- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Is It Too Late To Consider Meta After Its Huge AI Fueled Share Price Run?

Reviewed by Bailey Pemberton

- If you are wondering whether Meta Platforms remains attractive after its huge run, or if the easy money has already been made, you are in the right place to unpack what the current price really implies.

- The stock has climbed 2.7% over the last week, 4.0% over the past month, and is up 9.6% year to date. This adds to a gain of 443.6% over three years and 139.8% over five years, which has clearly shifted how the market views its risks and opportunities.

- Recently, Meta has kept investor attention with its heavy push into AI infrastructure, new monetization features across Facebook, Instagram, and WhatsApp, and ongoing investments in mixed reality hardware and software ecosystems. These moves help explain why the market keeps reassessing the long term earnings power of the business, even as questions remain about regulation, competition, and the eventual payoff from the metaverse strategy.

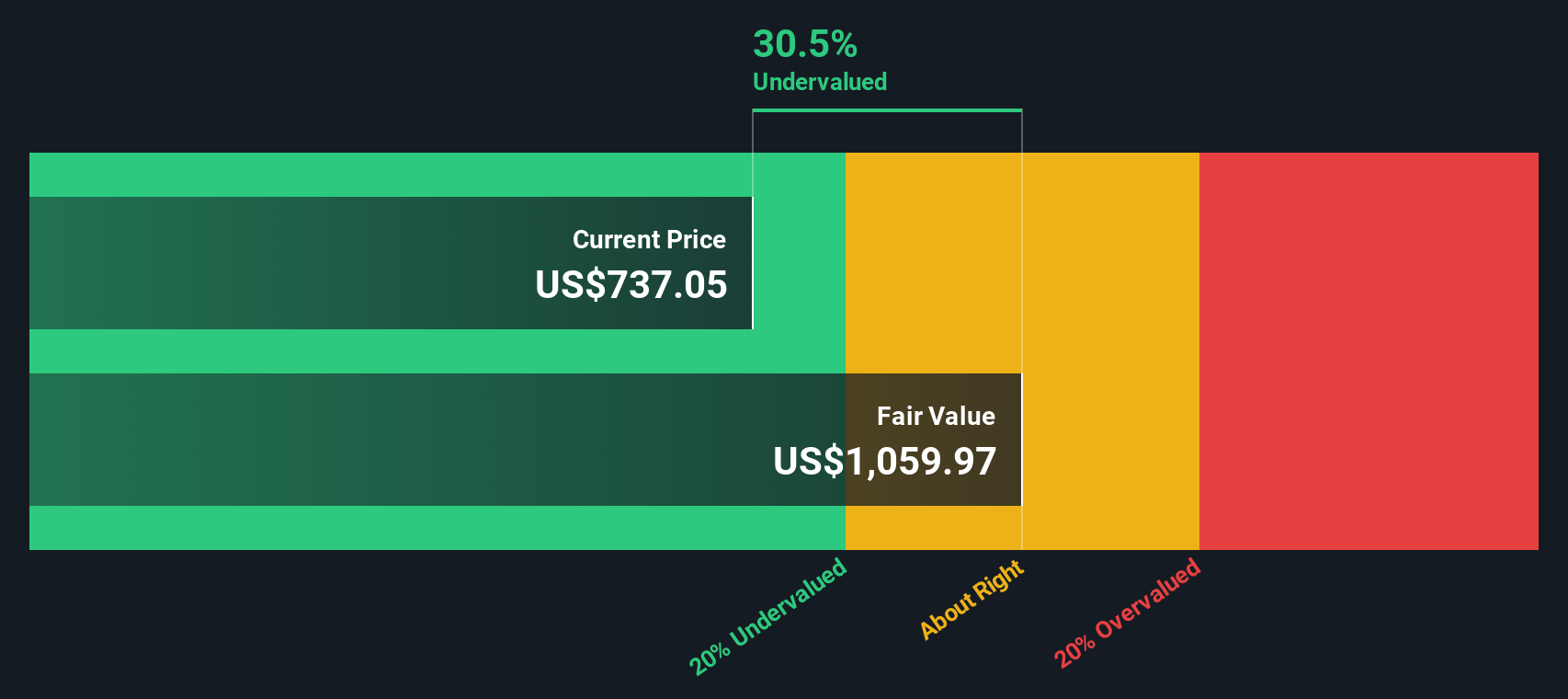

- On our framework, Meta scores a solid 5/6 valuation checks, suggesting it still looks undervalued on most traditional metrics. Next, we will walk through those valuation approaches, before finishing with a more holistic way to judge what the stock is really worth.

Find out why Meta Platforms's 4.2% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For Meta Platforms, the model starts with last twelve month free cash flow of about $58.8 billion and uses analyst forecasts for the next few years, then extends those trends further into the future. By 2029, annual free cash flow is projected to reach roughly $90.1 billion, with longer term estimates climbing above $160 billion by 2035, as growth gradually slows from high to more moderate rates. All of these figures are assessed in dollars and discounted back using a 2 Stage Free Cash Flow to Equity approach.

Adding these discounted cash flows together yields an estimated intrinsic value of around $841.29 per share. Compared with the current market price, this analysis suggests the stock could be trading at about a 21.9% discount to this DCF-based estimate of intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 21.9%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

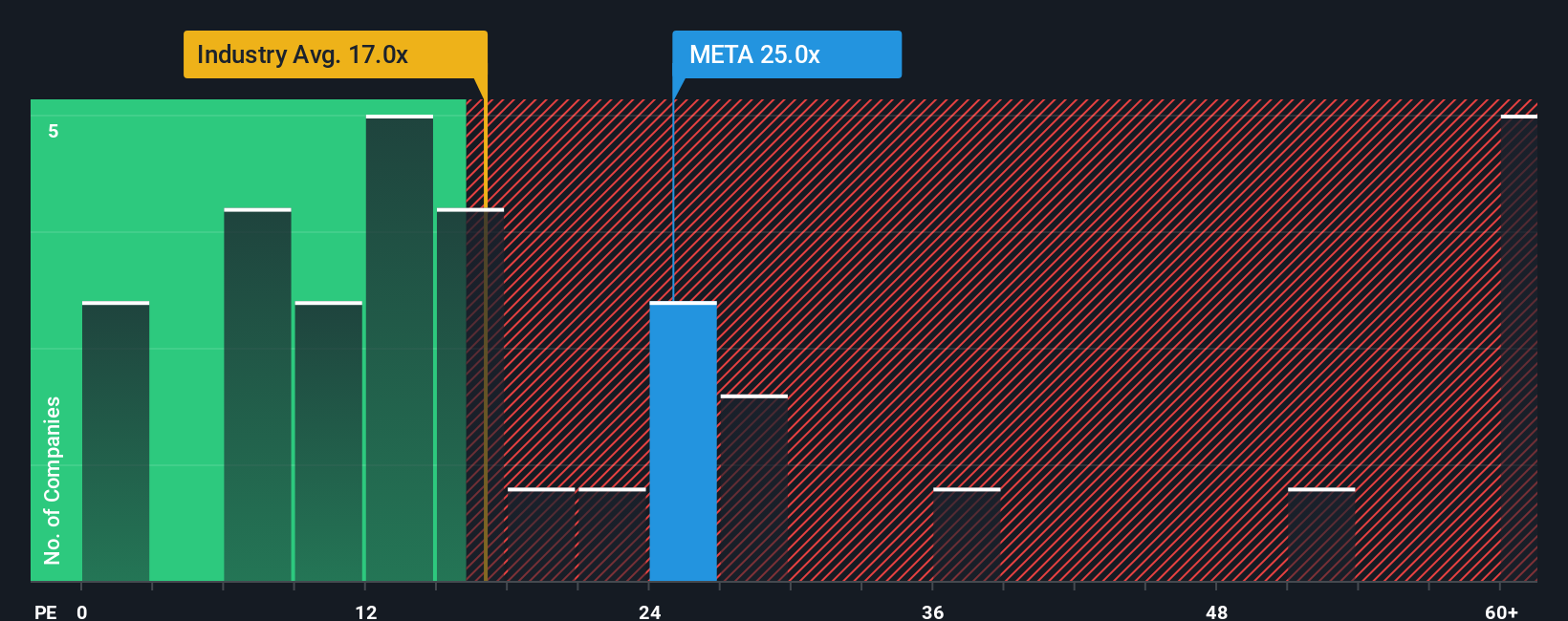

Approach 2: Meta Platforms Price vs Earnings

For profitable, mature but still growing businesses like Meta Platforms, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current profits. It naturally reflects both growth expectations and perceived risk, since faster growing and lower risk companies tend to justify a higher multiple, while slower, riskier names usually trade on lower PE ratios.

Meta currently trades on a PE of about 28.29x. That is substantially above the Interactive Media and Services industry average of around 17.59x, but below the 36.15x average of its higher growth peer group. To move beyond simple comparisons, Simply Wall St calculates a proprietary Fair Ratio, which is the PE that might be expected given Meta’s earnings growth outlook, profitability, industry, size, and risk profile. For Meta, this Fair Ratio is 37.25x.

Because the Fair Ratio that is computed builds in company specific factors like growth, risks, margins, industry dynamics, and market cap, it provides a more tailored benchmark than broad industry or peer averages. Comparing Meta’s current 28.29x to the 37.25x Fair Ratio indicates that the shares trade at a meaningful discount relative to this fundamentals-based benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Meta’s business with a concrete financial forecast and Fair Value estimate on Simply Wall St’s Community page. Millions of investors share how they think revenue, earnings, and margins will evolve, compare that Fair Value to today’s price to decide whether to buy or sell, and rely on dynamically updated assumptions as new news or earnings arrive. One investor might build a bullish Meta Narrative around rapid AI driven ad growth, rising ARPU, improving margins, and a Fair Value closer to the top end of analyst targets. Another might create a more cautious Narrative that stresses higher AI and Reality Labs spending, regulatory risks, and slower profit growth, resulting in a Fair Value nearer the low end. Yet both are using the same tool to tell their story through numbers.

For Meta Platforms, however, we will make it really easy for you with previews of two leading Meta Platforms Narratives:

Fair value: $841.42 per share

Implied undervaluation vs current price: 21.9%

Forecast revenue growth: 16.45%

- AI driven ad targeting, personalization, and new formats are expected to lift conversion rates, engagement, and monetization across Facebook, Instagram, and WhatsApp.

- Expanding digital ad budgets, rising global connectivity, and deeper ecosystem integration of social, commerce, and entertainment support durable, long term growth.

- Heavy AI and metaverse investment brings margin and regulatory risk, but consensus still sees attractive upside if Meta delivers on revenue and earnings forecasts.

Fair value: $538.09 per share

Implied overvaluation vs current price: 18.1%

Forecast revenue growth: 10.5%

- Meta is expected to keep social media leadership and grow ARPU through AI powered ads, but the stock already prices in strong execution and high growth.

- Large, ongoing capex on AI, AR or VR, and metaverse projects, alongside Reality Labs losses, creates significant execution risk and pressure on margins.

- Regulation, data privacy, macro sensitive ad spending, and uncertainty around broad metaverse adoption are seen as key threats to sustaining today’s valuation.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)