- United States

- /

- Food

- /

- NasdaqCM:BRFH

US Penny Stocks Spotlight: Barfresh Food Group And 2 Promising Picks

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, with major indices experiencing fluctuations after significant tech earnings and labor market reports, investors are exploring diverse opportunities for growth. Penny stocks, though often considered a relic of earlier market days, continue to attract attention due to their potential for substantial returns at lower price points. By focusing on those with solid financial foundations and growth potential, investors can uncover promising opportunities in this sector.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7652 | $5.56M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $158.96M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.20 | $526.12M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.8413 | $47.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.37 | $145.75M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.42 | $128.24M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.01 | $97.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.065 | $95.79M | ★★★★★☆ |

Click here to see the full list of 754 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Barfresh Food Group (NasdaqCM:BRFH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Barfresh Food Group, Inc. manufactures and distributes ready-to-drink and ready-to-blend frozen beverages in the United States, with a market cap of $37.31 million.

Operations: The company's revenue is primarily derived from its Non-Alcoholic Beverages segment, totaling $9.85 million.

Market Cap: $37.31M

Barfresh Food Group, Inc. is navigating the penny stock landscape with a focus on growth despite current unprofitability. The company reported third-quarter sales of US$3.64 million, marking a 40% increase from the previous year due to enhanced production and customer acquisition. However, net losses persist at US$0.513 million for Q3 2024, though slightly improved from prior periods. Barfresh anticipates record fiscal year revenue and higher gross profit margins in 2024, driven by new product launches like "Pop & Go"™ in educational channels. Despite shareholder dilution and high volatility, its seasoned management aims for continued expansion.

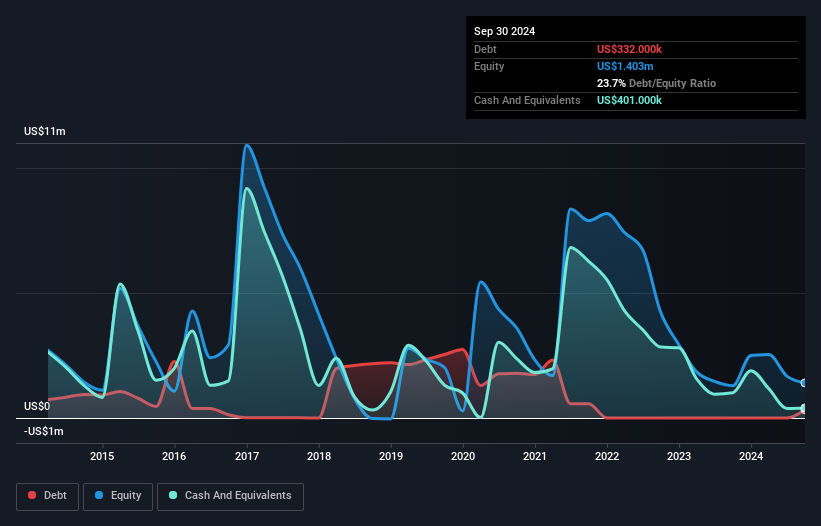

- Navigate through the intricacies of Barfresh Food Group with our comprehensive balance sheet health report here.

- Understand Barfresh Food Group's earnings outlook by examining our growth report.

Marchex (NasdaqGS:MCHX)

Simply Wall St Financial Health Rating: ★★★★★★

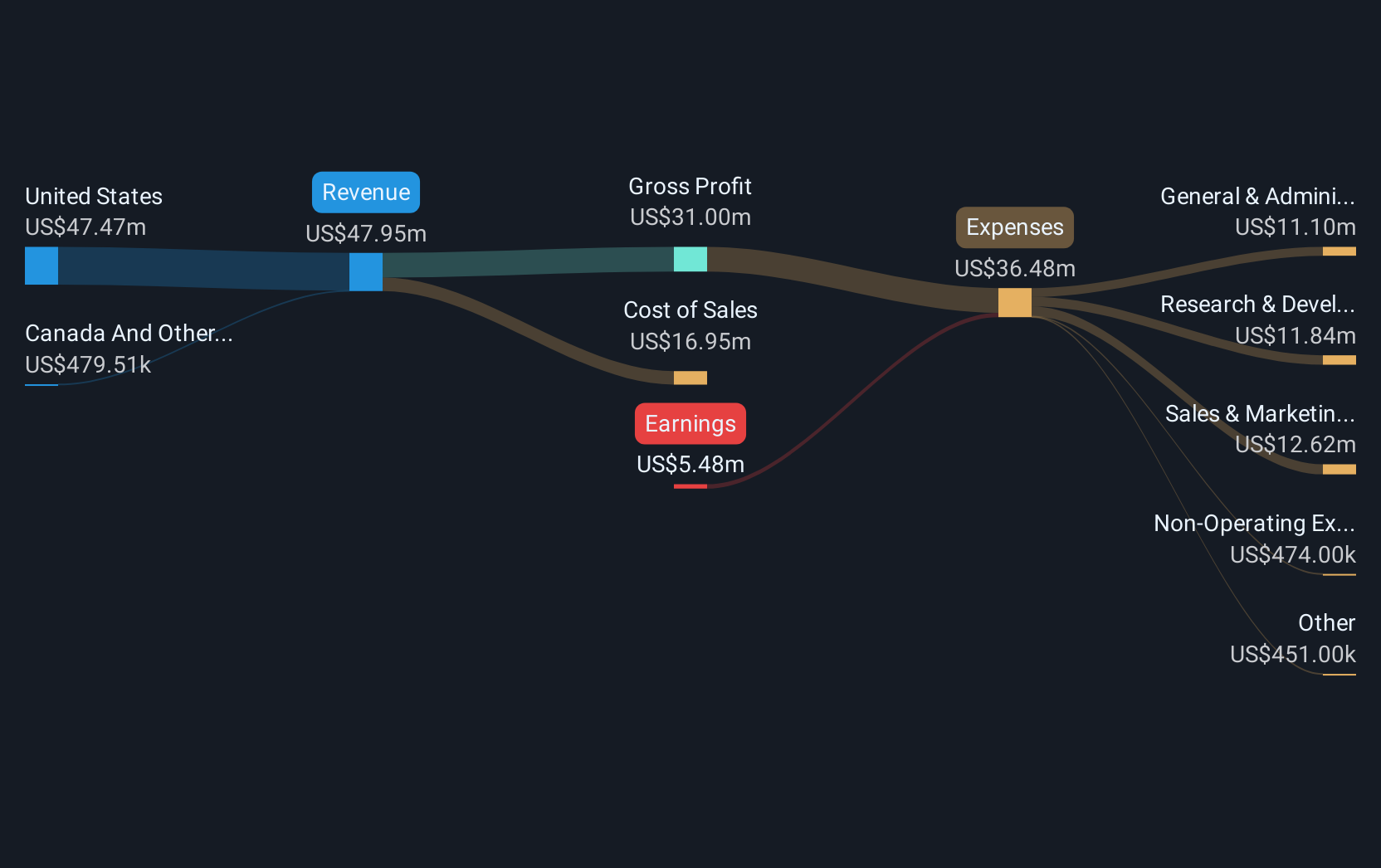

Overview: Marchex, Inc. is a conversation intelligence company that offers conversational analytics and related solutions across the United States, Canada, and internationally, with a market cap of approximately $75.80 million.

Operations: The company generates revenue of $48.59 million from its Conversational Analytics and Related Solutions segment.

Market Cap: $75.8M

Marchex, Inc. operates within the penny stock realm with a focus on conversation intelligence solutions, reporting Q3 2024 sales of US$12.55 million and a reduced net loss of US$0.831 million compared to the previous year. The company remains unprofitable but has improved its financial position over recent years, maintaining sufficient cash reserves for over three years without incurring debt. Recent product innovations in AI-driven analytics aim to enhance marketing effectiveness across various sectors, potentially contributing to future revenue growth as indicated by their positive guidance for 2025 despite current earnings forecast challenges.

- Click to explore a detailed breakdown of our findings in Marchex's financial health report.

- Explore Marchex's analyst forecasts in our growth report.

Aeluma (OTCPK:ALMU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aeluma, Inc. develops optoelectronic devices for sensing and communications applications in the United States and has a market cap of $37.63 million.

Operations: The company generates revenue of $0.92 million from its Industrial Automation & Controls segment.

Market Cap: $37.63M

Aeluma, Inc., a developer of optoelectronic devices, operates with a market cap of US$37.63 million and reported minimal revenue of US$0.92 million for the past year, categorizing it as pre-revenue. Despite being unprofitable with increasing losses over five years, its short-term assets exceed liabilities. The company recently secured DARPA funding totaling nearly US$11.7 million over three years to advance semiconductor technology, which aligns with its strategic goals in AI and communications sectors. Additionally, Aeluma raised US$4 million through convertible notes to bolster its financial position amidst high share price volatility and limited cash runway.

- Unlock comprehensive insights into our analysis of Aeluma stock in this financial health report.

- Gain insights into Aeluma's historical outcomes by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 754 US Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Barfresh Food Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barfresh Food Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BRFH

Barfresh Food Group

Manufactures and distributes ready-to-drink and ready-to-blend frozen beverages in the United States.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives