- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Is Alphabet’s (GOOGL) Expanding AI Footprint Shifting Its Investment Narrative?

Reviewed by Simply Wall St

- Last week, Alphabet made headlines with new AI-driven hardware launches, major infrastructure investments, and a Department of Defense pilot featuring Google Public Sector collaboration for advanced AI and machine learning solutions.

- This series of events signals Alphabet's broadening influence in enterprise, government, and consumer sectors as it deepens integration of artificial intelligence across products and services.

- We'll look at how Alphabet's strengthened partnerships and AI-powered product rollouts influence its current investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alphabet Investment Narrative Recap

To be a shareholder in Alphabet today, you need to believe that the company's push into AI-driven products and cloud infrastructure will translate into sustainable revenue and profit growth, despite record-high capital expenditures and regulatory headwinds. The recent wave of launches and collaborations, like the Department of Defense pilot, supports management’s focus on enterprise relevance, but does not meaningfully change the near-term risk of margin compression from rising infrastructure costs or the importance of monetizing AI at scale.

The most prominent announcement this week was Alphabet’s key partnership with the Department of Defense, integrating Google AI with mission-critical military workflows. While this boosts Alphabet’s credibility and potential in government and enterprise markets, the ultimate catalyst for shares remains the successful scaling of AI-powered Search and Cloud services, rather than headlines alone.

However, investors should be aware that despite strong product momentum, the real risk may be in how quickly rising infrastructure spending could...

Read the full narrative on Alphabet (it's free!)

Alphabet's outlook projects $512.2 billion in revenue and $148.3 billion in earnings by 2028. This assumes annual revenue growth of 11.3% and a $32.7 billion increase in earnings from the current $115.6 billion.

Uncover how Alphabet's forecasts yield a $216.96 fair value, in line with its current price.

Exploring Other Perspectives

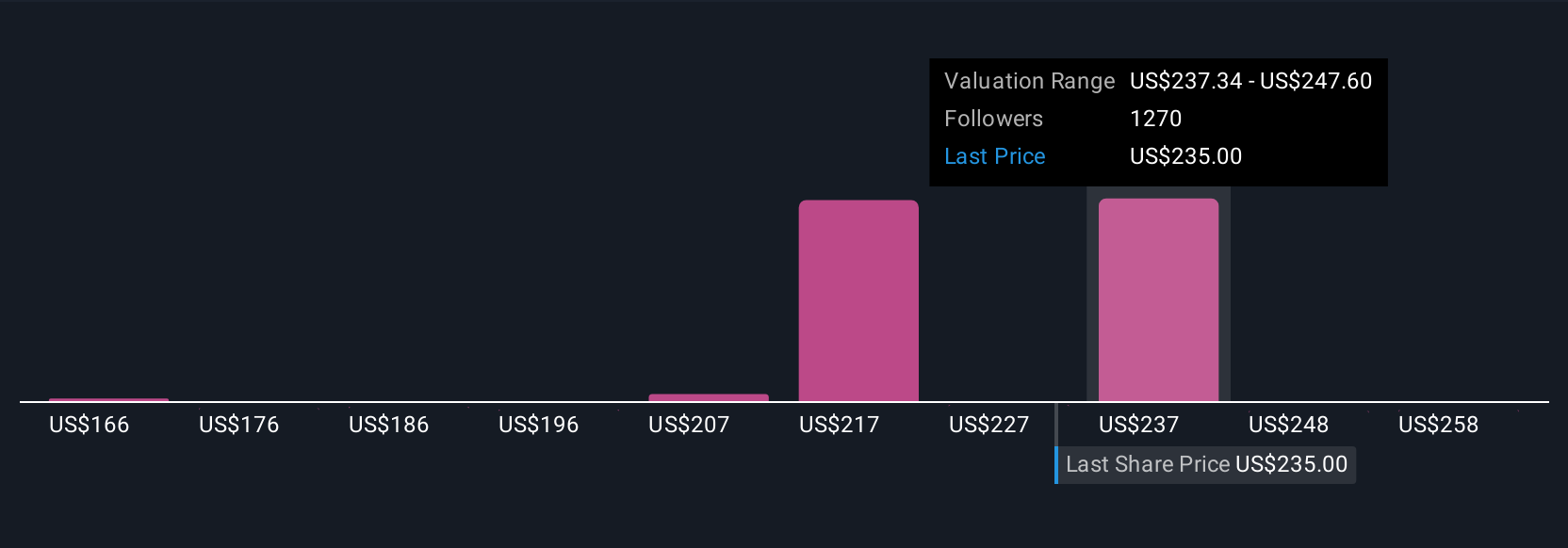

Simply Wall St Community members provided 193 fair value estimates for Alphabet, ranging from US$165.53 to US$265 per share. With high capital expenditures still a critical factor, your outlook on Alphabet’s ability to deliver profitable AI growth can shape very different views on what the company is worth.

Explore 193 other fair value estimates on Alphabet - why the stock might be worth 22% less than the current price!

Build Your Own Alphabet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alphabet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Alphabet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alphabet's overall financial health at a glance.

No Opportunity In Alphabet?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives