- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Dips 12% After UFC Partnership Announcement

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) recently announced a multiyear partnership with UFC, aiming to invigorate UFC fan engagement through innovative technology platforms. Despite this promising collaboration, Meta's share price fell 12% over the past week. This decline aligns with a broader market downturn, as major indices plunged amidst tariff-induced turmoil, reflecting heightened concerns over economic growth and inflation. Meta, alongside other tech giants like Apple and Nvidia, experienced significant declines, with the Nasdaq entering bear market territory. These reactions illustrate the pervasive market volatility, overshadowing individual company developments like Meta's UFC partnership.

Meta Platforms has 1 weakness we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The multiyear partnership between Meta Platforms and UFC is intended to diversify Meta’s offerings and enhance user engagement through innovative platforms. While immediate market reaction to this announcement and broader economic turmoil has led to a 12% decline in Meta's share price, the company's shares have experienced a substantial total return of 189.46% over the past five years. This demonstrates significant long-term growth, providing necessary context for the current volatility.

Over the past year, Meta's performance remained aligned with the Interactive Media and Services industry and the overall US market, both experiencing declines. Analysts expect the UFC partnership to potentially strengthen revenue streams and boost user engagement, albeit its impact on earnings remains uncertain amid regulatory challenges and high competition.

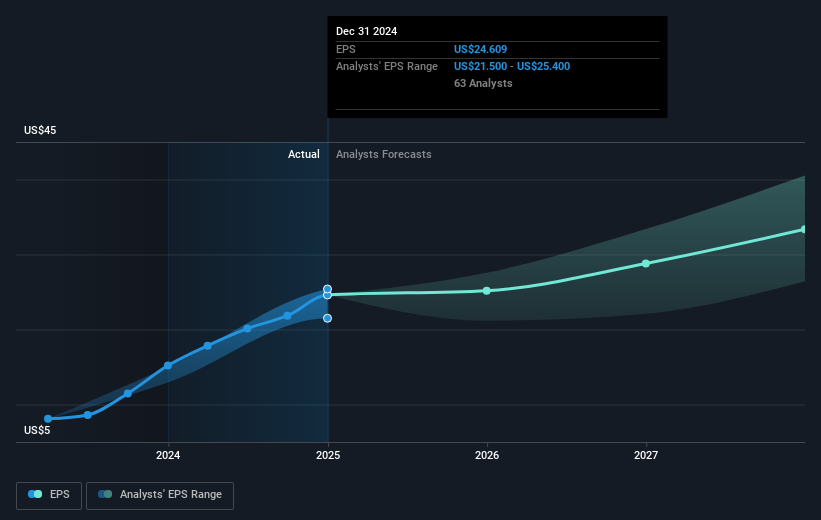

Meta's current share price faces a discount of approximately 23% relative to the analyst consensus price target of US$765.07. With anticipated revenue growth of 11% per year, Meta continues to exhibit a strong position despite recent turbulence. The market outlook suggests that while short-term fluctuations are evident, the long-term strategic investments in AI and platform expansion could shape positive future returns.

Learn about Meta Platforms' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Meta Platforms, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives