- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Partners With Red Hat To Advance Generative AI Innovation

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) has recently announced a significant collaboration with Red Hat, aimed at advancing generative AI technologies for enterprise applications. This partnership, along with others such as those with Cerebras and Groq, seeks to position the company at the forefront of the AI development landscape, emphasizing interoperability and open innovation. In a generally stable market environment with the S&P 500 experiencing a slight dip and the broader indices generally maintaining their gains, Meta's price surged by 27% over the past month. This surge likely gained momentum from its collaborative efforts in AI innovation, countering broader economic stability and slight market declines.

Buy, Hold or Sell Meta Platforms? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

Meta Platforms' recent collaboration with Red Hat aiming to advance generative AI technologies could significantly impact the company's strategic direction. Enhancing AI capabilities may boost Meta's ad targeting precision and creativity, potentially increasing revenue as global advertising evolves. Additionally, partnering with various AI pioneers like Cerebras and Groq underscores Meta's commitment to leading AI development, which could drive further engagement and adoption across its platforms.

Over the past three years, Meta's total shareholder return was a substantial 253.10%, indicating strong long-term performance. In the last year, Meta's share price outperformed the U.S. Interactive Media and Services industry, which achieved a 6.6% return, showcasing the company's robust financial standing and resilience. The S&P 500, for context, experienced a more moderate return of 11.1% during the same period.

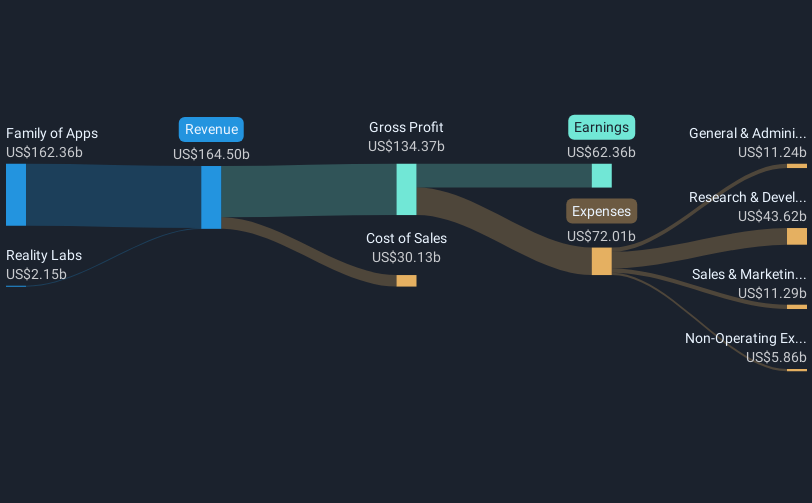

The recent advancements and collaborations in AI have the potential to meaningly impact Meta's revenue and earnings forecasts. As analysts expect revenue to grow at a rate of 10.9% annually over the next few years and assume earnings will rise to US$86 billion by 2028, the company's strategic AI initiatives could further support these projections. However, significant investments in AI and operational costs in regions like Europe may affect profitability.

As of today, Meta's share price stands at US$587.31, and analysts' consensus price target is US$703.89, indicating a potential upside of 16.6%. The price movement, propelled by recent AI developments, aligns with analysts’ growth expectations, suggesting a promising future for Meta in the frontier of AI and digital engagement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives