- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Is Meta (META) Still Undervalued After Its Recent Share Price Rebound?

Reviewed by Simply Wall St

Meta Platforms (META) has quietly moved higher, up about 6% over the past month even after a choppy past 3 months that left the stock roughly 17% lower from its recent peak.

See our latest analysis for Meta Platforms.

Zooming out, Meta’s latest share price of $647.51 comes after a volatile few months, but the year to date share price return of around 8% and a three year total shareholder return of roughly 470% suggest the longer term momentum story is still very much intact, even if near term sentiment has cooled slightly.

If Meta’s move has you rethinking your exposure to the broader tech rally, this may be a moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With earnings still growing double digits and shares trading at roughly a 23% discount to some intrinsic estimates and nearly 30% below analyst targets, is Meta quietly undervalued, or is the market already banking on years of future growth?

Most Popular Narrative Narrative: 23% Undervalued

With Meta closing at $647.51 versus a widely followed fair value near $841, the narrative leans decisively optimistic, grounding that gap in aggressive long term assumptions.

Meta's foundational investments in AI infrastructure (e.g., multi-gigawatt compute clusters, LLM model development) are materially enhancing platform engagement and recommendation quality (e.g., global time spent on video up >20% YoY on Instagram and Facebook), supporting further increases in user engagement, which translates into greater advertising opportunities and revenue scalability.

Curious how this engagement surge supposedly compounds into years of double digit growth, fatter margins, and a premium earnings multiple above the sector? The narrative breaks down the exact revenue runway, profitability glide path, and discount rate math used to justify that higher fair value, and the numbers behind it are not what most investors are modeling.

Result: Fair Value of $841.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI and metaverse spending, combined with mounting regulatory and privacy pressures, could squeeze margins and derail the long term upside case.

Find out about the key risks to this Meta Platforms narrative.

Another Lens on Valuation

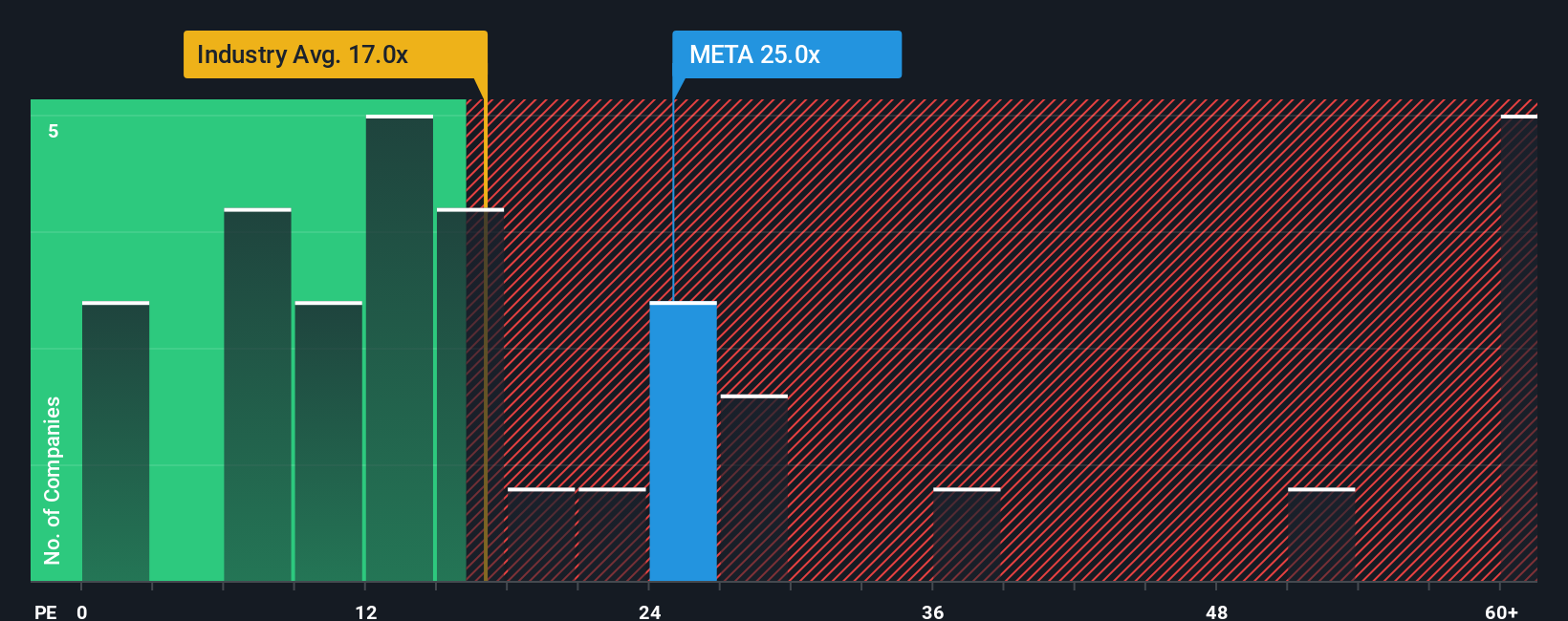

Looked at through its earnings multiple, Meta tells a more demanding story. The stock trades at about 27.9 times earnings, far above the US Interactive Media and Services average of 17.4 times, even if still below peers at 35.2 times. Is the premium really justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meta Platforms Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Meta Platforms.

Looking for more investment ideas?

Do not park your capital in one story when you can quickly scan rigorously filtered opportunities across sectors using the Simply Wall Street Screener and stay ahead.

- Turn spare cash into calculated opportunities by hunting for mispriced potential in these 3612 penny stocks with strong financials that still boast surprisingly solid financial foundations.

- Ride structural growth trends by targeting cash flow strength with these 908 undervalued stocks based on cash flows, where fundamentals can support long term performance potential rather than short term hype.

- Boost your income strategy by focusing on dependable cash payers through these 13 dividend stocks with yields > 3%, where higher yields do not have to mean reckless risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)