Platforms

Is Meta Cheap?

Balancing out these well-known challenges is the fact that the stock price is already 57% below last September's all-time high. It's now trading on a price-to-earnings (P/E) ratio of 12.7x which makes it look attractive relative to its peers, and relative to its own historical valuation.

The chart above shows the average analyst price target of $169 12 months from now, which is 39% above the current price. However the confidence in this price target is low as it is very little agreement between analysts on where the stock will be trading in a year's time. Consensus between analysts diverged in February when the company reported a drop in user numbers.

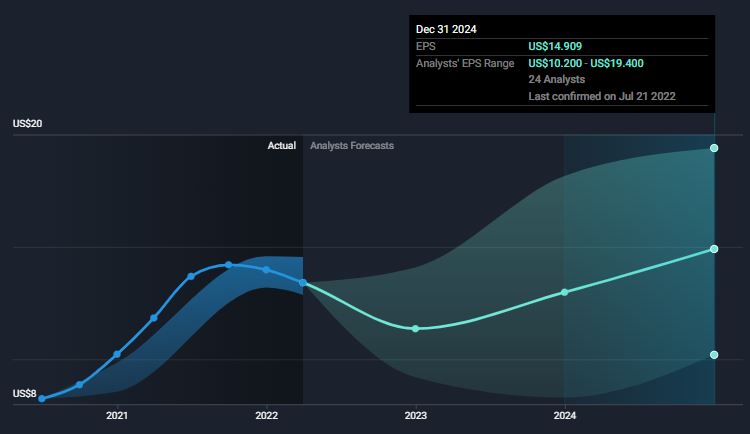

Below we can see just how wide the gap is between the lowest and highest EPS estimates for the end of 2024. With EPS forecast to be between $10.20 and $19.4, the forward P/E could be as low as 8.8x or as high as 16.5x, with an average of 11.34x.

What does this mean for investors?

A P/E ratio of 12.7x is low even if growth is expected to be low - but current forecasts imply that upside could be limited. Typically we would like to see the forward P/E significantly lower than the current P/E ratio. The lower forward P/E of 8.8x does imply substantial upside, but the average and higher forward ratios imply more modest upside.

Right now analysts and investors are uncertain about what Facebook's future looks like, and this is reflected in these forecasts. Meta is widely regarded as cheap and has even been added to the Russell 1000 Value index. If market sentiment improves or the industry experiences a limited slowdown there may well be a rally — but Facebook's historical long-term returns may not repeat if there isn't clarity about future earnings growth.

This article only touches on the current valuation and growth expectations for Meta. If you are interested in understanding the company at a deeper level, take a look at our full analysis which includes some of the other factors to consider.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives